- Activating the Rising Wedge could bring new selling opportunities.

- A new higher high may activate an upside continuation.

- The US inflation data could be decisive today.

The GBP/USD price edged higher as the Dollar Index retreated at the time of writing. Technically, the DXY showed overbought signs in the short term, which could be natural after its strong growth.

–Are you interested to learn more about forex options trading? Check our detailed guide-

DXY’s correction could force the greenback to depreciate versus its rivals. Still, it remains to be seen what will happen and how the Dollar Index will react as the US releases its inflation figures later today.

The fundamentals could move the market. That’s why you need to be careful. Anything could happen. The price action developed a downside continuation pattern, but this formation was invalidated.

The US Consumer Price Index is expected to report a 1.1% growth in June versus 1.0% in May, while the Core CPI could register a 0.5% growth in the last month compared to a 0.6% growth in the former reporting period. Also, the BOC could bring more volatility as well.

The British Pound took the lead in the short term as the UK reported positive economic data. The GDP rose by 0.5%, beating the 0.1% estimates, Construction Output surged by 1.5% exceeding the 0.2% growth forecasted, Industrial Production reported a 0.9% growth versus a 0.0% growth estimated, while Manufacturing Production and the Index of Services came in better than expected as well.

GBP/USD price technical analysis: Swing higher

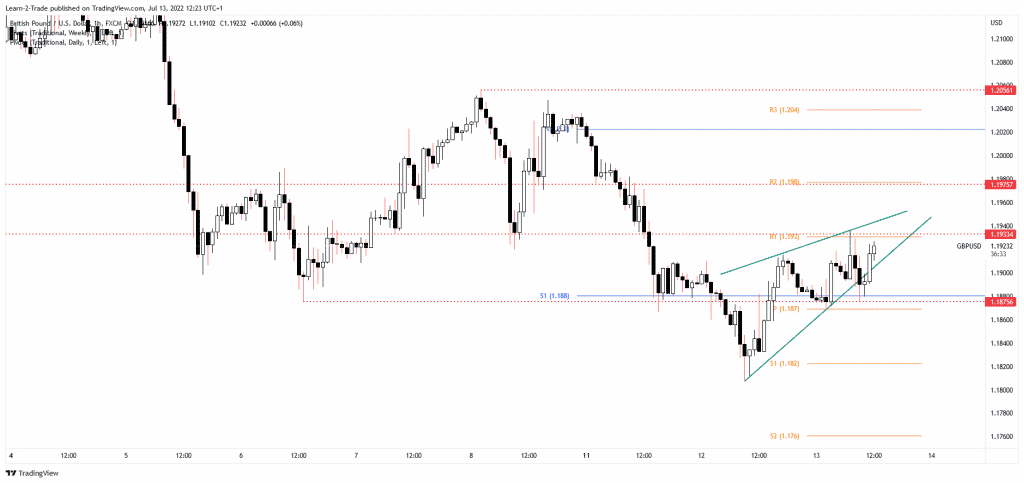

As you can see on the 1-hour chart, the GBP/USD pair developed a Rising Wedge pattern. After registering a false breakout with great separation above 1.1933, the price dropped, but it has registered only a false breakdown through the uptrend line. As long as it stays above the uptrend line, the rate could try to come back higher. A new higher high, a valid breakout above 1.1933, could activate a larger swing higher.

–Are you interested to learn about forex robots? Check our detailed guide-

On the other hand, staying below this static resistance and making a valid breakdown below the uptrend line confirms that the leg higher ended and that the rate could turn to the downside. The bias remains bearish, so the current rebound could bring new selling opportunities.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money