- The GBP/USD pair maintains a bullish bias in the short term, despite temporary retreats.

- A new higher high could activate an upside continuation.

- Coming back to test and retest the 1.2111 key level could bring new long opportunities.

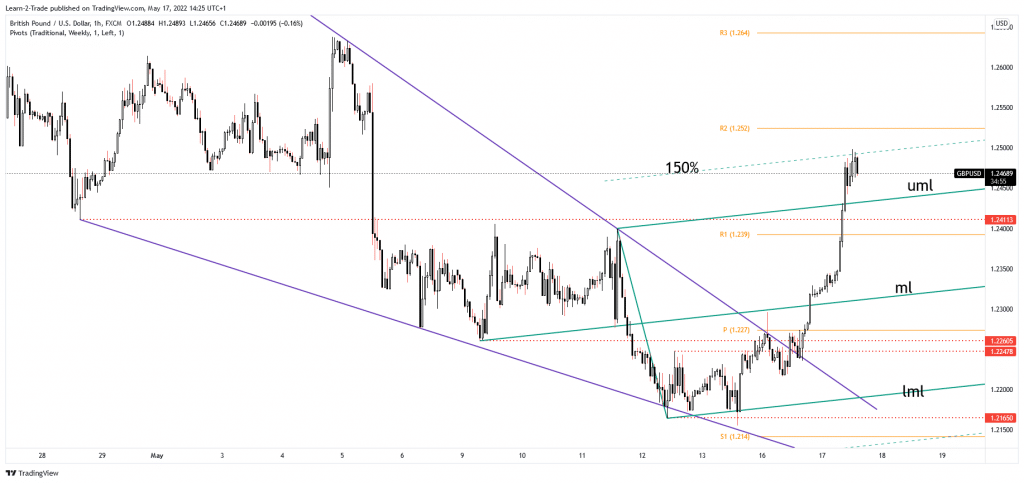

The GBP/USD price registered a strong leg higher after escaping the Falling Wedge pattern. The pair is trading at a 1.2476 level at the time of writing, below 1.2498 today’s high.

–Are you interested in learning more about forex robots? Check our detailed guide-

After its amazing rally, we cannot exclude a temporary retreat. The currency pair edged higher as the Dollar Index plunged. The DXY is fighting hard to rebound and recover after its massive drop. DXY’s further drop could force the USD to lose more ground versus the other major currencies.

Technically, the Dollar Index is in a corrective phase. However, a deeper drop is in the cards despite a minor rebound. As a result, the DXY could return to test and retest the 103.65 – 103.82 area.

The UK data came in better than expected, while the US reported mixed data. The UK Unemployment Rate dropped from 3.8% to 3.7% below 3.8% estimates; Claimant Count Change came in at -56.9K below -42.3K forecasts, while the Average Earnings Index rose by 7.0% exceeding the 5.4% expected.

Earlier, the US Retail Sales registered a 0.9% growth in April versus 1.0% expected, while the Core Retail Sales reported a 0.6% growth in the last month versus 0.4% forecasted. In addition, Industrial Production reported a 1.1% growth beating 0.4% estimates, while Capacity Utilization Rate came in at 79.0%, better than 78.5% forecasts. Later, the US Business Inventories could bring more action.

GBP/USD price technical analysis: Swing higher

The GBP/USD pair found resistance at the 150% Fibonacci line, and now it could approach and reach the upper median line (UML).

From the technical point of view, a temporary retreat or a range pattern is natural after its amazing rally. It could come back down to test and retest the immediate support levels before resuming its growth.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

A sideways movement could help the pair to attract more buyers. 1.2411 broken resistance turned into support. Retesting this level or developing a strong consolidation above it may bring new long opportunities.

Also, a valid breakout above the 150% Fibonacci line and through the 1.2500 psychological level, a new higher high could activate an upside continuation.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money