- Sterling looking for a foothold after a week of steady declines.

- A big week of economic data for the UK turned into a fright-fest for Pound bulls.

The GBP/USD is heading into the London market session for Friday pushing to the upside, testing near 1.3030 after a week of steady declines.

Key economic data for the Uk this week has been a disappointing showing, consistently missing expectations and helping to drive the Sterling into new yearly lows near 1.2950, though the early Friday trading window is seeing a brief respite for weary bulls.

Brexit, the other shoe that continues to drop on the GBP/USD on a continual basis, has been pushed to the back burner temporarily amidst this week’s lackluster showing for the GBP, but with the UK parliament continuing to squabble with staunch Brexiteers digging in their heels and decrying any move that may weaken their demands for absolute UK sovereignty, even at the cost of British enterprises, concerns over the UK’s thus-far botched attempts to make a clean exit from the European Union will continue to weigh on the Queen’s currency moving forward.

Friday is a limited showing for the Sterling on the economic calendar, a welcome relief for tired Pound traders. Public Sector Net Borrowing, a second-tier indicator, is due at 08:30 GMT, with markets expecting a slight move higher from the previous £3.356 billion to £3.6 billion.

GBP/USD Technical Analysis

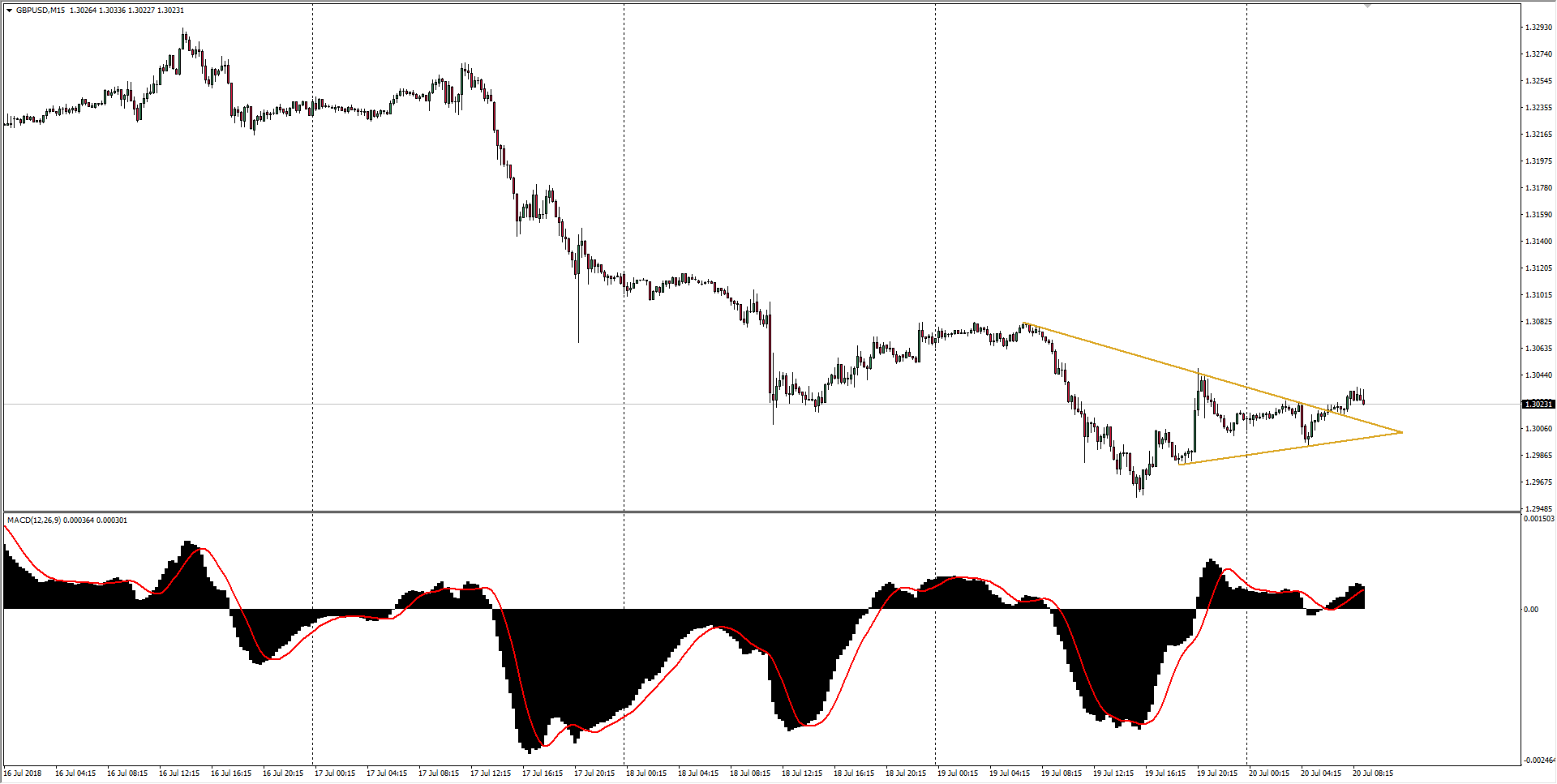

The intraday chart on the GBP/USD shows the pair in the middle of a bull flag breakout, a strong indicator of a potential move higher, signalling that the recovery from Thursday’s low of 1.2957 could pick up speed, with bulls targeting the June 28th low of 1.3050.

GBP/USD Chart, 15-Minute

| Spot rate: | 1.3023 |

| Relative change: | 0.07% |

| High: | 1.3035 |

| Low: | 1.2994 |

| Trend: | Intraday bullish |

| Support 1: | 1.3000 (major psychological level) |

| Support 2: | 1.2970 (H1 Bollinger Band support) |

| Support 3: | 1.2957 (previous day low) |

| Resistance 1: | 1.3050 (June 28th swing low) |

| Resistance 2: | 1.3100 (psychological hurdle) |

| Resistance 3: | 1.3163 (10-day Moving Average) |