- The GBP/USD pair rebounded, but the throwback could be temporary.

- False breakouts above 23.6% could announce a new sell-off.

- The FOMC could boost the greenback on Wednesday.

The GBP/USD price rebounded in the short term as the DXY’s retreat punished the USD. Technically, a temporary throwback was somehow expected after its massive drop. It could come back to test the immediate resistance levels before dropping deeper.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

The bias remains bearish, so personally, I’m waiting for the rebound to end before looking for potential new short opportunities. In the short term, the USD was overbought, that’s why the GBP/USD pair grows and not because the Pound is strong. Yesterday, the greenback took a hit from the US Advance GDP which reported an unexpected 1.4% drop in Q1.

Fundamentally, the USD could try to take the lead again after positive economic data reported by the US earlier. The Core PCE Price Index rose by 0.3%, matching expectations, while the Employment Cost Index registered a 1.4% growth versus 1.1% expected.

In addition, Personal Spending reported a 1.1% growth beating the 0.7% estimates, while Personal Income surged by 0.5% exceeding the 0.4% forecasts. Later, the Chicago PMI and the Revised UoM Consumer Sentiment could bring more action.

USD’s retreat is natural ahead of the FOMC. As you already know, the Federal Reserve is expected to hike rates again on Wednesday. The Federal Funds Rate could be increased from 0.50% to 1.00%. Hawkish FOMC could boost the dollar.

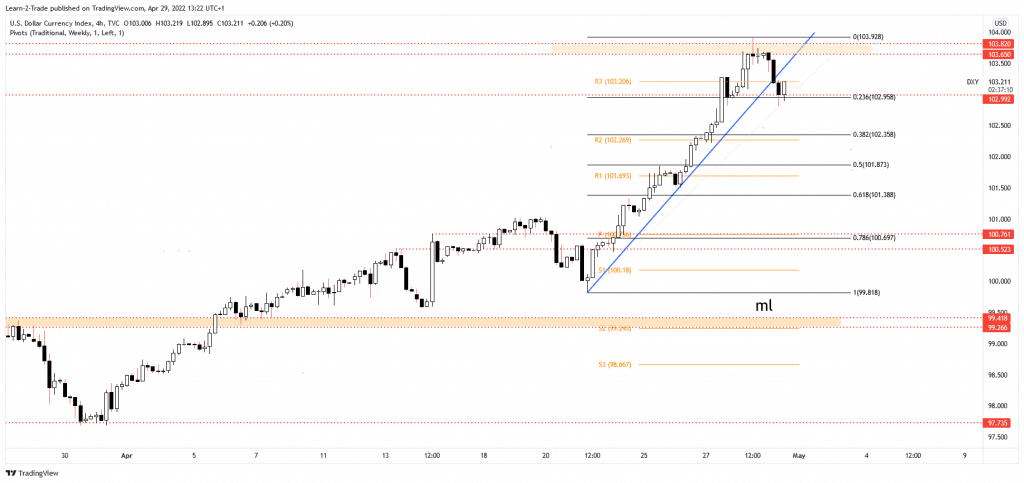

Dollar Index price technical analysis: Correction

Staying above this critical support may signal a new bullish momentum towards the resistance area. A larger correction may signal USD’s depreciation in the short term versus the other major currencies. However, the bias is bullish, so further growth could help the greenback dominate the currency market.

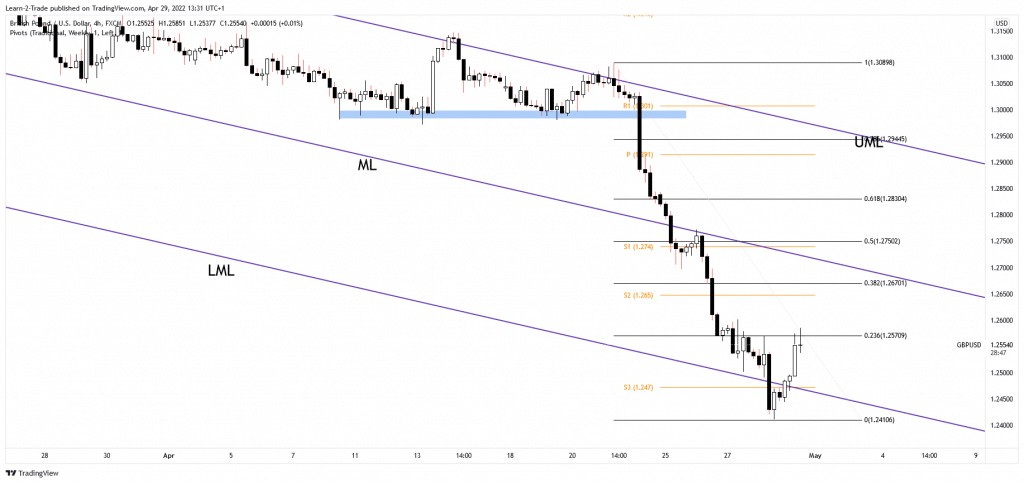

GBP/USD price technical analysis: Bounce back

Technically, the GBP/USD pair found support under the weekly R3 (1.2470) and below the lower median line (LML), which represented downside obstacles. It has challenged the 23.6% (1.2570) upside obstacles, but unfortunately, it has failed to stabilize above it.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

False breakouts above this near-term resistance may signal a new sell-off towards the lower median line (LML). Only a valid breakout could activate more gains. On the other hand, a larger downside movement could be activated by a valid breakdown below the LML.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money