- GBP/USD has been holding onto high ground as markets digest the US jobs report.

- The pound may come under pressure due to Brexit, coronavirus, and protests.

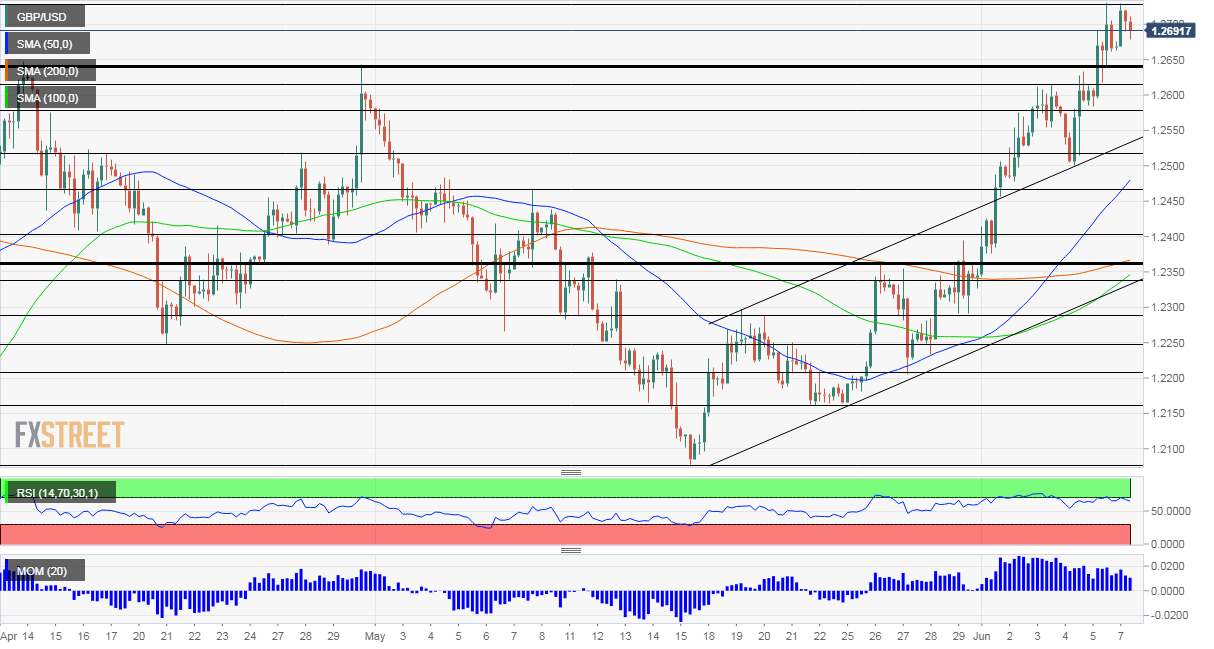

- Monday’s four-hour chart is showing nearly overbought conditions.

“The UK continues to backtrack on commitments taken” – the harsh words of Michel Barnier, Chief EU Negotiator, reflects the deadlock in talks about future relations between Brussels and London. While the lack of progress has been unsurprising, the tone and the potential to abandon negotiations is becoming more real.

Barnier’s presser on Friday took only a minor toll on the pound, as markets were gearing up for the US Non-Farm Payrolls figures. Nevertheless, the specter of the UK falling to World Trade Organization terms may still weigh on the pound.

Another factor that may pressure the pound is Britain’s slow reopening. Coronavirus statistics have been falling at a slower pace than continental countries. That, and potentially Prime Minister Boris Johnson’s near-death experience with COVID-19, are behind the cautious approach.

While moving more slowly may reap benefits later down the line, the economy is suffering in the immediate term. Moreover, the UK’s decision to demand a 14-day quarantine for entering passengers has angered airlines and is set to hurt the tourism sector.

The third bearish factor is massive protests that were seen in the UK over the weekend. Inspired by demonstrations in America, Brits came out to the streets in a call to end racial discrimination. Grievances span the history of slavery and run through coronavirus – which has taken a disproportionate toll on Black, Asian, and minority ethnic (BAME) communities.

The PM has already been losing support due to his handling of the disease and discontent over racial discrimination piles up. Moreover, protesters have not observed social distancing measures, risking new clusters, which may further delay the return to normal.

Large demonstrations were also seen over the weekend in the US, and may indirectly have a positive effect on markets. Lawmakers have reportedly accelerated talks on another fiscal relief package. That may boost stocks and weigh on the dollar.

On the other hand, elected officials may feel disincentivized to act after the US surprisingly reported an increase of over 2.5 million jobs in May. The Non-Farm Payrolls provided a positive shock to investors bracing for the bad news. Government support played a substantial role in keeping people on the job.

This week’s most significant event is the Federal Reserve’s decision on Wednesday. The world’s most powerful central bank will likely reiterate its ongoing support to the economy but may loosen its efforts amid the bounce in employment.

See:

- NFP Analysis: The complete labor market surprise

- NFP Analysis: Shocker surge in jobs may trigger a much-needed dollar bounce, regardless of stocks

Overall, UK factors may weigh on the pound, while American developments may have a mixed impact on the dollar.

GBP/USD Technical Analysis

Momentum on the four-hour chart is somewhat weaker and the Relative Strength Index is close to 70 – nearing overbought conditions. That implies that the room for gains is limited, yet bulls remain in control.

Resistance awaits at 1.2730, the daily high, and also Friday’s peak. It is followed by 1.2780 and 1.2845, levels that were in play early in the year.

Support is at 1.2645, the former double-top seen in previous months. It is closely followed by 1.2615, which capped the pair last week, and then by 1.2575, a support line before the latest rise.

More Will race relations rock markets? Election campaign, coronavirus, crippled economy all in the mix