- The GBP/USD pair rallied as the Dollar Index turned to the downside.

- As long as it stays within the up channel’s body, the currency pair could try to approach and reach new highs.

- Only a new lower low could activate a larger drop.

The GBP/USD price edges higher as the USD is weighed by the DXY’s drop. The Dollar Index started to drop after better-than-expected Eurozone data and the SNB. The Eurozone and German Flash Manufacturing PMI and Flash Services PMI came in better than expected, signaling expansions in both sectors. Still, the DXY’s drop could be only a temporary one.

–Are you interested in learning more about STP brokers? Check our detailed guide-

The GBP/USD pair plunged after the UK reported higher than expected inflation in February. Technically, the price is trapped within an up-channel pattern. Now, it has rebounded after reaching a confluence area.

Fundamentally, the UK data came in mixed earlier. The Flash Services PMI was reported at 61.0 points above 58.0 expected versus 60.5 points in the previous reporting period signaling further expansion. On the other hand, the Flash Manufacturing PMI dropped from 58.0 to 55.5 points below 57.0 estimates announcing a slowdown in expansion.

Later, the US is to release its Flash Manufacturing PMI and Flash Services PMI. The economic indicators are expected to drop and might signal a slowdown in expansion. For example, the Unemployment Claims indicator could be reported at 210K in the last week, below 214K in the previous reporting period. In addition, the Durable Goods Orders may report a 0.5% drop, while the Core Durable Goods Orders could register a 0.5% growth.

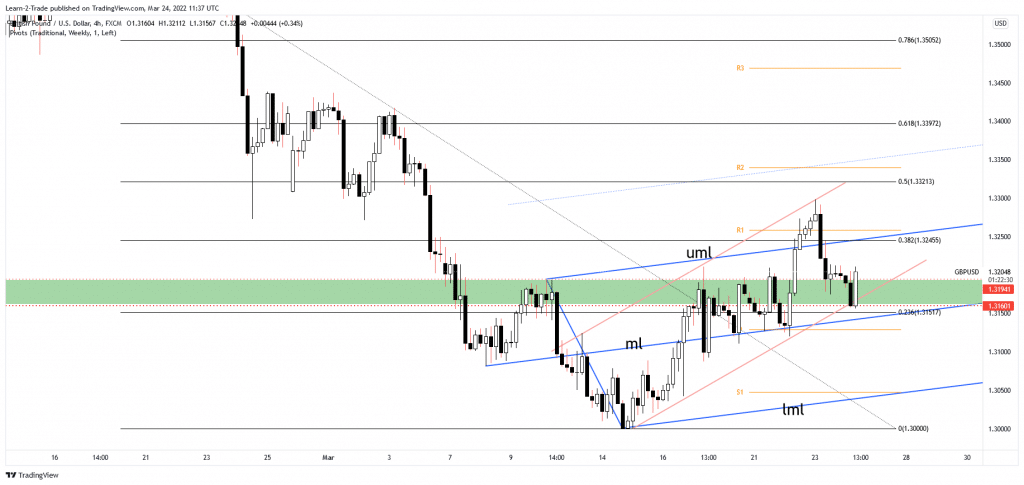

GBP/USD price technical analysis: Uptrend channel

The GBP/USD pair rebounded after reaching the up-channel’s support, the up trendline. We have a strong confluence between the up trendline and the 1.3160 key level. Now, it has jumped above 1.3194 static resistance. Stabilizing above it may signal further growth towards the 38.2% (1.3245) retracement level. Also, the price could be attracted by the upper median line (UML) of the ascending pitchfork.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

As long as it stays above the uptrend line, the GBP/USD pair could try to come back higher. However, dropping and closing below 1.3156 today’s low, a new lower low could open the door for a larger drop. Only a new higher high or breakout above the weekly R1 (1.3258) could signal an upside continuation.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money