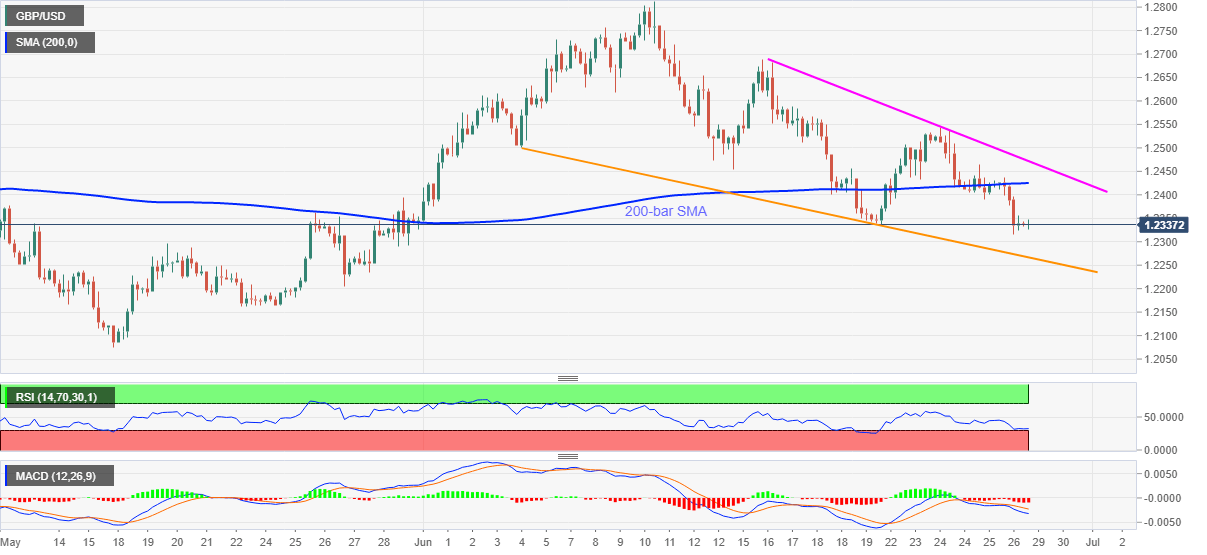

- GBP/USD fails to extend the late-Friday pullback from the lowest since May 29.

- A descending trend line from June 04 stays on the bears’ radars below 200-bar SMA.

- Oversold RSI conditions confront bearish MACD signals ahead of the key EU-UK Brexit talks.

GBP/USD drops to 1.2335 during the initial Asian session on Monday. The Cable refreshed the monthly low while declining to 1.2315, lowest since May 29, on Friday. However, the follow-on short-covering propelled the quote to 1.2355 levels amid oversold RSI conditions.

However, bearish MACD continues to portray the pair’s weakness below 200-bar SMA, which in turn directs sellers towards a short-term falling support line, at 1.2266 now. Though, the pair’s further downside could be challenged by May 27 low near 1.2200.

Meanwhile, a clear break of 200-bar SMA, at 1.2425 now, will have to cross a two-week-old falling resistance line, currently near 1.2475, to justify the momentum strength. In doing so, the GBP/USD prices may target June 24 top near 1.2545 in an extended recovery.

Other than the technical signals, the GBP/USD traders should be cautious ahead of the key Brexit talks between the UK and the European Union (EU) policymakers. Both the sides have recently agreed to faster the post-divorce trade deal talks. Though, there are many twists in the tale that could entertain the pair watchers.

GBP/USD four-hour chart

Trend: Bearish