- The GBP/USD pair maintains a bullish bias in the short term.

- A valid breakout through the median line could activate a larger growth.

- DXY’s deeper drop should weaken the greenback.

The GBP/USD price is trading around 1.1770 at the time of writing and is fighting hard to stay higher as the US dollar finds buying momentum today.

Fundamentally, the UK data came in mixed on Friday. The Gross Domestic Product dropped by 0.6% versus the 0.4% expected, and Prelim GDP fell by 0.2% less than the 0.5% estimated.

In comparison, Construction Output registered a 0.4% growth even if the traders expected a 0.6% drop. In addition, Goods Trade Balance, Index of Services, Industrial Production, Manufacturing Production, and Prelim Business Investment came in better than expected.

On the other hand, the Prelim UoM Consumer Sentiment came in at 54.7 points, far below the 59.5 expected. Today, the UK Rightmove HPI reported a 1.1% drop. Later, the CB Leading Index will be released as well.

Tomorrow, the UK is to release Claimant Count Change and Average Earnings Index, while the US is to release the Empire State Manufacturing Index, PPI, and the Core PPI.

GBP/USD price technical analysis: Bullish bias

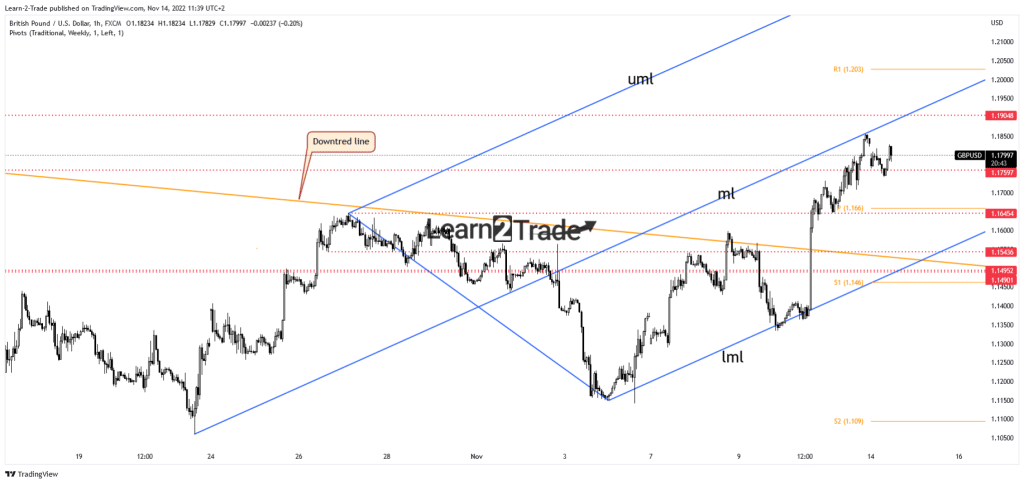

Technically, the GBP/USD pair retreated after failing to hit the median line (ML). Now, it tries to close the gap down. As long as it stays above 1.1759, the price could resume its growth. The 1.1645 and the pivot point (1.1660) also represent downside targets. After its strong rally, a temporary retreat is natural. The pair may retest the near-term support levels before developing a new bullish momentum.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

As you can see on the hourly chart, the price confirmed the ascending pitchfork after testing and retesting the lower median line (LML). As long as it stays within the ascending pitchfork’s body, the rate could still hit the median line (ML), representing a dynamic resistance. The 1.1904 historical level represents an upside target as well.

The GBP/USD pair could approach and reach new highs if the DXY drops deeper. A larger upwards movement could be confirmed after a valid breakout through the median line (ML). On the contrary, false breakouts may result in a new sell-off.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.