- GBP/USD bears are now paused, awaiting US NFP data for the fresh impetus.

- BoE kept rates unchanged amid inflation pressure.

- Asset purchases remained at £895.

The GBP/USD price analysis suggests a strong bearish scenario. However, a corrective upside can be expected now towards 1.3600 after the BoE-led losses.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started.

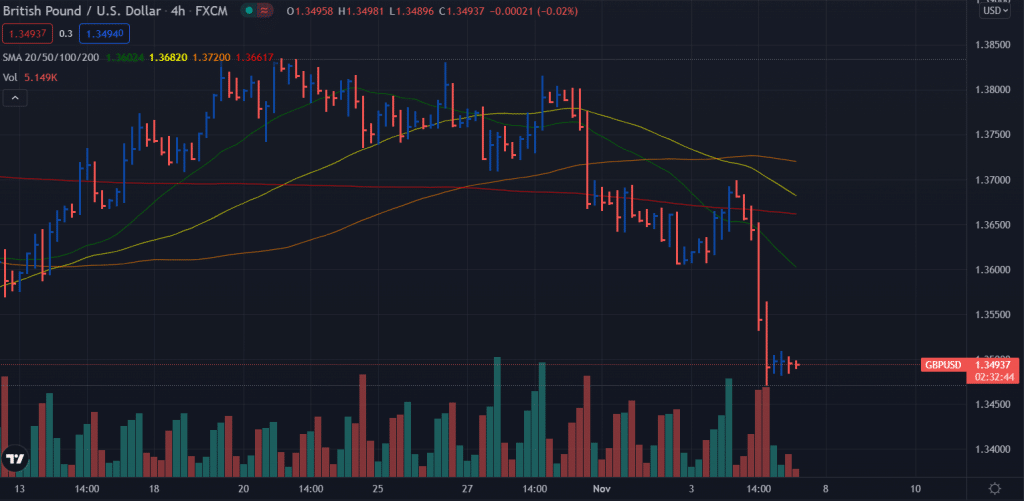

As the bears await the US NFP report, the GBP/USD price falls below 1.3500 after a 200-point decline caused by the Bank of England.

Following the Bank of England’s 7-2 rejection of an interest rate hike at its November meeting, the cable fell to a fresh five-week low of 1.3471.

Governor Andrew Bailey appeared as the devil during a press conference after warning the markets that expectations of a rate hike could push inflation below the central bank’s 2% target.

Similarly, the continued recovery of the US dollar following the fall of the Fed added weight to the GBP/USD. Dollar traders repositioned ahead of the NFP’s release, ignoring a decline in government bond yields and a positive sentiment on Wall Street.

With central bank monetary policy coming back into play, a cautious BOE and Brexit fears will continue to undermine pound sentiment. However, despite a meeting between Brexit minister David Frost and EU minister Clement Bone in Paris on Thursday, the two sides disagree, and the fishing row has come to a halt.

A few weeks earlier, several Bank of England policymakers, including Governor Andrew Bailey, had expressed high inflation concerns, spurring the Bank of England’s (BoE) Monetary Policy Committee to keep rates at 0.10% on Thursday.

The MPC explains the Bank of England will need to raise rates if data, particularly on jobs, are in line with projections if it keeps rates unchanged. In addition, they stated that “MPC still believes that it makes sense to delay tightening policies until after the holidays.”

Asset purchases stayed at £895 billion for the bank. According to BoE, inflation will reach 4.80% in the second quarter of 2022. According to the UK Central Bank, inflation will be 2.23% based on market rates in two years.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

GBP/USD price technical analysis: Finding support around 1.3500

The GBP/USD price is consolidating under the 1.3500 area while the volume is minimal at the moment, absorbing earlier high volume that broke the 1.3600 support. The average daily range is 26%, which is very low, indicating market participants’ “wait n watch” behavior. The further downside may test the YTD lows at the 1.3410 area. On the upside, 1.3570 is the first resistance ahead of 1.3600. After such a huge loss, we may expect an upside correction before resuming an uptrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.