“¢ BoE’s unanimous vote to raise rates did provide a short-lived boost.

“¢ Carney’s comments on Brexit risks prompt some aggressive selling.

“¢ Broad-based USD strength further aggravates the bearish momentum.

The post-BoE selling pressure surrounding the British Pound now seems to have abated a bit, helping the GBP/USD pair to rebound around 40-pips from the 1.30 neighborhood.

The pair did enjoy a brief rally and spiked above the 1.3100 handle following the BoE’s unexpected unanimous vote to raise interest rates by 25 bps to 0.75%. The uptick, however, turned out to be short-lived and was quickly sold into after the UK central bank signalled that it was in no hurry to raise rates further amid Brexit uncertainties.

The downfall accelerated further, with the pair tumbling over 110-pips from the post-BoE announcement swing high in reaction the BoE Governor Mark Carney‘s comments at the post-meeting press conference, saying that Brexit is weighing on business investments.

This coupled with a strong follow-through US Dollar buying interest, supported by the Fed’s upbeat assessment of the US economy, kept exerting downward pressure and dragged the pair to a near two week low level of 1.3016.

Technical Analysis

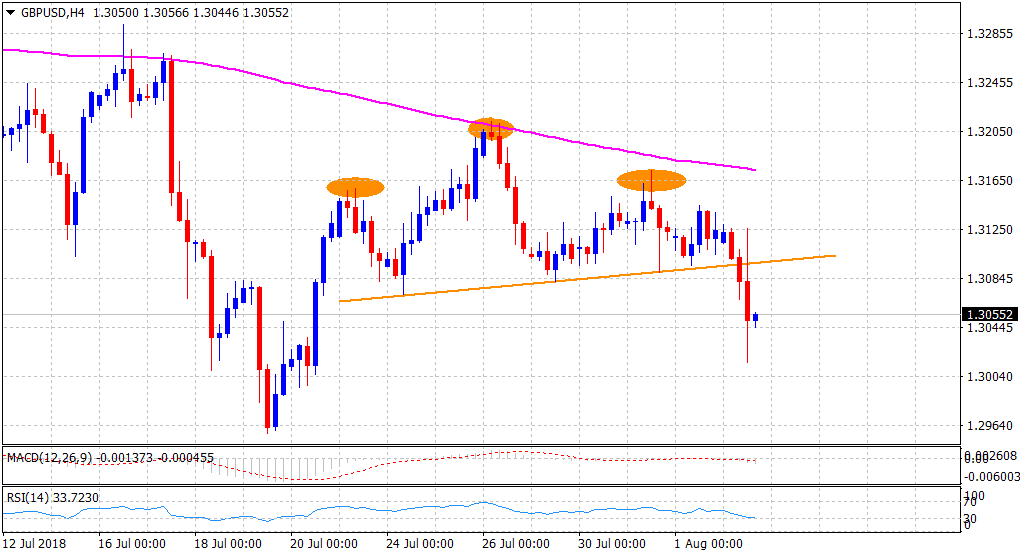

The latest leg of a modest rebound could be attributed to some short-covering amid near-term oversold conditions on the 4-hourly chart. However, given that the pair has already confirmed a break through a bearish head & shoulders chart pattern on the mentioned chart, any attempted recovery is likely to confront some fresh supply at higher levels.

Technical indicators on the daily chart hold in negative territory and are still far from being oversold, reinforcing the bearish outlook. Hence, the pair seems more likely to finally breakthrough the key 1.30 psychological mark and aim towards retesting YTD lows, around the 1.2960-55 region.