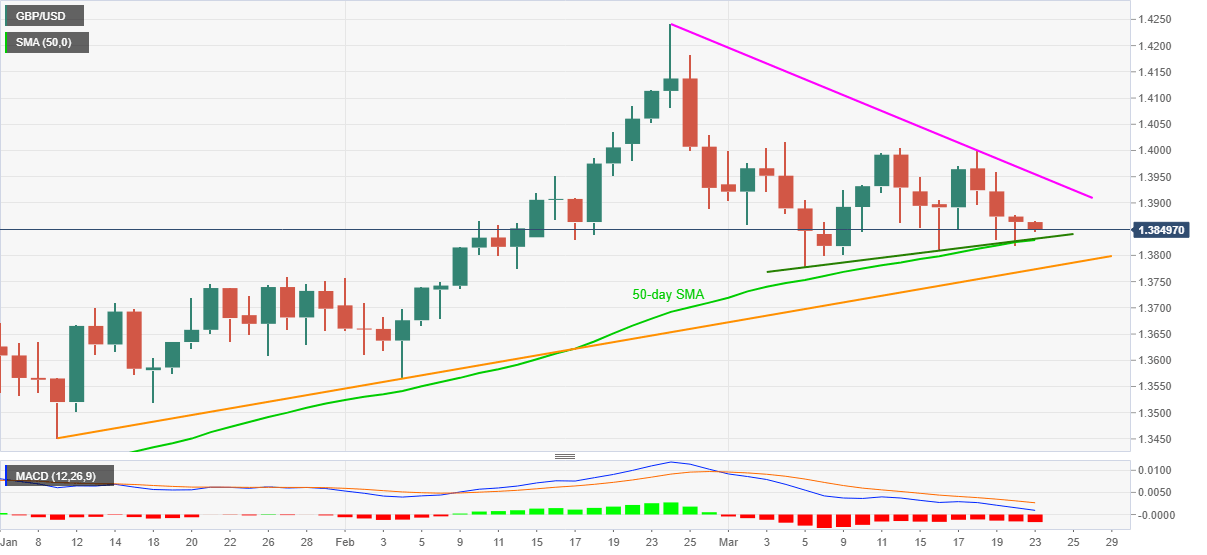

- GBP/USD refreshes intraday low during the four-day downtrend.

- Bearish MACD directs sellers to short-term rising trend line, 50-day SMA.

- Bulls need to cross one-month-old resistance line for fresh entry.

GBP/USD drops to the day’s low of 1.3846, down 0.12% intraday, amid Tuesday’s Asian session. In doing so, the cable prints a four-day losing streak after reversing from the 1.4000 threshold amid bearish MACD signals.

Given the pair’s failures to cross the key hurdle, backed by downbeat MACD, GBP/USD is likely inching closer to the key 1.3830-25 support convergence, including 50-day SMA and an ascending trend line from March 05.

Should UK employment figures and BOE Governor Bailey turns out to be bearish for the cable, an upward sloping support line from January 11, currently around 1.3770 will be the key to watch.

Meanwhile, the corrective pullback can eye the 1.3900 round-figure before confronting a short-term falling trend line resistance at 1.3955.

In a case where the GBP/USD buyers cross the 1.3955 barrier to the north, the 1.4000 could jump back on their radars.

GBP/USD daily chart

Trend: Further weakness expected