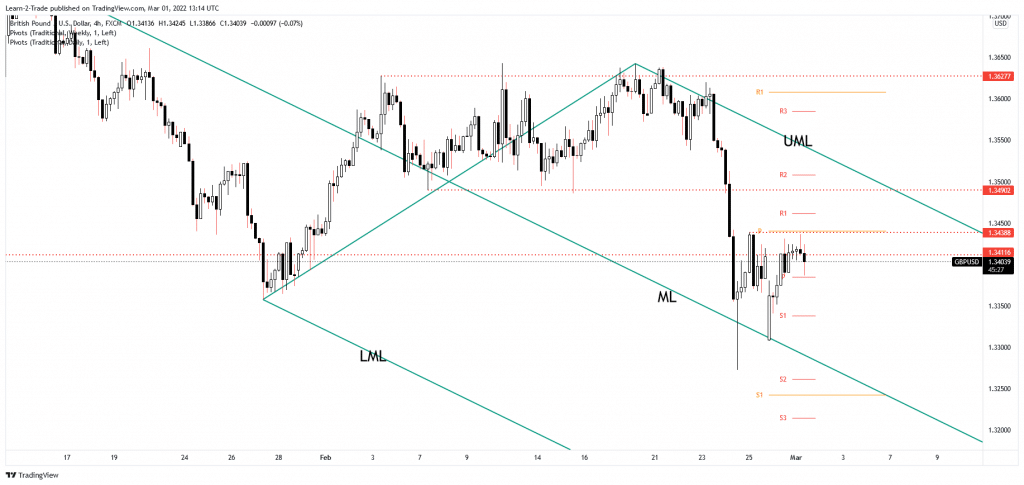

- The GBP/USD pair could develop a larger drop to make a new lower low.

- Only a new higher high could activate an upside continuation.

- The rebound could be only a temporary one after reaching the median line.

The GBP/USD price dropped today as the DXY’s rally boosted the USD. Technically, the currency pair was in a temporary rebound.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

However, the bounce-back seems over after reaching a strong resistance area. The pair is trading at 1.3389 at the time of writing, far below today’s high of 1.3436. The Pound dropped despite the fact that the United Kingdom Final Manufacturing PMI was reported at 58.0 points above 57.3 estimates, signaling expansion. In addition, the Net Lending to Individuals came in at 6.5B higher than 5.0B expected, Mortgage Approvals surged from 71K to 74K, exceeding the 72K forecasts. Unfortunately, the M4 Money Supply rose by 0.1%, less than 0.4% expected.

Later, the US will release the ISM Manufacturing PMI, which is expected to jump to 58.0 points from 57.6 points announcing the expansion. This could be good for the USD. In addition, the Final Manufacturing PMI could remain unchanged at 57.5, the Construction Sending may report a 0.2% growth, ISM Manufacturing Prices could be reported at 77.4. At the same time, the Wards Total Vehicle Sales may drop from 15.0M to 14.4M.

GBP/USD price technical analysis: Supply zone

The GBP/USD pair failed to reach the 1.3438 former high, signaling that the buyers are exhausted. Now, it has dropped below the 1.3411 static resistance key level. As long as it stays under this level, the price could drop. Even if the rate closed the gap, its failure to make a new higher high indicates that the rebound could be over. Dropping and closing below 1.3382 today’s low may open the door for a larger drop.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

From the technical point of view, the pair rebounded after retesting the descending pitchfork’s median line (ML), which represents dynamic support. The rebound could help the sellers to catch a new downside movement. Only a new higher high, jumping and closing above 1.3438, could invalidate a larger drop and announce an upside continuation.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money