- A new lower low could really activate a larger downside movement.

- DXY’s further growth should force the USD to dominate the currency market.

- After its massive drop, we cannot exclude a minor rebound.

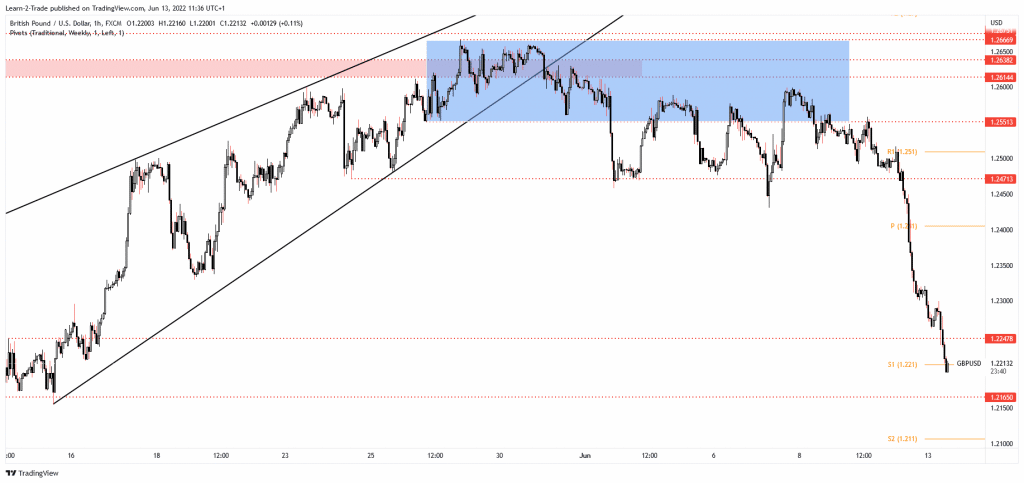

The GBP/USD price plunged as the Dollar Index accelerated its growth. The currency pair was trading at 1.2203 at the time of writing. It seems vulnerable to slide further.

-Are you interested in learning about forex tips? Click here for details-

Technically, the price is strongly bearish. DXY’s further growth should force the USD to dominate the currency market, so the GBP/USD pair could approach new lows.

As you already know from my previous analyses, the price was expected to come back down after escaping from a Rising Wedge pattern and reaching a resistance area.

Fundamentally, the USD was boosted by the US inflation data on Friday. The CPI rose by 1.0% in May versus 0.7% expected, while the Core CPI surged by 0.6% exceeding the 0.5% growth forecasted.

Higher than expected inflation forces the Federal Reserve to act in the next monetary policy meetings. 50-bps rate hikes are expected. That’s why the USD rallies.

Today, the UK’s GDP came in worse than expected. The GDP dropped by 0.3% versus a 0.2% growth estimated, Goods Trade Balance was reported at -20.9B below -20.3B expected, Index of Services rose by 0.0% compared to 0.1% growth forecasted, Industrial Production registered a 0.6% drop even if the traders expected a 0.3% growth. In comparison, Manufacturing Production dropped by 1.0% versus a 0.3% growth.

GBP/USD price technical analysis: Bears pouncing 1.2200

The GBP/USD pair activated a larger downside movement after making a new lower low, after dropping and closing below the 1.2430 former low.

-Are you interested in learning about the forex basics? Click here for details-

It has also ignored the 1.2247 strong support. The next downside target is represented by the 1.2165 former low. It remains to see how it will react around this level.

A valid breakdown may signal a downside continuation. Only false breakdowns or a strong bullish pattern could announce a temporary rebound.

Actually, after this massive drop, a bounce-back could take shape, but it’s premature to talk about something like this. A new lower low, making a valid breakdown below 1.2165, could confirm a larger downside movement.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money