- GBP/USD tested at the fresh cycle highs on negative Brexit comments from Gove.

- Bulls, otherwise, remain optimistic that a deal will be done and US dollar weakness is playing its role.

GBP/USD is trading at 1.3619 between a low of 1.3490 and a high of 1.3624, higher by 0.83% at the time of writing with markets firmly fixated on dollar weakness and Brexit noise.

The pound climbed to the 1.36 area on Thursday, extending the 2-1/2 year highs against a crippled dollar while earlier reports of progress in Brexit trade talks boosted risk-appetite.

Path for rates is binary to Brexit

Meanwhile, the Bank of England left its stimulus programme unchanged as it awaited the outcome of Britain’s negotiations with the EU.

The Monetary Policy Committee voted unanimously to maintain the Bank Rate at 0.10% and to keep its asset purchase targets unchanged at a pace of purchases of GBP 4.4B per week.

However, cable did not register any direct reaction to the decision with investor’s attention was firmly elsewhere.

Brexit concerns remain the key driver for now.

We have heard snippets of optimism throughout the week and the latest came in the AFP News Agency, citing parliamentary sources, reporting that the European Unions’s chief Brexit negotiator, Michel Barnier, suggested that a Brexit deal with the UK is possible by Friday.

However, in more recent trade, Cabinet minister Michael Gove has said the chances of the UK and EU agreeing on a post-Brexit trade deal are “less than 50%”.

Mr Gove told MPs “regrettably the chances are more likely we won’t secure an agreement”.

Nevertheless, talks in Brussels are continuing on Thursday, with two weeks to go before the UK leaves EU trading rules.

Sunday has been set as a deadline by the EU for them to see the text of any deal agreed by the negotiating teams.

The senior MEPs said they would “not be rushed” into approving an agreement at their end, and would have to see the text by the end of the week if they were to sign it off by 31 December.

MPs from the UK Parliament have been warned by Mr Gove they could be called back during their Christmas break to ratify any deal that emerges from talks.

Gove, today, has echoed the comments of Prime Minister Boris Johnson’s spokesman on Wednesday, who said he still viewed no deal as “the most likely outcome”.

Nevertheless, there has been a muted response in the market, at least by comparison to the start of the week’s reaction to weekend headlines of optimism which sparked a huge opening gap of almost 100 pips and a continuation of over an additional 300 pips.

However, the planned rollout of effective vaccines would be expected to have a positive impact on activity and inflation and is seen to reduce downside risks which were ascertained from today’s stance at the BoE.

Moreover, the sheer weakness in the US dollar is a major contributor to cable’s strength.

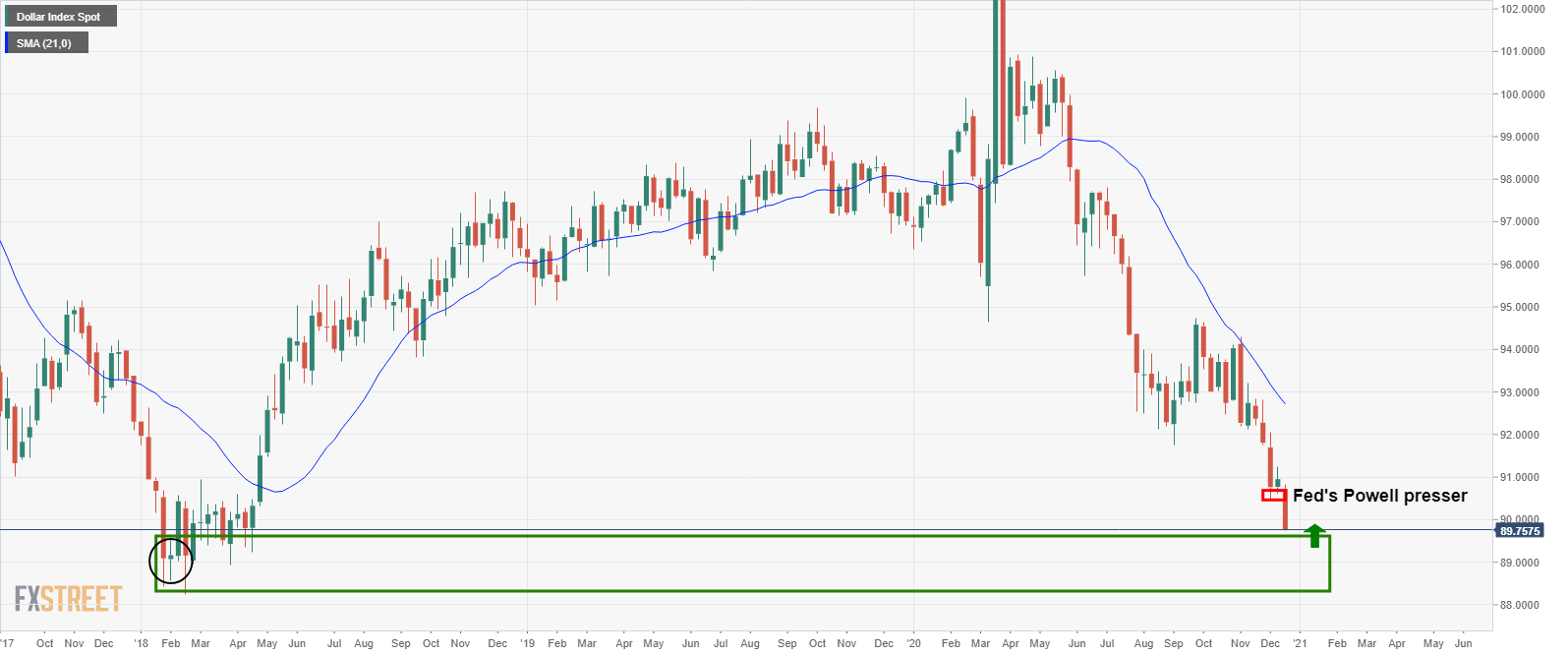

DXY daily chart

The US dollar was unable to capitalise on the prospects of the Federal Reserve’s QE tapering sooner than that of the worst feared outcomes of the pandemic for the economy and subsequent longevity of stimulus.

Instead, the press conference with the Fed’s chair, Jerome Powell, was the nail in the coffin for the US dollar with his opening statement, ”we will continue to provide powerful support until the recovery is complete.”

Additionally, he stated ”we have the ability to buy more bonds, or buy longer-term bonds, and may use it, and ”any time we feel like economy could use stronger accommodation we ‘would be prepared to provide it.’

”When we see substantial progress we will say so ‘well in advance’ of tapering. Lowering QE is ‘some ways off’.

Meanwhile, despite the conflicting headlines, ”the latest uptick modestly re-calibrates our expectations of what a knee-jerk reaction to a positive deal outcome to look like,” analysts at TD Securities argued

”Here, we think we could see a push above 1.3712, but cable could begin to see the interest to fade an announcement arise between 1.3750 and 1.38.”

”In any case, we think sterling will be a sell in the wake of any announcement, as the pound faces shaky fundamental underpinnings.”