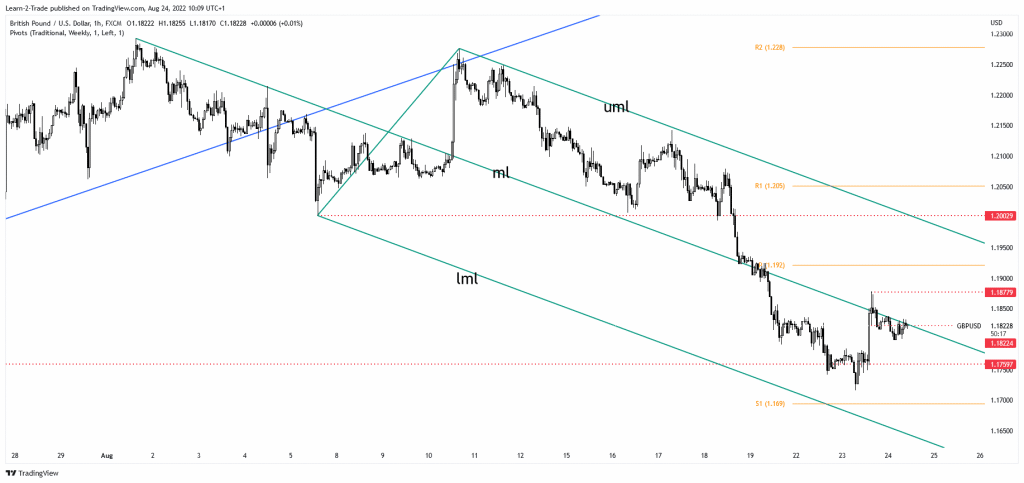

- Failing to stay above the median line (ml) signaled strong downside pressure.

- Temporary rebounds could bring new selling opportunities.

- The lower median line (lml) is seen as a downside obstacle and target.

The GBP/USD price was trading at 1.1821 at the time of writing. The price rebounded yesterday as the Dollar index posted losses after the US economic data.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Technically, the bias remains bearish despite temporary rebounds. In fact, short-term pullbacks could bring new selling opportunities. The Dollar Index was expected to retrace after its solid rally.

Still, the DXY maintains a bullish bias. It could only test the near-term downside obstacles before jumping higher. The FED is expected to increase the Federal Funds Rate by 0.50% in September.

Unfortunately for the USD, the Flash Services PMI, Flash Manufacturing PMI, Richmond Manufacturing Index, and the New Home Sales came in worse than expected yesterday. Today, the US economic figures could bring more action.

The Durable Goods Orders could report a 0.9% growth, Core Durable Goods Orders may surge by 0.2%, while Pending Home Sales is expected to register a 2.6% drop. Tomorrow, the US Prelim GDP and the Unemployment Claims could shake the markets. Better than expected data today and tomorrow may help the greenback take the lead again versus its rivals.

GBP/USD Price Technical Analysis: Temporary Rebound

The GBP/USD pair bounced back after failing to stabilize below the 1.1759 level. Still, the bullish momentum was paused by the descending pitchfork’s median line (ml) which stands as a dynamic resistance.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

Now, it has tested this upside obstacle and it could come back down towards 1.1759 again. Its failure to take out the dynamic resistance signaled strong downside pressure. As long as it stays under the median line (ml), the bias is bearish. The 1.1716 former low stands as a downside target.

Moreover, the S1 of 1.1690 is seen as a downside obstacle if the GBP/USD pair continues to drop. In my opinion, only a valid breakout above the median line (ml) may signal a larger rebound. On the other hand, dropping and stabilizing below 1.1759 may activate a downside continuation. The lower median line (lml) could be used as a downside obstacle as well.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.