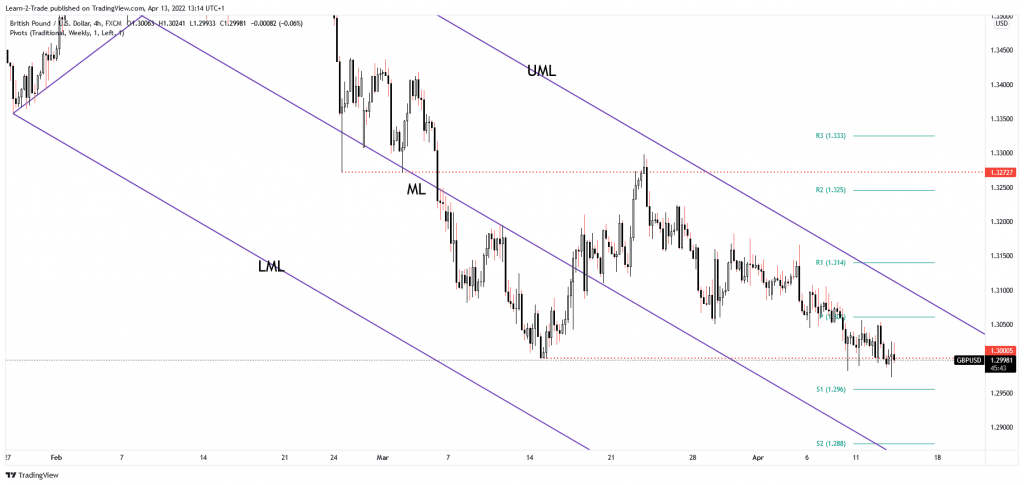

- The GBP/USD pair could extend its downwards movement if it makes a valid breakdown below 1.3000.

- Its failure to reach and retest the upper median line (UML) indicates strong bearish pressure.

- Stabilizing above 1.3000 could announce a potential rebound.

The GBP/USD price is trading in the red at 1.2997. The currency pair maintains a bearish bias despite temporary rebounds as I said yesterday. After the US inflation data, the price rebounded, but it was only short-lived.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

The Dollar Index resumed its upside movement, boosting the greenback. DXY is bullish, so further growth could force the USD to dominate the currency market. The US Consumer Price Index reported 1.2% growth, matching expectations, while the Core CPI registered only a 0.3% growth versus 0.5% expected. Higher inflation should force the Federal Reserve to continue to hike rates.

Today, the United Kingdom CPI rose by 7.0% in March versus 6.7% estimates compared to 6.2% in the previous reporting period, while the Core CPI registered a 5.7% growth exceeding the 5.3% forecasts. In addition, the PPI Output surged by 2.0% versus 1.2% expected, the PPI Input reported a 5.2% growth beating the 2.0% growth expected, while the HPI came in better than expected.

Earlier, the US PPI and Core PPI came in better than expected. Still, it remains to see how the BOC will impact the greenback later.

GBP/USD price technical analysis: Turns lower

The GBP/USD pair failed to develop a meaningful rebound, signaling that the sellers are very strong. It challenges the 1.3000 psychological level, a major downside obstacle. Failing to reach the descending pitchfork’s upper median line (UML) announced strong selling pressure.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Stabilizing below the 1.3000 level could result in more decline. Only false breakdowns below this level could signal that the GBP/USD pair could try to rebound.

This scenario could shape if the Dollar Index slips lower after its amazing rally. Personally, I believe that the BOC could bring sharp movements to the DXY today. That’s why you have to be careful. Anything could happen, even if the index is bullish.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money