- The GBP/USD pair could extend its sideways movement as the DXY seems undecided.

- A valid breakdown from the current range pattern could announce a larger drop.

- It could come back to test and retest the immediate upside obstacles in the short term.

The GBP/USD price plunged even if the Dollar Index dropped aggressively after reaching 96.25. It’s trading around the 1.3590 level at the time of writing.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Unfortunately, the rate failed to confirm a potential upside continuation signaling that the sellers are still in the game. Now, it’s almost reaching the near-term support levels. Personally, I’ll wait to see how the rate will react around these downside obstacles.

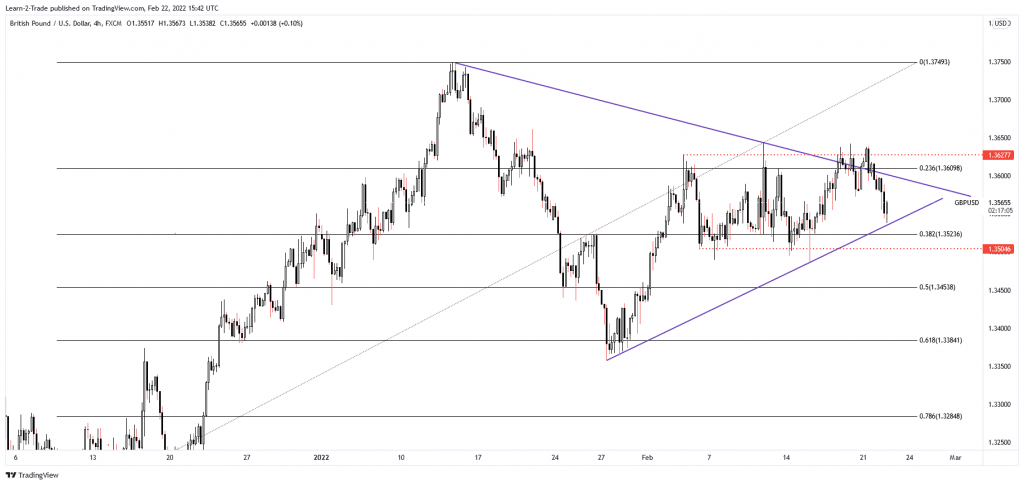

Technically, the GBP/USD pair continues to move sideways within a range pattern. Only a valid breakout from this pattern could bring a great trading opportunity and offer a clear direction. Fundamentally, the Pound took a hit from the United Kingdom data. The CBI Industrial Order Expectations dropped from 24 points to 20 points, even if the specialists expected a potential growth to 25 points. Moreover, the Public Sector Net Borrowing was reported at -3.7B versus -4.3B estimates.

On the other hand, the US data came in better than expected earlier. It remains to be seen how the greenback will react as the Dollar Index is under strong bearish pressure. The CB Consumer Confidence was reported at 110.5 points above 109.9 expected, the Flash Services PMI jumped unexpectedly higher from 51.2 to 56.7 points, far above 52.9 expected. At the same time, the Flash Manufacturing PMI came in at 57.5 versus 55.9 signaling expansion.

GBP/USD price technical analysis: False breakout!

The currency pair failed to hit the uptrend line. Now, it has rallied only because the DXY is vulnerable. Still, the rebound could be only a temporary one after its massive drop. After it failed to take out the 1.3627 static resistance or stabilize above the downtrend line, the GBP/USD pair signaled that the upside was over.

–Are you interested in learning more about forex robots? Check our detailed guide-

Still, in the short term, the rate could come back to test and retest the downtrend line and the 23.6% retracement level before dropping deeper. Then, the price could extend its sideways movement between 1.3627 and 1.3504 levels. Only a valid breakdown below the uptrend line and below 1.3504 could really announce a larger drop.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money