- The weaker dollar is pushing GBP/USD higher.

- The Bank of England is expected to raise interest rates at least twice this year.

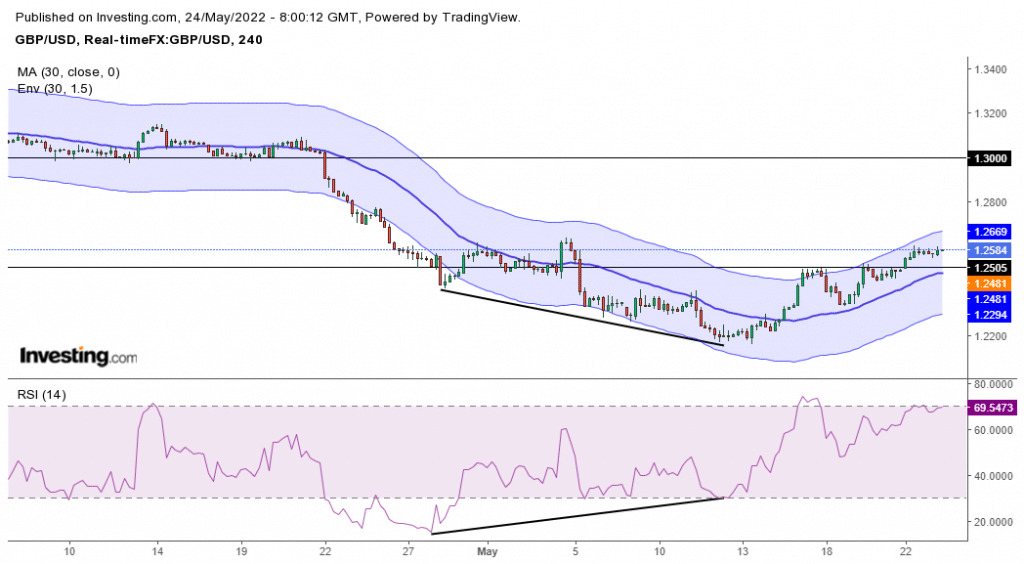

- The GBP/USD bulls pushed the pair back above 1.2500.

Monday saw the GBP/USD price close on a bullish candle. Most of this move is attributed to the weaker dollar as investors run to risk instruments amid the positive risk sentiment.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

The Bank of England’s governor, Andrew Bailey, has been accused of doing nothing as inflation went up and the cost-of-living crisis hit the UK. However, the governor insists that higher interest rates would only damage an economy recovering from the pandemic.

He said high energy prices would reduce consumer spending and allow them to take a less aggressive approach to rate hikes. The Bank of England is expected to raise interest rates at least twice this year, from 1% to 1.5%.

GBP/USD key events today

Investors will be paying attention to the Purchasing Managers’ Index data coming out later, starting with the UK composite PMI. The activity level of purchasing managers is expected to drop from 58.2 to 56.5. The UK Manufacturing PMI is expected to decrease from 55.8 to 54.9, showing decreased activity in the manufacturing sector.

Lastly, investors expect the Services PMI to drop from 58.9 to 56.9, showing slowed activity in the services sector. We might see GBP/USD push higher if these releases are favorable. Anything lower than expected could see the return of bears in the market.

From the US, there is the new home sales data expected to go down to 750k from 763k. Investors will be paying close attention to Fed Chair Powell, who is expected to speak later in the day.

GBP/USD price technical forecast: RSI bullish divergence

Looking at the 4-hour chart, we see how bears pushed prices below 1.2500 and lost momentum, as seen in the RSI bullish divergence. Since then, the bulls have pushed the pair back up and only yesterday managed to break and close above 1.2500.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

However, we need a larger momentum candle to confirm this new bullish trend. If the price continues trading above the 30-SMA and gets to the overbought region, we might just see the price get to 1.3000. Today, the price might pull back to retest the 1.2500 level before going higher. However, the probability of breaking the 1.2600 area also exists.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money