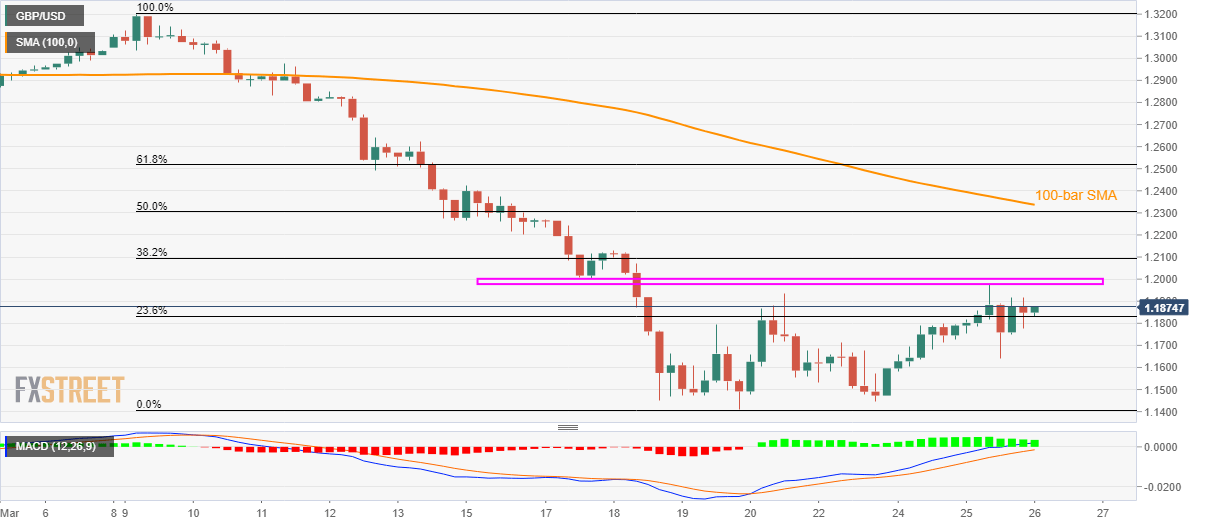

- GBP/USD extends pullback from the multi-year low.

- The one-week-old horizontal resistance questions immediate upside ahead of 100-bar SMA.

- A sustained break below 1.1650 could recall the bears.

- Bullish MACD favors the buyers.

While extending its recent recovery, GBP/USD marks 1.1870 as a quote, down 0.07%, amid the Asian session on Thursday. In doing so, the pair inches closer to the short-term horizontal resistance amid the bullish MACD conditions.

Also read: UK coronavirus confirmed cases jumps to 9,529 from 8,077

In addition to 1.1975-1.2000 horizontal area, 100-bar SMA near 1.2335 and 61.8% Fibonacci retracement level of the current month’s fall, around 1.2520, could also challenge the buyers during the further upside.

If at all the bulls manage to cross 1.2520, 1.2650 and 1.2810 could return to the charts.

On the downside, sellers will wait for a clear break below 1.1650 to recall 1.1610 and 1.1530 numbers to the south.

Following the pair’s sustained break below 1.1530, the latest low near 1.1410 could lure the bears.

GBP/USD four-hour chart

Trend: Pullback expected