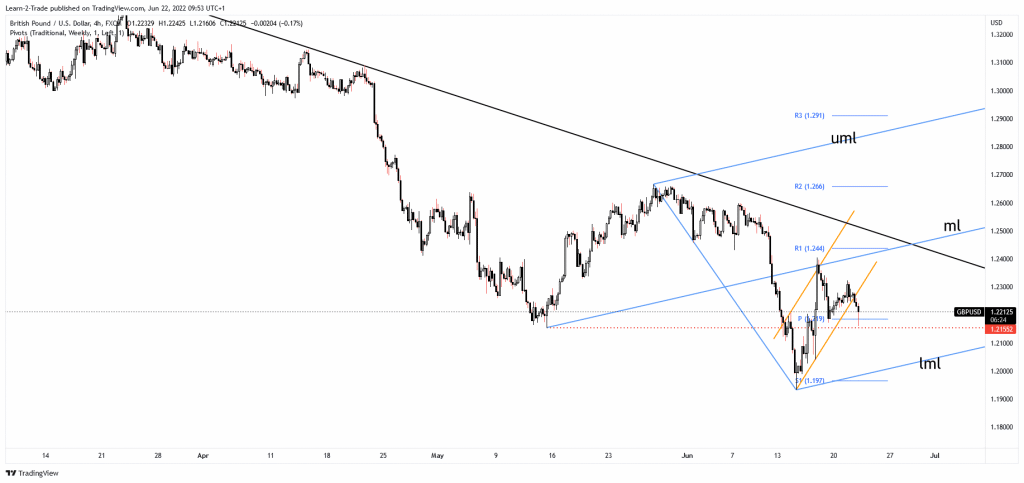

- The GBP/USD pair maintains a bearish bias as long as it stays under the downtrend line.

- A new lower low could activate more declines.

- After its false breakdown with great separation below the weekly pivot point, the rate could try to come back higher.

The GBP/USD price plunged in the short term, but now it is trying to rebound. Today, the fundamentals moved the price, so we’ll have to wait for a fresh trading opportunity before taking action.

-Are you interested in learning about forex live calendar? Click here for details-

The price also dropped because the Dollar Index has managed to rebound. Still, the DXY stands below strong upside obstacles, so we cannot exclude a new sell-off. Fundamentally, the USD remains bullish despite temporary declines.

As you already know, the FED increased the Federal Funds Rate by 75-bps in the June meeting, and it’s expected to continue hiking rates in the next monetary policy meetings.

Earlier, the United Kingdom Consumer Price Index reported 9.1% growth matching expectations, while the Core CPI rose by 5.9% less versus the 6.0% growth expected. In addition, the HPI rose by 12.4%, beating the 10.0% estimated. RPI registered a 11.7% growth versus 11.4% expected, PPI Output surged by 1.6% as expected, while the PPI Input reported a 2.1% growth exceeding the 1.8% growth expected.

Later today, Fed Chair Powell’s testimony could bring more action and change the sentiment in the short term.

GBP/USD price technical analysis: Bears dominating

The GBP/USD pair rebounded after its massive drop. As you can see on the 4-hour chart, the price found resistance at the ascending pitchfork’s median line (ml) and dropped again. In the short term, the price rose within an uptrend channel.

-Are you interested in learning about forex signals? Click here for details-

This formation could represent a bearish continuation pattern. Still, unfortunately, the pair registered only a false breakdown below the weekly pivot point of 1.2190, and failed to reach the 1.2155 key support after escaping from the channel pattern. As long as it stays above these downside obstacles, the price could still try to gain back.

Technically, the bias remains bearish as long as it stays under the major down trendline. So, despite temporary rebounds, the rate could drop deeper anytime. A valid breakdown below the 1.2155 could confirm more declines, at least towards the lower median line (LML).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money