- GBP/USD price is neutral at the moment, around 1.3800.

- The recent pressure on the pound is attributed to the coming up BOE session.

- The retail sales data came lower than expected at -0.9%.

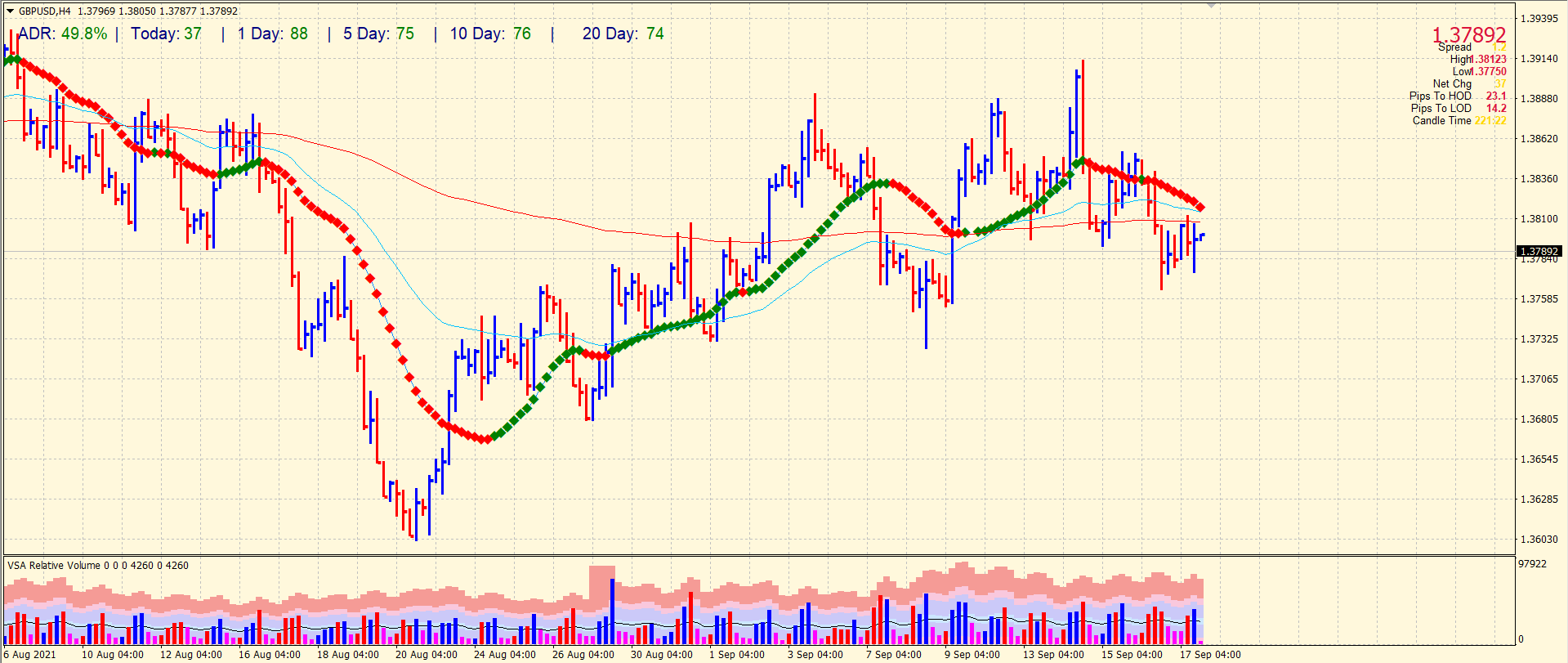

The GBP/USD price analysis suggests a neutral momentum as the price is still indecisive near the 1.3800 key level. However, a clear breakout may suggest some directional move on either side.

Though the GBP/USD pair declined yesterday, it has risen today, indicating a positive trend.

-Are you looking for the best CFD broker? Check our detailed guide-

Despite the price action for the GBP/USD, there is an expectation that technical bias will stay bullish for a while.

We can attribute the decline to the upcoming news on the Bank of England set purchase program scheduled for September 23, 2021. In the absence of data, economists predict it may be £895 billion. So, the reading from one month ago is unlikely to change.

One mechanism for buying assets is the amount of money a person wants to create by purchasing open market bonds and investing in the economy to influence long-term interest rates.

The GBP/USD pair is trading around 1.3800 and could move higher if various support levels hold.

The National Bureau of Statistics released retail sales data today that showed a value of -0.9 percent, lower than economists’ expectations.

A percentage change over the month is used to determine how these sales have changed. Thus, indicators of consumer spending include shifts in retail sales. Generally, a low consumer spending value is bad for the pound.

-Are you looking for forex robots? Check our detailed guide-

GBP/USD price technical analysis: Attempting to break 1.3800

The GBP/USD price is trying to gain beyond the 1.3800 level, but the 200-period SMA on the 4-hour chart is resisting gains. The key SMA coincides with the important level of 1.3800. In addition, the congestion of 20-period and 50-period SMAs slightly above the 1.3800 area may also provide some resistance. However, these levels are broken. Thus, we may see a quick surge to the mid-1.3800 mark ahead of 1.3900. On the downside, immediate support lies at yesterday lows around 1.3760 ahead of 1.3700.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.