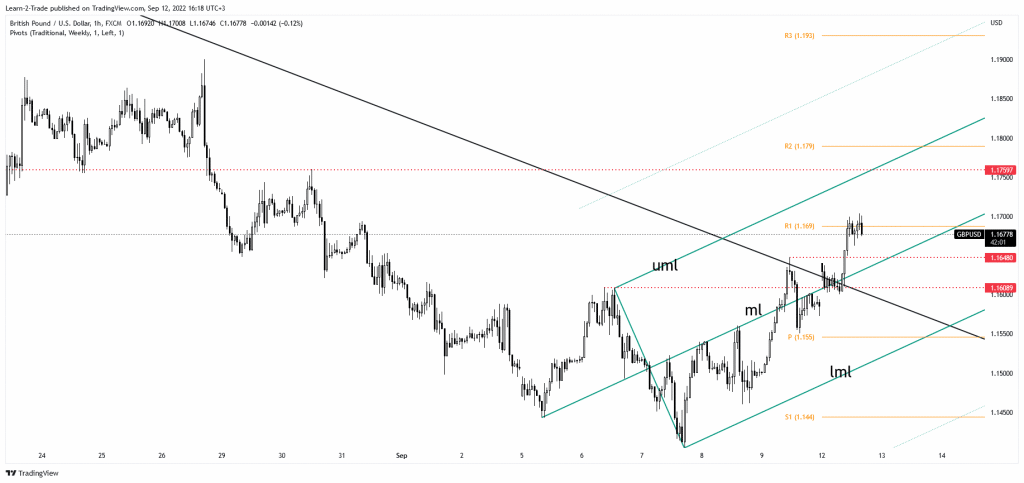

- The GBP/USD pair is strongly bullish in the short term.

- The upper median line (UML) represents an upside obstacle.

- The bias is bullish as long as it stays above the median line (ml).

The GBP/USD price climbed as high as 1.1704 today. However, the pair has failed to stay above the 1.17 psychological level. Now, it is trading at the 1.1673 level.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

As you already know, the USD started to drop after the BOC and ECB as the US dollar entered a corrective phase. Today, the price rallied even though the UK data was not quite impressive. The GDP rose by 0.2% less versus 0.3% growth expected, Construction Output registered a 0.8% drop, though the analysts expected a 0.4% growth, while Goods Trade Balance came in at -19.4B above -22.2B estimated.

In addition, the Index of Services dropped by 0.2%, matching expectations. Industrial Production fell by 0.3% despite the 0.4% growth forecasted, while Manufacturing Production reported a 0.1% growth less versus the 0.3% expected.

The US will release the Unemployment Rate, Claimant Count Change, and Average Earnings Index tomorrow. Still, the week’s most important events are represented by the US and UK inflation data releases. The US CPI is expected to report a 0.1% drop in August, while Core CPI may register a 0.3% growth.

GBP/USD price technical analysis: Swing higher

From the technical point of view, the GBP/USD pair rebounded. The pair seems determined to approach new highs. As you can see on the hourly chart, the price validated today’s breakout by testing the descending trendline. Now, it has jumped above the weekly R1 (1.1690), representing an upside obstacle.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

Stabilizing above this level may signal further growth towards the ascending pitchfork’s upper median line (UML) and up to the 1.1759 static resistance. The bias is bullish as long as it stays above the median line (ml). A larger upwards movement could be activated only by a valid breakout through the 1.1759 historical level. After passing above the descending trendline, the GBP/USD pair indicates a potential bullish reversal in the short term.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.