- The BoE’s Mark Carney will be speaking before parliament today, and traders will be keeping a close eye on the central bank ahead of August’s rate call.

- The following US session sees a Senate testimony from the Fed’s Powell, and Tuesday marks a day of central planning focus for market participants.

The GBP/USD is trading just beneath the 1.3250 level ahead of Tuesday’s London markets, which sees a showing from two key central bankers in the upcoming sessions.

The Bank of England’s (BoE) Mark Carney, alongside the BoE Deputy Governor Jon Cunliffe, will be delivering statements to the UK’s Treasury Select Committee regarding the Financial Stability Report, and traders will be keeping their eyes peeled for hints about the central bank’s forward-looking plans. Traders are expecting a rate hike from the BoE’s next rate call on August 2nd, and bulls are eager to establish an upward trend as Brexit continues to drag the Sterling down.

Prime Minister Theresa May’s latest Brexit proposal has seen some key changes made by the House of Commons in voting yesterday, and the move by hard-line Brexiteers within May’s own party to introduce changes to the framework could prove lethal for PM May’s latest attempt to strike a successful middle ground between Brexiteers in the UK and EU leaders in Brussels, who have so far remained stalwart, providing little in the way of special concessions that the UK leavers have been demanding.

On the US side, the Fed’s Jerome Powell will be delivering his testimony to the Senate Banking Committee regarding the Semiannual Monetary Policy Report, and markets will be focused on the central banker’s words as the Fed is expected to remain on the hawkish side, keeping closely in-line with the Fed’s current gradual policy tightening.

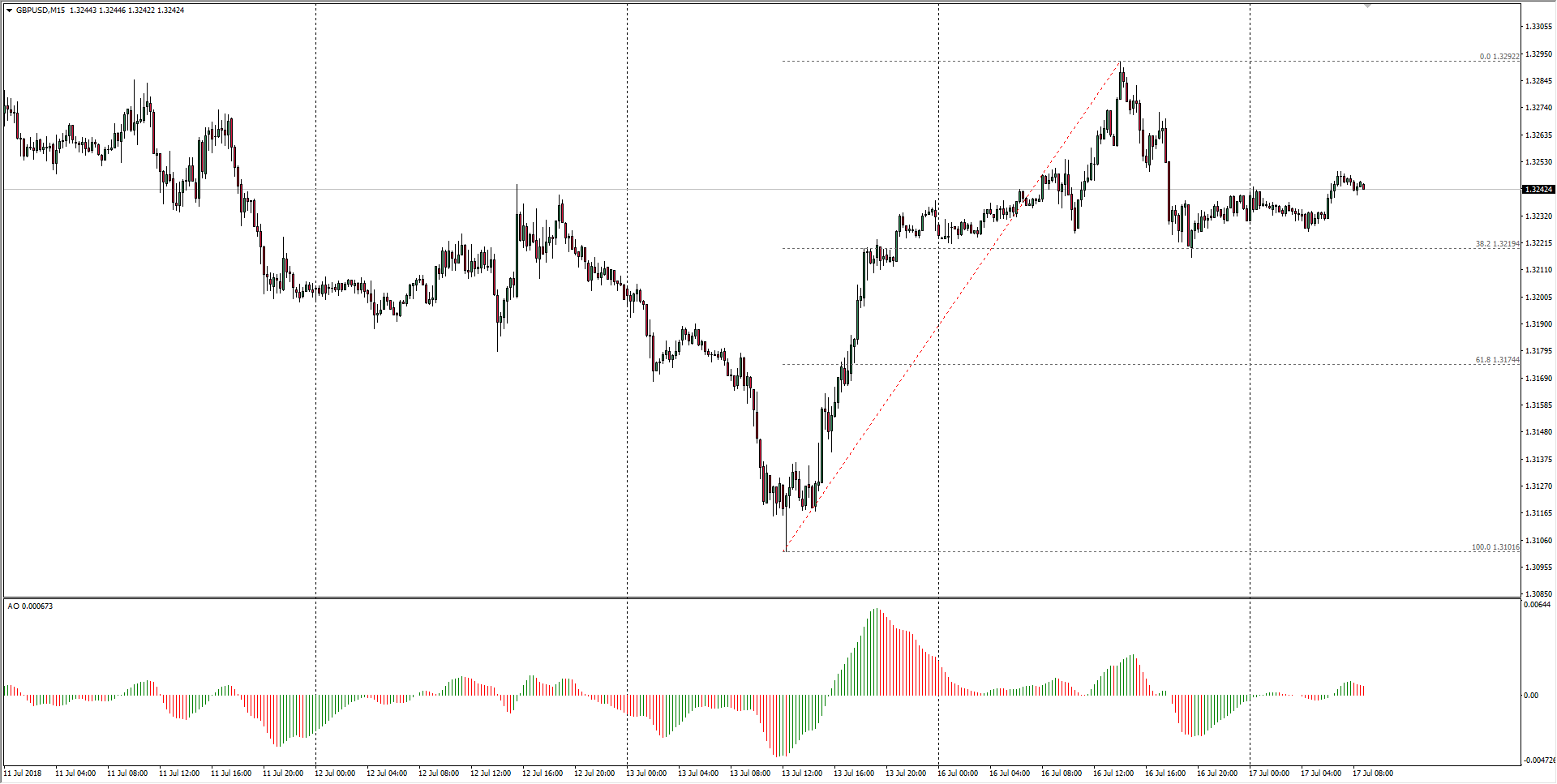

GBP/USD Technical Analysis

Sterling kicking upwards in Tuesday’s early trading ahead of the BoE’s Carney testimony as GBP bulls look to make a play above 1.3250, but failure to recapture 1.3300 yesterday sees bearish pressure mounting.

GBP/USD Chart, 15-Minute

| Spot rate: | 1.3242 |

| Relative change: | 0.09% |

| High: | 1.3249 |

| Low: | 1.3225 |

| Trend: | Flat to bullish |

| Support 1: | 1.3225 (current day low) |

| Support 2: | 1.3174 (61.8% Fibo retracement level) |

| Support 3: | 1.3101 (one month low) |

| Resistance 1: | 1.3292 (previous week low) |

| Resistance 2: | 1.3325 (R2 daily pivot) |

| Resistance 3: | 1.3361 (July 9th swing high) |