- GBP/USD holds above the two-week high for the sixth consecutive day despite pulling back from the intraday high.

- Due to concerns over Johnson’s sacking, a German British official’s warning, and a Brexit halt in Northern Ireland, investigations have been halted.

- A 0.25% rate hike was announced by the Bank of England to fight inflation. US data was mixed.

The GBP/USD price is struggling to support a two-week high near 1.3600 heading into Friday’s London open. Nevertheless, the cable pair remains positive for the sixth straight day at press time despite falling from an intraday high of 1.3615.

–Are you interested to learn more about Islamic forex brokers?

In the wake of the Bank of England (BOE) rate hikes, GBP/USD bulls face challenges from UK politics and Brexit fears as markets prepare for the US jobs report. Thus, cable pair buyers face a challenging path on the upside.

On Friday, the Times reported that cabinet ministers believe there is a 50/50 chance Boris Johnson will be ousted after four of his top advisers left Downing Street, and his Chancellor publicly scolded him. Johnson was facing political difficulties early Friday in Asia.

Prime Minister Johnson was rebuked by British Chancellor Rishi Sunak for claiming that Labor Party leader Sir Keir Starmer was responsible for not prosecuting pedophile Jimmy Savile.

As required by the Brexit deal, Northern Ireland’s suspension of inspections of goods entering its ports shows a growing problem. According to Reuters, Franziska Brantner, Parliamentary State Secretary at the Federal Ministry for Economic Affairs and Energy, said: “The UK must respect the post-Brexit trade rules or face the consequences.”

On Wednesday, the US ISM PMI for services and nonfarm payrolls were strong in the 4th quarter, but December factory orders data and Q4 unit labor costs were weak. Based on the data, Richmond Federal Reserve Chairman Thomas Barkin said, “The Federal Reserve should raise interest rates, but it’s still too early to tell how fast or how far that process will have to go to get inflation under control.”

The 10-year Treasury yield rose 1.8 basis points (bps) to 1.845% in this context, marking the first weekly gain in the past three days. Moreover, S&P 500 futures are up 1.14% near 4520, while Asia-Pacific stocks have been mixed recently.

For clues ahead of US jobs data in January, traders will be keeping an eye on Brexit and political news.

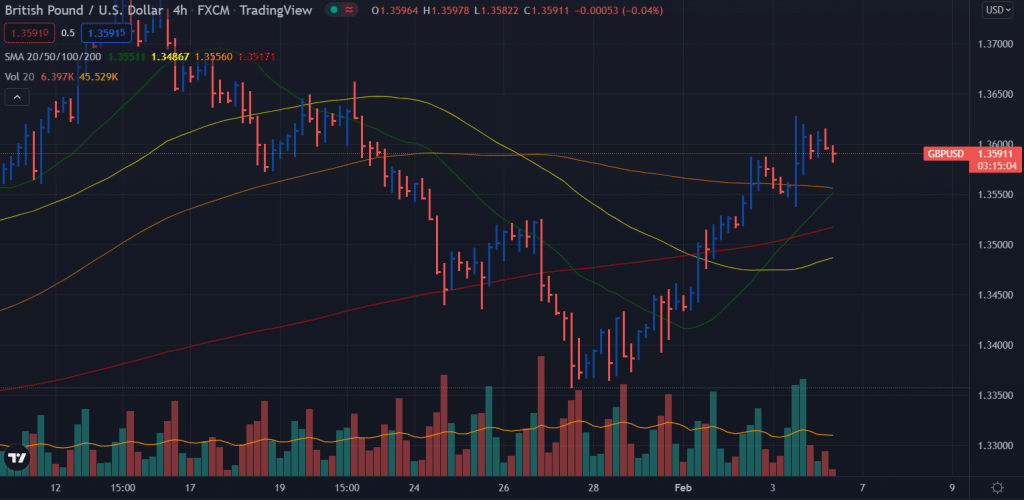

GBP/USD price technical analysis: Potential bearish reversal

The GBP/USD price formed a bearish reversal pattern on the 4-hour chart. The pair posted a widespread up bar that closed in the middle. The volume of the bar was very high. Since then, the top of the bar has remained intact, and the price is moving down. However, a bearish trend will be confirmed once the price breaks the 1.3550 area. The pair may aim for 1.3500 ahead of 1.3500 and then 1.3460.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

On the upside, breaking 1.3622 may trigger further buying and aim for 1.3650 ahead of 1.3710. Meanwhile, the path of least resistance lies on the downside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.