- The GBP/USD pair signaled that the swing higher ended.

- The US data could be decisive these days.

- A new lower low activates a larger drop.

The GBP/USD price is trading around 1.2036 at the time of writing. The pair has turned bullish as the US dollar lost traction.

The currency pair tries to recover after posting heavy losses. However, it remains to see how it will react later as the US is to release the CB Consumer Confidence. This represents a high-impact indicator and is expected to drop from 102.5 to 100.0 points in November.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

A deeper drop could force the USD to lose significant ground versus its rivals. On the contrary, better-than-expected data should boost the greenback. In addition, the US HPI and S&P/CS Composite-20 will also be released.

Yesterday, the Pound took a hit from the UK CBI Realized Sales. The economic indicator came in at -19 points versus the 2 points expected. Today, the UK is to release the M4 Money Supply, Mortgage Approvals, and Net Lending to Individuals.

Tomorrow, the US data could be decisive. The ADP Non-Farm Employment Change is expected at 197K in November versus 239K in October. Prelim GDP could report a 2.8% growth, while JOLTS Job Openings may drop from 10.72M to 10.24 M.

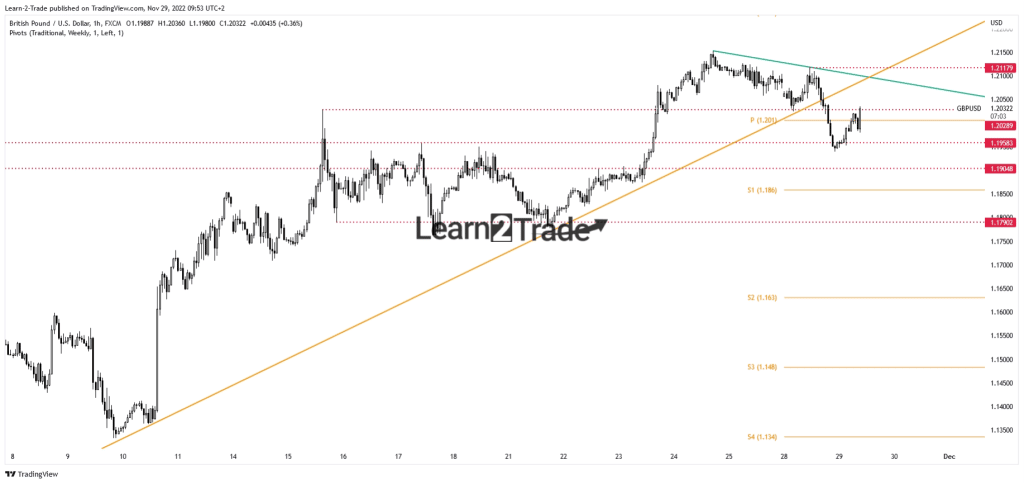

GBP/USD price technical analysis: Retesting the broken level

After dropping below the ascending trendline, the price signaled that the upside movement ended and the sellers might dominate again. Still, the pair tries to recover after its massive drop.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Now, it challenges the 1.2028 resistance (support turned into resistance). The broken ascending trendline and the minor descending trendline represent dynamic resistance levels. As long as it stays under these levels, the price could drop again.

Still, only a new lower low, dropping and closing below 1.1940, activates a larger drop. Only a new higher high, a valid breakout above 1.2117, invalidates the downside scenario and validates further growth. Technically, the current rebound could represent a bearish pattern on the lower time frames. False breakouts through the resistance levels could result in triggering a new sell-off.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.