- The GBP/USD pair saw some subsequent selling on Wednesday amid a strengthening US dollar.

- The Fed’s hawkish outlook, higher US bond yields, and the Ukraine crisis were positive factors for the US dollar.

- Technically, the pair is attempting to correct higher but the major hurdle lies at 1.3223 (double top).

As the London session opened, the GBP/USD price traded around the three-week low near 1.3055 as the greenback continued its upside momentum.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

During the first half of Wednesday’s trading, the pair fell to its lowest level since March 16 but showed resilience below the 1.3050 level, posting rapid gains to 1.3080. However, with the US dollar reaching a nearly two-year high for the fifth consecutive day, the GBP/USD pair was under some downward pressure.

Fed’s hawkish tone

Fed rates are expected to rise by 100 basis points in the next two meetings to combat persistently high inflation. In addition, Fed Governor Lael Brainard stated that the Federal Reserve could rapidly reduce its balance sheet following the May meeting, which substantially bolstered the dollar.

US treasury yields

Treasury yields on two-year Treasury bills, which are sensitive to expectations of rate hikes, have reached their highest level since January 2019 as hopes of a more aggressive decision by the Federal Reserve increase. Further, benchmark 10-year and 5-year bond yields hit their highest levels in December 2018 and April 2019.

What’s next to watch for the GBP/USD price?

Based on the fundamental backdrop, the GBP/USD pair may depreciate further in the near term. Therefore, the market will remain focused on the minutes of the Fed’s monetary policy meeting, which will be released later during the US meeting. Meanwhile, the fading prospect of a diplomatic solution to end the conflict in Ukraine and fears that new sanctions will be imposed on Russia over its alleged war crimes should benefit the safe-haven dollar.

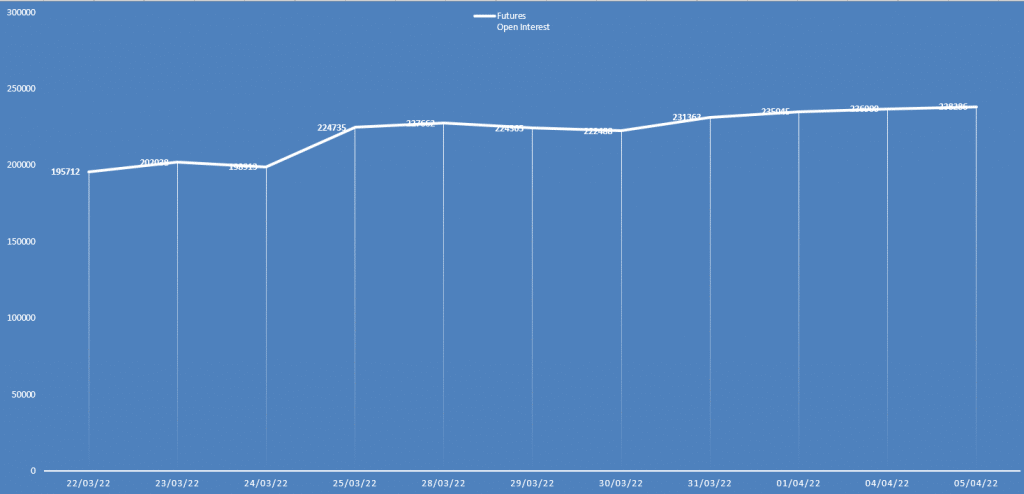

GBP/USD daily open interest

The GBP/USD fell sharply yesterday but the open interest had no significant change. It shows a neutral bias.

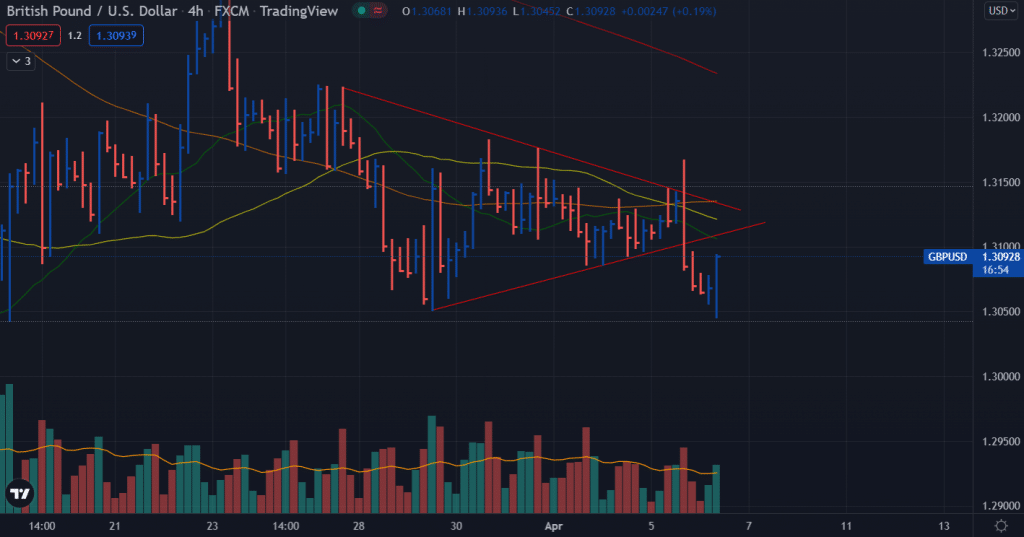

GBP/USD price technical analysis: Bulls trying to take back control

The GBP/USD price has formed a short-term bottom at 1.3044 and sharply jumped above the 1.3080 area. The pair has posted a widespread bar with a very high volume. The volume for the recent two up bars is high, while the previous three down bars have a declining volume. It means that the volume is showing a tendency to go upside.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

However, the bearish bias remains intact if the price remains below the double top at 1.3223. If the double top is broken, the pair may lead the rally towards 1.3300. On the flip side, if the double bottom at 1.3000 breaks, the price will drift lower towards 1.2900.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money