- Amidst Brexit fears and political issues in the country, the GBP/USD fails to benefit from a pullback in the US dollar.

- In the wake of the party gate scandal, Labor pulls back from a Brexit waiver, and UK Prime Minister Johnson battles to defend his position

- Dollar growth is not helped by yields but by the US-China trade dialogue.

- Fresh impetus will be provided by US manufacturing orders and the final UK PMI data.

Despite the US dollar breaking away from a two-week high, the GBP/USD price is struggling to defend 1.2100 as pessimism over Brexit weighs on the cable pair. In anticipation of Tuesday’s London opening, the citations remain aimless.

-Are you interested to find high leverage brokers? Check our detailed guide-

If all of this occurs, the Tories will have more difficulty at re-election if Labor leader Keir Starmer backs Brexit. Brexit’s problems are also evident in the deadlock over the Northern Ireland Protocol (NIP).

Following the coming-out-to-the-party scandal, British Prime Minister Boris Johnson is facing immense pressure from all sides, whether the opposition or Tory rebels. There was a recent attempt by British politicians to overthrow Johnson by changing the committee’s rules that had previously protected him.

As a whole, Liu He’s comments suggest that US-China trade relations are improving, at least for now, which has helped improve market sentiment earlier this year. The macroeconomic information release cited phone conversations between Chinese Minister Liu He and US Treasury Secretary Janet Yellen as evidence of the need to strengthen communication and macroeconomic policy coordination between China and the United States.

Conversely, recession concerns keep cable buyers from putting pressure on GBP/USD rates, hindering the Bank of England (BOE).

GBP/USD key events to watch

On Thursday, we will see the final readings of the S&P Global Month Composite PMI for June and Services PMI for June, which will entertain pairs ahead of the Federal Open Market Committee (FOMC) report for June and US employment figures for June. Short-term traders may be guided by intraday US factory order data for May, which are expected to rise 0.5% vs. 0.3%.

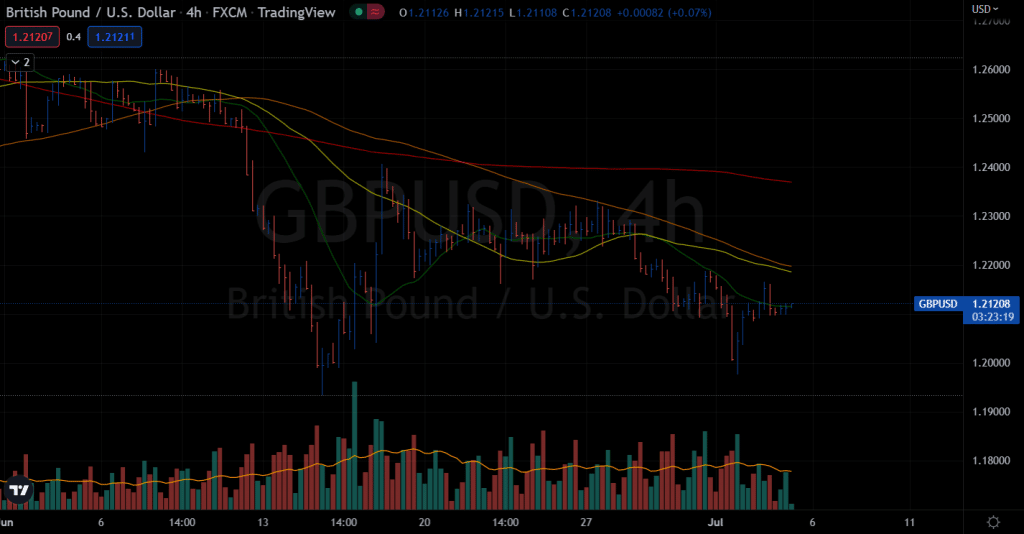

GBP/USD price technical analysis: Key SMAs pointing downside

The GBP/USD price is wobbling around the 20-period SMA. The price remains depressed as the key moving averages on the 4-hour chart lie well above the price while pointing to the downside.

-Looking for high probability free forex signals? Let’s check out-

The buyers may attempt to test yesterday’s highs of 1.2165. However, sustaining above the level may be hard for the bulls. Meanwhile, staying above the 1.1975 level may attract more buyers and look for a meaningful recovery towards 1.2300.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money