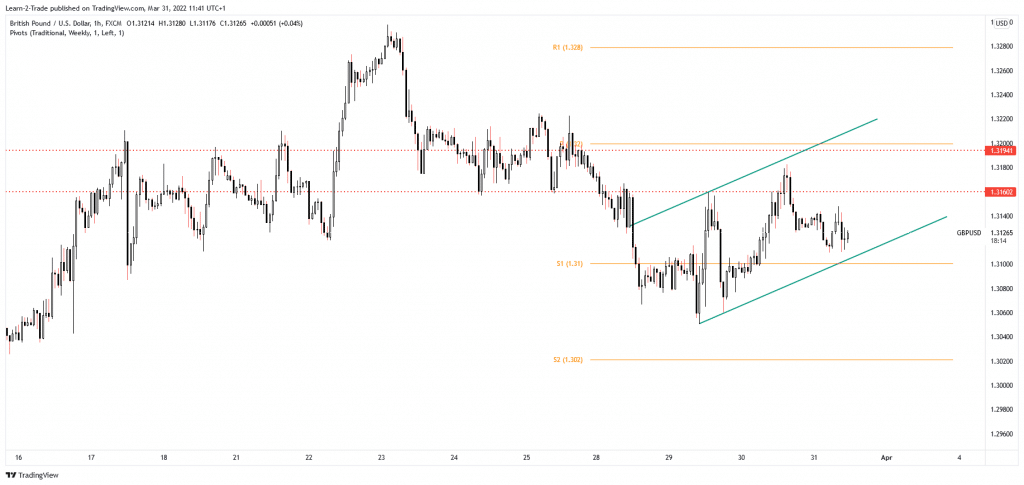

- The GBP/USD pair is traded within an up channel, representing a bearish pattern.

- A valid breakdown below the uptrend line could activate more declines.

- The bias remains bearish as long as it stays under the resistance area.

The GBP/USD price rebounded in the short term as the Dollar Index plunged. However, the pair has again turned to the downside as the bias remains bearish after the DXY reaches a major support level. Moreover, the GBP/USD developed an uptrend channel pattern in the short term. This could represent a bearish formation. Still, we’ll have to wait for confirmation before confirming a new leg down. Fundamentally, the British Pound could try to appreciate versus its rivals after the UK reported better than expected data earlier today.

The Revised Business Investment rose by 1.0% versus 0.9% expected, the Current Account was reported at -7.3B above -18.5B estimates, while the Final GDP rose by 1.3% exceeding the 1.0% growth expected. In addition, Nationwide HPI surged by 1.1% versus 0.5% forecast. Later, the US economic figures could bring high volatility and sharp movements.

The Unemployment Claims indicator could be reported at 195K in the last week, higher than 187K in the last reporting period, while the Core PCE Price Index could report a 0.4% growth in February. Furthermore, Chicago PMI could jump from 56.3 to 56.9 points, while Personal Income and Personal Spending could register a 0.5% growth in the last month.

GBP/USD price technical analysis: Bears to break uptrend channel

The GBP/USD pair maintains a bearish bias as long as it stays below the 1.3160 and 1.3194 levels. As you can see, the price action developed an uptrend channel pattern. The price failed to reach the downside in the last attempt. A valid breakdown below this dynamic support could activate a downside movement.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

Still, in the short term, the currency pair could try to come back higher to test and retest the upside obstacles before escaping from the chart pattern. A valid breakdown below the 1.3100 psychological level through the weekly S1 could activate a strong downside movement. In my opinion, only jumping and stabilizing above 1.32 could invalidate a downside continuation.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money