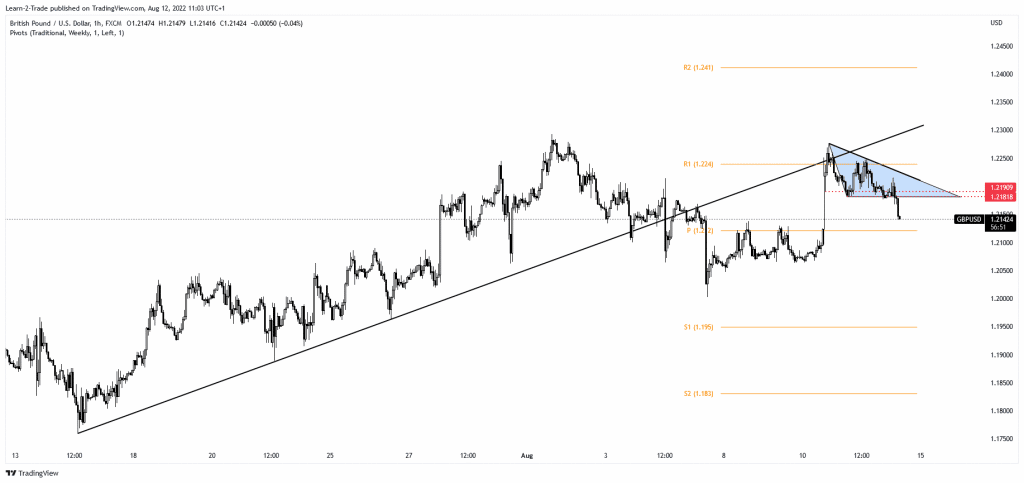

- The GBP/USD pair invalidated further growth after breaking below the triangle’s support.

- Poor UK data forced the GBP to depreciate.

- DXY’s rally boosted the greenback.

The GBP/USD price plunged after failing to make a new higher high. Now, it was trading at 1.2137 at the time of writing.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Technically, the price signaled exhausted buyers and triggered a new sell-off. As you already know, the US CPI and Core CPI came in below expectations on Wednesday, while the PPI and Core PPI reported worse than expected data yesterday. Still, despite poor US economic data, the USD appreciated in the short term.

Fundamentally, the GBP/USD pair plunged after the UK economic data. The GDP dropped by 0.6% versus 1.2% expected, Prelim GDP reported a 0.1% drop compared to 0.2% forecasted. At the same time, Industrial Production, Manufacturing PMI, Construction Output, and Prelim Business Investment also came in better than expected.

Still, despite better-than-expected data, the figures came in worse than in the previous reporting period. That’s why the GBP crashed.

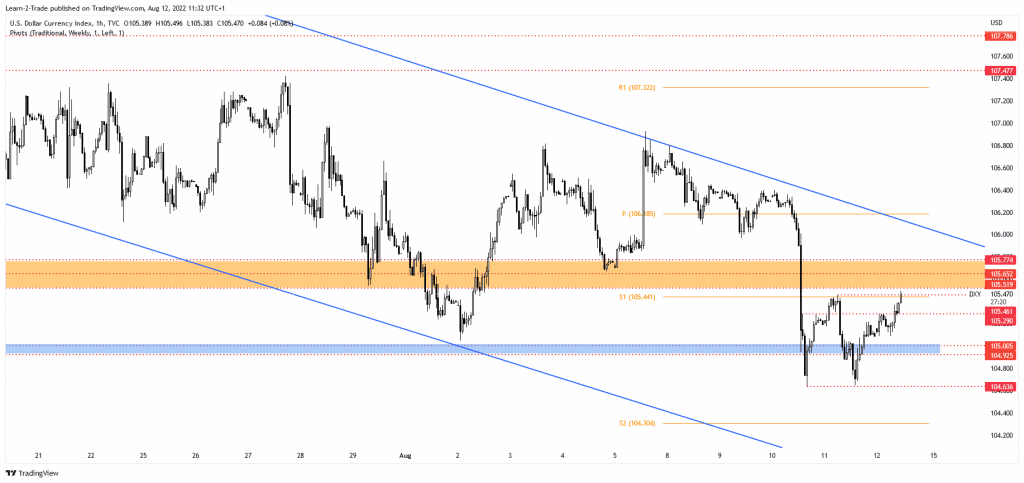

Dollar Index price technical analysis: Rebounding

DXY found strong demand above the 104.63 level. Now it has rebounded. The index has challenged the 105.46 former high, a static resistance. The current rally forced the USD to appreciate versus its rivals.

A further rise towards the downtrend line may signal that the greenback is about to dominate the currency market. Only a new sell-off from around 105.51 – 1.0577 resistance area could trigger a fresh downtrend.

GBP/USD price technical analysis: Triangle breakout

Technically, the GBP/USD developed a triangle pattern in the short term after failing to stabilize above the uptrend line. It has registered an aggressive breakdown from this pattern, signaling that the leg higher ended and that we may have a new sell-off.

-Are you looking for the best CFD broker? Check our detailed guide-

The weekly pivot point of 1.2120 stands as a downside obstacle. Taking out this support may signal a potential drop at least towards the 1.2100 psychological level. Failing to reach the 1.2293 former high confirmed exhausted buyers. A more significant downside movement could be activated by a valid breakdown below 1.2062.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.