“¢ Investors looked past today’s UK manufacturing PMI print for July.

“¢ USD fails to build on early up-move and helps gain positive traction.

“¢ Traders eye US data/FOMC decision for some impetus ahead of BoE.

The GBP/USD pair continued with its steady climb through the mid-European session and has now recovered around 35-40 pips from sub-1.3100 level.

After a rather muted reaction to today’s slightly disappointing UK manufacturing PMI, coming in at a three month low levle of 54.0 for July, the pair gained some positive traction and is currently placed at fresh session tops, around the 1.3135-40 region.

Despite a goodish pickup in the US Treasury bond yields, the US Dollar struggled to build on the early uptick and was seen as one of the key factors lending some support to the major, amid prospects for an eventual BoE rate hike move on Thursday.

Moving ahead, traders now look forward to the US economic docket, highlighting the release of ADP report on private sector employment and ISM manufacturing PMI, for some short-term impetus ahead of the key FOMC monetary policy decision.

Technical Analysis

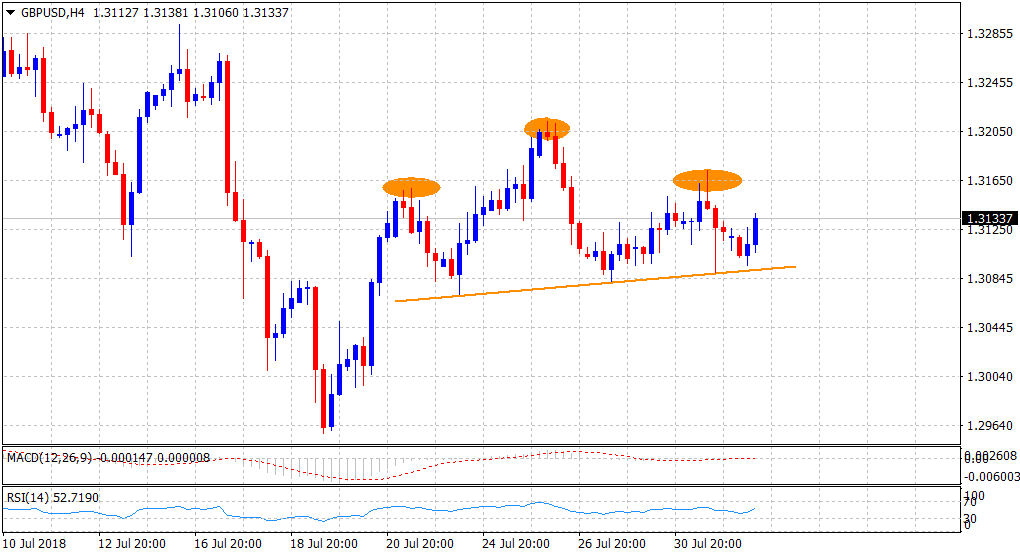

Meanwhile, today’s up-move could also be attributed to some technical buying from a short-term ascending trend-line, acting as a neckline support of the bearish head & shoulders chart pattern formation on the 4-hourly chart.

Hence, the pair needs to decisively break through the 1.3150-60 supply zone before traders start positioning for any further appreciating move ahead of the highly anticipated BoE Super Thursday.