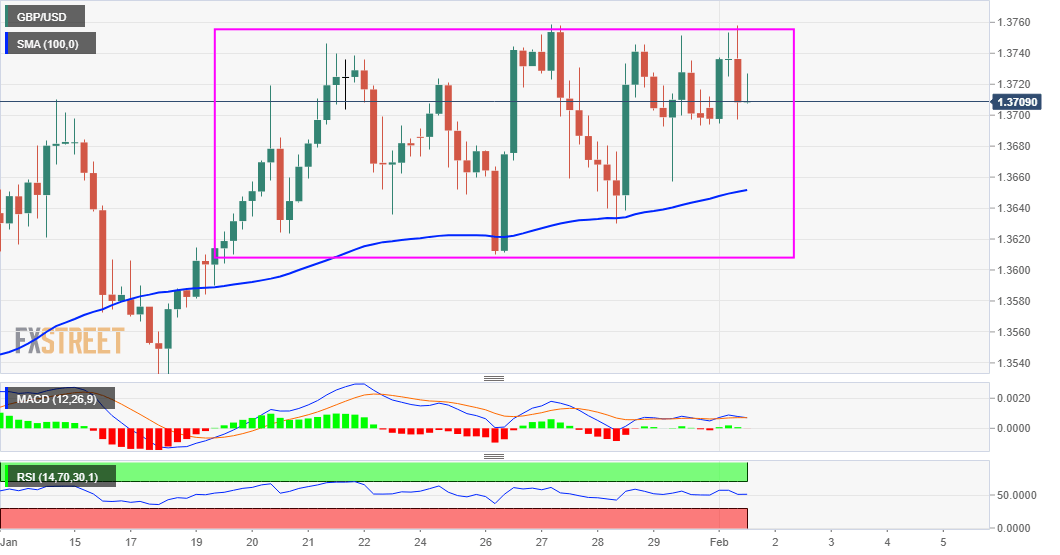

- GBP/USD continued with its struggle to make it through the 1.3755-60 resistance zone.

- The formation of a rectangle points to near-term consolidation before the next leg up.

- A sustained break below trading range support will negate any near-term positive bias.

The GBP/USD pair regained traction on Monday, albeit struggled to capitalize on the move and once again failed near the 1.3755-60 resistance zone.

Looking at the technical picture, the pair has been consolidating in a range over the past two weeks or so. The range-bound price action constitutes the formation of a rectangle, indicating a brief pause before the next leg of a directional move.

Given the recent strong move up, the rectangle might still be categorized as a bullish continuation pattern. The constructive set-up is reinforced by the fact that technical indicators on the daily chart are holding comfortably in the bullish territory.

That said, bulls might still wait for a sustained move beyond the 1.3755-60 congestion zone before positioning for any further appreciating move. The GBP/USD pair might then aim back to reclaim the 1.3800 mark before darting towards the 1.3840 hurdle.

On the flip side, immediate support is pegged near the 1.3675 level. Failure to defend the mentioned support might prompt some technical selling and drag the GBP/USD pair towards the lower end of the recent trading range, around the 1.3630-20 region.

A convincing break below will negate the positive outlook and set the stage for some near-term corrective fall for the GBP/USD pair. The pullback could then drag the pair further below the 1.3580 intermediate support, towards the key 1.3500 psychological mark.

GBP/USD 4-hourly chart

Technical levels to watch