- The GBP/USD pair maintains a bearish bias despite temporary rebounds.

- The US PPI and Core PPI could bring more action today.

- A new lower low could activate a larger drop.

The GBP/USD price turned to the upside today. The pair is trying to recover after yesterday’s massive drop. The price is 1.1558 at the time of writing versus today’s low of 1.1479.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

The bias remains bearish despite a temporary rebound. Retreat of the US dollar after the amazing rally forced the greenback to lose ground versus its rivals. Still, the Dollar Index could register only a temporary drop before jumping higher. The Federal Reserve is expected to increase the Federal Funds Rate from 2.50% to 3.00% next week. After higher inflation reported by the US, a 75bps rate hike is also in the cards.

Today, the UK Consumer Price Index reported a 9.9% growth in August versus a 10.0% growth expected compared to the 10.1% growth in July, while the Core CPI surged by 6.3% exceeding the 6.2% growth forecasted. In addition, the PPI Input, PPI Output, and RPI came in worse than expected.

Later, the US is to release the PPI, which is expected to report a 0.1% drop and the Core PPI, which could register a 0.3% growth.

GBP/USD price technical analysis: Bullish momentum

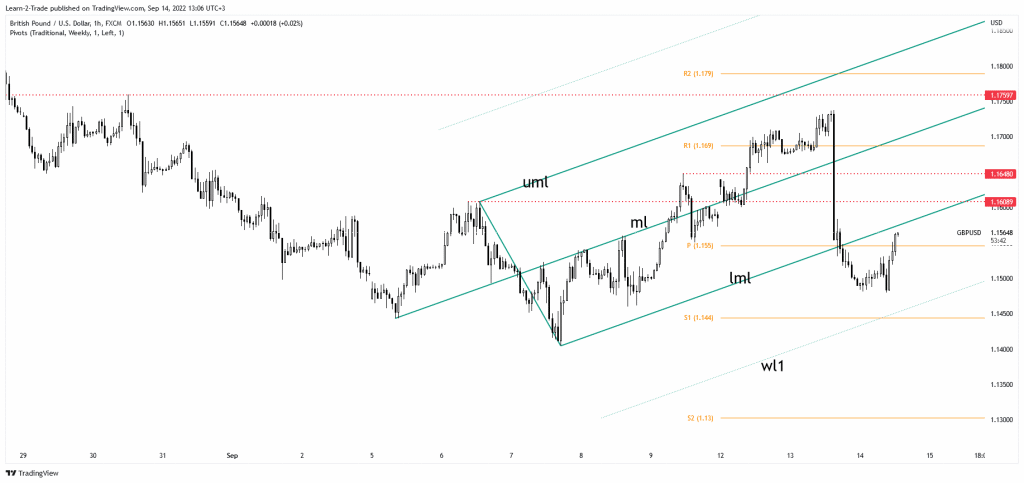

From the technical point of view, the GBP/USD pair tumbled after the US reported higher inflation in August. After its massive drop, a temporary rebound was natural and expected. Now, it has passed above the weekly pivot point of 1.1550 and almost reached the lower median line (LML). The 1.1600 psychological level and the 1.1608 represent upside obstacles as well. The rebound could help the sellers to catch a new sell-off. The price could only test the near-term resistance levels before going down. Testing the lower median line (LML), registering only false breakouts could announce that the rebound ended.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

Still, a larger downside movement, a downside continuation, could be activated only by a new lower low if the rate drops and closes below 1.1404. On the other hand, a larger rebound could be signaled by strong consolidation above 1.1450.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.