“¢ Brexit white paper triggers the initial leg of rebound from an ascending trend-channel support.

“¢ USD witness some selling on softer US CPI print and provides an additional boost.

The GBP/USD pair reversed an early dip to an intraday low level of 1.3180, or over one-week lows, and spiked to fresh session tops post-US CPI, albeit lacked any strong follow-through.

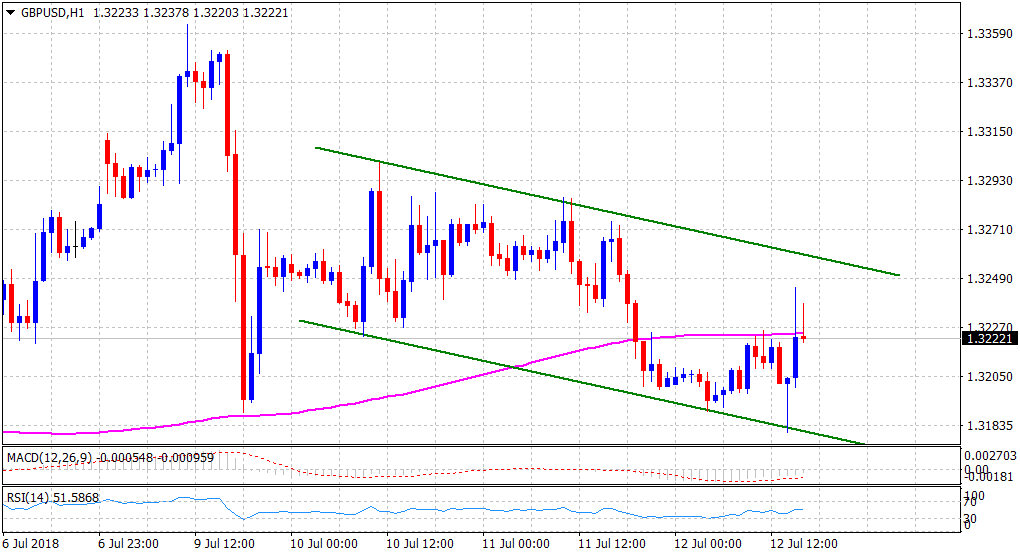

The pair managed to find some buying interest near a support marked by short-term ascending trend-channel formation on the 1-hourly chart. The release of updated Brexit white paper triggered the initial leg of rebound and was further supported by a modest US Dollar retracement.

The USD struggled to build on its positive momentum and was being capped by softer US inflation figures, coming in to show 0.1% m/m rise in June as against 0.2% expected. However, mostly in-line core CPI/yearly figures and upbeat weekly initial jobless claims data helped limit a sharp downfall and eventually kept a lid on any meaningful up-move for the major.

Technical Analysis

Currently hovering around 200-hour SMA, the hourly chart set up points to further upside and short-term technical indicators also support prospects for additional gains.

However, a decisive break below the trend-channel support might negate the positive outlook and turn the pair vulnerable to extend this week’s rejection slide from 50-day SMA.

Spot rate: 1.3192

Daily High: 1.3226

Daily Low: 1.3180

Trend: Bearish below trend-channel support

Resistance

R1: 1.3256 (100-period SMA H1)

R2: 1.3317 (R2 daily pivot-point)

R3: 1.3335 (50-day SMA)

Support

S1: 1.3180 (descending trend-channel)

S2: 1.3144 (S2 daily pivot-point)

S3: 1.3095 (July 2 swing low)