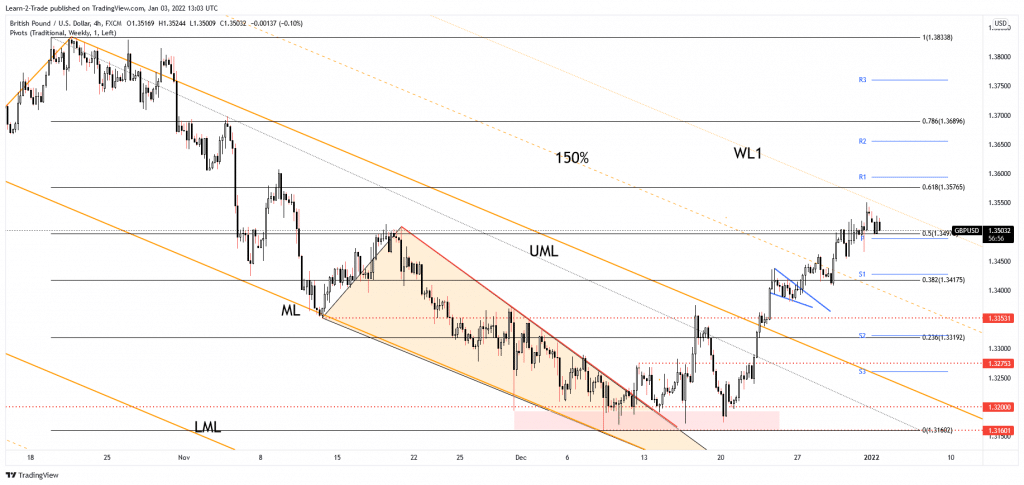

- The GBP/USD pair could extend its upside movement if it stays above the weekly pivot point.

- The warning line (WL1) represents an important dynamic resistance.

- Stabilizing below the weekly pivot point may signal a potential deeper drop towards the S1.

The GBP/USD price is trading in the red far below 1.3500, failed to find acceptance above the 1.35 psychological level. In the short term, the pressure is high as the Dollar Index tries to rebound and recover after its massive drop. The pair maintains a bullish bias, but it remains to see what will really happen as the price stands right below a major dynamic resistance level. As you already know, the US data came in better than expected on Friday. The Unemployment Claims dropped from 206K to 198K below 205K expected, while the Chicago PMI jumped unexpectedly higher from 61.8 points to 63.1 points.

Today, the US is to release its Final Manufacturing PMI which is expected at 57.7, and the Construction Spending, which may report a 0.8% growth. Tomorrow, the US ISM Manufacturing PMI will drop from 61.1 to 60.4 points. This is seen as a high-impact event. In addition, the JOLTS Job Openings, ISM Manufacturing Prices, and the Wards Total Vehicle Sales could also bring high action.

On the other hand, the UK releases the Final Manufacturing PMI, M4 Money Supply, Mortgage Approvals, and the Net Lending to Individuals.

GBP/USD price technical analysis: Bulls fail to sustain

The GBP/USD pair rose to the 1.3550 level on Friday, where resistance was found. It seems very heavy, so we cannot exclude a potential drop below the 1.3489 weekly pivot point. However, the bias remains bullish if the price stays above this level and above the 1.3500 psychological level.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

The descending pitchfork’s first warning line (WL1) stands as a dynamic resistance. Personally, despite a temporary drop, I still believe that the price could approach and reach this upside obstacle. Staying near the warning line (WL1) could indicate an imminent upside breakout.

Closing and stabilizing below the weekly pivot point (1.3489) could announce a potential drop towards the weekly S1 (1.3428).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.