“¢ Trump’s Brexit comments prompt some fresh selling on Friday.

“¢ The ongoing USD bullish move adds to the downward pressure.

The GBP/USD pair managed to find some support near the 1.3100 handle, albeit has struggled to register any meaningful recovery.

The US President Donald Trump commented on the PM Theresa May’s updated ‘soft-Brexit’ proposal and said that it would probably kill hopes of a US-UK trade deal, which prompted some fresh selling around the British Pound.

This coupled with the prevalent US Dollar bullish bias, amid easing US-China trade tension and firming Fed rate hike expectations, exerted some additional downward pressure and dragged the pair to near two-week lows.

In absence of any market-moving economic data, Brexit headlines and persistent USD buying interest turned out to be key factors weighing on the major.

Technical Analysis:

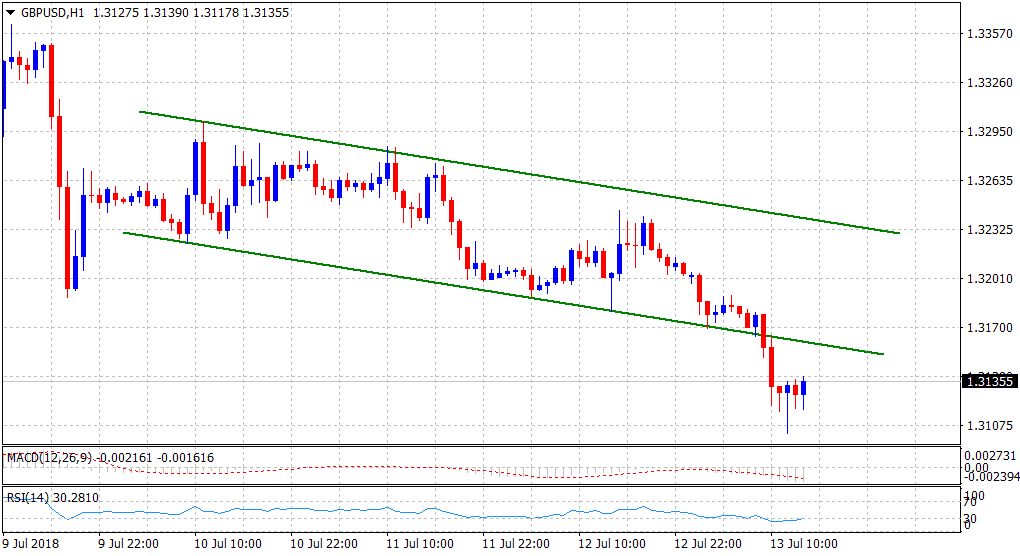

Today’s steep decline during the early European session could also be attributed to some fresh technical selling on a decisive break below a support marked by a short-term descending trend-channel formation on the 1-hourly chart.

However, slightly oversold conditions, as depicted by RSI on the mentioned chart, helped limit deeper losses, at least for the time being. Hence, it would be prudent to wait for a follow-through selling before positioning for any further near-term downside.

Spot rate: 1.3136

Daily High: 1.3205

Daily Low: 1.3103

Trend: Sideways

Resistance

R1: 1.3160 (trend-channel support break-point)

R2: 1.3205 (current day swing high)

R3: 1.3242 (R1 daily pivot-point)

Support

S1: 1.3103 (current day swing low)

S2: 1.3095 (monthly low set on July 2)

S3: 1.3050 (YTD lows set on June 28)