- The GBP/USD pair could bring new opportunities after escaping from the current range.

- A new lower low activates more declines towards the lower median line (LML).

- The US data could bring strong moves later today.

The GBP/USD price seems undecided in the short term after failing to activate a meaningful recovery. It was trading at 1.2207 at the time of writing. The pair has been trapped within a narrow range.

-Are you interested in learning about forex live calendar? Click here for details-

The USD took the lead again as the Dollar Index rebounded and erased yesterday’s losses. DXY maintains a bullish bias despite temporary declines. Technically, the Dollar Index showed overbought signs. That’s why a short-term retreat was natural. Now, the index signaled that the corrective phase had ended and that it could resume its major uptrend.

Fundamentally, the UK Consumer Price Index reported a 9.1% growth in May, matching expectations, while the Core CPI rose by 5.9% versus the 6.0% growth expected. Today, the United Kingdom Flash Services PMI came in at 53.4 points above 53.0 expected, and Flash Manufacturing PMI dropped from 56.1 to 53.4 points below 53.5 points estimated.

In addition, the CBI Realized Sales was reported at -5 points versus -2 points forecasted, while the Public Sector Net Borrowing came in at 13.2B above 11.6B estimates.

Later, the US data could be decisive. The Flash Services PMI could jump from 53.4 to 53.9 points signaling further expansion. Flash Manufacturing PMI is expected at 56.0 points below 57.0 points in the previous reporting period, while the Unemployment Claims indicator could be reported at 227K in the previous week.

GBP/USD price technical analysis: Ranging pattern

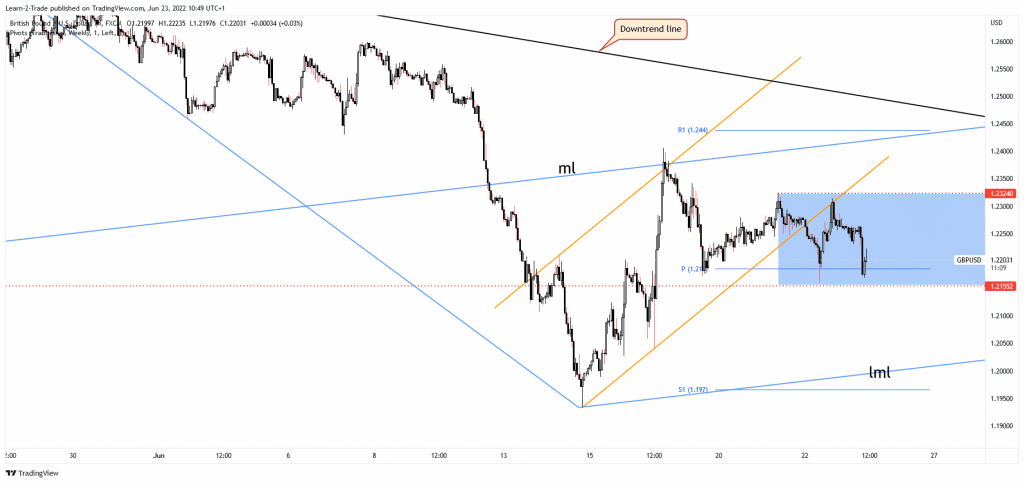

The GBP/USD pair found resistance at the confluence area formed at the intersection between the median line (ml) with the channel’s upside line. Now, it has escaped from the channel pattern signaling that the upside movement ended and the price could drop. In the short term, it’s trapped between 1.2324 and 1.2155 levels.

-Are you interested in learning about forex signals? Click here for details-

Escaping from this range could bring new opportunities. Its failure to make a new higher high signaled that the buyers were exhausted and that the sellers could take the lead again. A new lower low, a valid breakdown below the 1.2155, could activate more declines toward the lower median line (LML).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money