- GBP/USD recovers from weekly lows on Wednesday on moderate dollar weakness.

- The positive sentiment on the stock markets is undermining the safe haven dollar.

- Recession fears, US-China tensions, and hawkish comments from Fed officials to limit dollar losses.

- Investors also appear cautious ahead of Thursday’s BoE and Friday’s NFP decisions.

The GBP/USD price halts its decline from its high in late June, attracting some buyers near the weekly low this Wednesday or around 1.2135. Earlier in the London session, the pair made a new daily high, and now bulls are trying to gain momentum.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

With the US dollar struggling to recover from a multi-week low and Wednesday’s decline, the GBP/USD pair is being supported. In equity markets, the generally positive sentiment is undermining the safe-haven dollar, reflected in the slight rebound in global risk sentiment. US dollar losses could, however, be limited by a combination of factors, limiting the currency’s upside potential.

Markets will likely be dampened by rising diplomatic tensions over US House Speaker Nancy Pelosi’s visit to Taiwan amid rising recession fears. Dollars could benefit from the Fed’s hawkish statements hinting at a rate hike shortly. The risk of a central bank event may discourage bulls from aggressively betting on GBP/USD.

On Thursday, the Bank of England is expected to announce its monetary policy decision, raising rates by 50 basis points, the largest increase since 1995. Markets, however, seem divided over whether or not to hike rates further. Consequently, the pound sterling will be impacted by the near-term political outlook. Following Friday’s NFP report, traders will focus on the monthly US jobs report closely watched.

GBP/USD is expected to benefit from the release of the final UK services PMI and US ISM services PMI on Wednesday. Before determining the next phase of a directional move, any significant market reaction is likely to be short-lived.

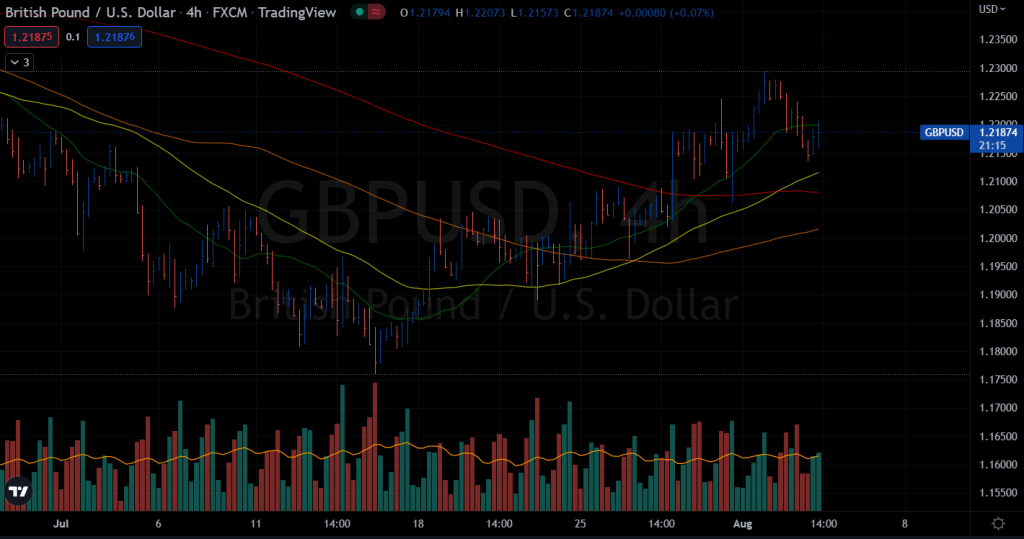

GBP/USD price technical analysis: Bulls shy of 20-SMA

The GBP/USD price remains capped by the 20-period SMA on the 4-hour chart. However, the crossover between the 200-period and 50-period SMAs may provide some room for the bulls.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The volume data looks positive for the bulls. The upside target for the bulls lies around 1.2250 ahead of 1.2300. On the flip side, if the bulls appear short-lived, the price may slip towards 1.2150 ahead of 1.2100.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.