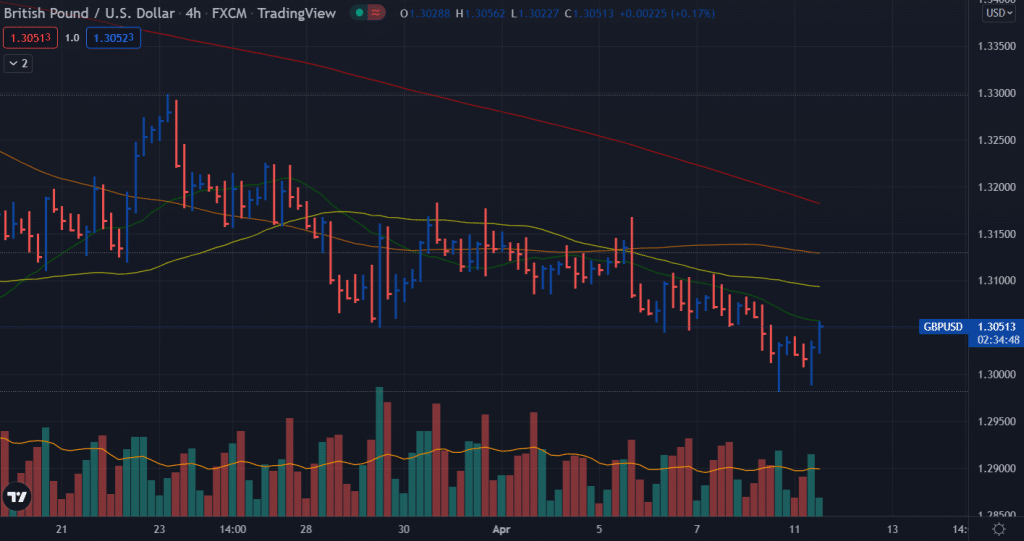

- The GBP/USD pair saw some buying on the dip later in the day, which reversed the decline to below 1.3000.

- The US dollar extended its recent gains to a near two-year high.

- As a result of the Fed’s hawkish outlook, the gains in major pairs have been limited.

During the London session, the GBP/USD price reversed course quickly, nearing a yearly low and closing near the top of its daily range around 1.3050.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

On Monday’s dip, the pair again showed some resilience below the psychological level of 1.3000, which prompted some buying despite the recovery attempt not lasting. Furthermore, the incumbent French president, Macron, provided some support for the common currency in the first round of presidential elections. As a result, the US dollar was forced to consolidate its recent strong gains to the highest levels since May 2020, which enabled the GBP/USD pair to make gains.

Strong greenback caps gains

The US dollar has nevertheless seen its decline moderated, and significant gains have been tempered, at least for now, by a combination of factors. First, investors believe that inflation is expected to rise due to tightening monetary policy more quickly. The US Treasury yields are at multi-year highs over fears that commodities prices will drive up already high consumer prices, which should support the dollar.

What’s next to watch?

Due to this, markets will remain focused on the latest US consumer inflation data, released on Tuesday. The yield on US bonds will also play an important role in determining US dollar rates. In addition, a rise in risk appetite and a demand for safe-haven assets will be stimulated by developments around the Russian-Ukrainian conflict. As a result, there is little chance of a major economic announcement impacting the market, which should help the GBP/USD pair.

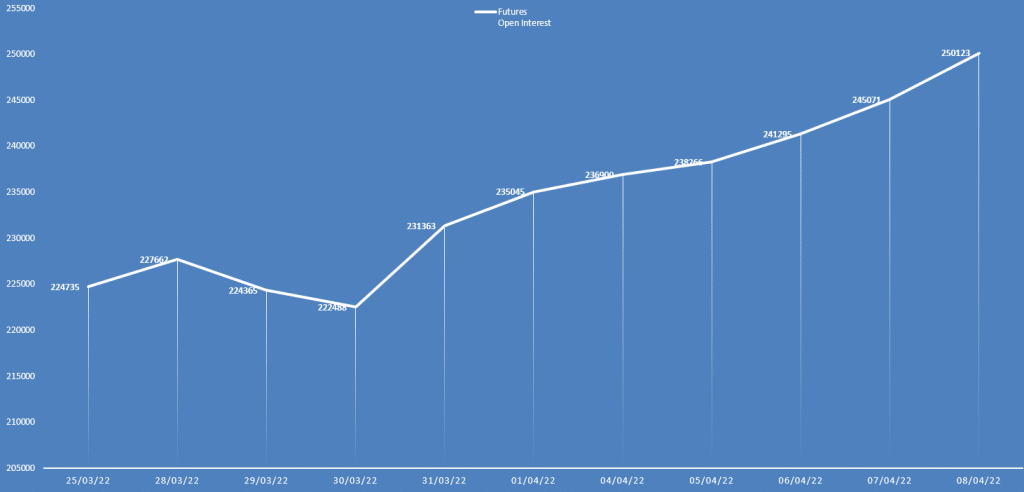

GBP/USD price daily open interest

The GBP/USD price closed with slight losses on Friday. Meanwhile, the daily open interest went significantly higher. This shows a bearish bias.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

GBP/USD price technical analysis: Bulls picking up

Alternatively, if the price falls below the 1.3000 area, the bias will turn strongly bearish and may find more sellers that help the bears slip towards 1.2900.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money