- GBP/USD is moving toward 1.30 as the dollar loses steam ahead of the Fed.

- The UK’s relations with Europe, China, and even American could pressure the pound.

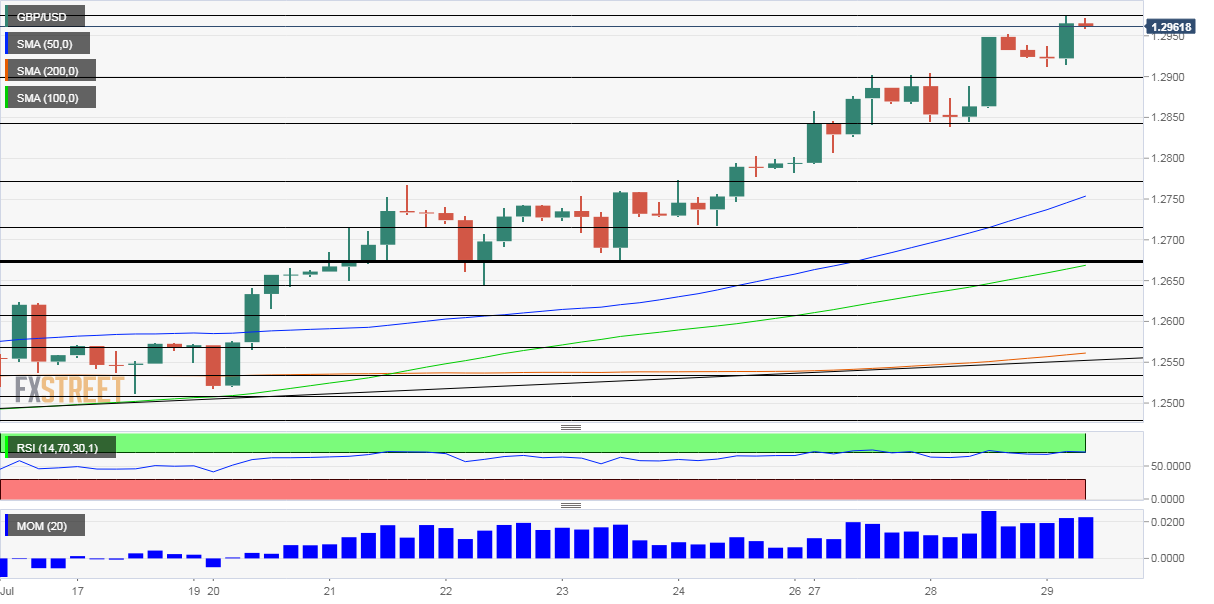

- Wednesday’s four-hour chart is pointing to overbought conditions.

“I’m afraid you are starting to see in some places the signs of a second wave of the pandemic” – the words of UK Prime Minister Boris Johnson when referring to “our European friends” angered many in the old continent, and especially in Spain.

The UK’s decision to advise against traveling to one of Europe’s top summer destinations angered airlines and the government in Madrid alike. Moreover, it seems like the PM punched back at Europe – being gleeful at the rise in cases after Britain was previously compared unfavorably to other countries.

This Schadenfreude – experiencing pleasure at the misery of others – characterizes GBP/USD trading. Cable is climbing due to the dollar’s weakness, not sterling strength.

The greenback has been struggling amid rising US coronavirus cases, unwinding of the safety trade, disagreement in Washington about the next fiscal steps – days ahead of the expiry of federal unemployment benefits. Updated COVID-19 figures and reports about bipartisan talks will move markets, but Wednesday’s big event is the Federal Reserve’s decision.

Given the recent deterioration in the world’s largest economy – reflected in falling consumer confidence and rising jobless claims – some expect the Fed to open the door to further stimulus. Jerome Powell, Chairman of the Federal Reserve, will likely be asked about Yield Curve Control (YCC) and may warm up to the idea. YCC means the Fed pushes long-term borrowing costs to a certain range.

If Powell hints it is under active consideration, the dollar has more room to fall. If he passes the ball to lawmakers, the greenback would recover.

In the UK, Brexit negotiations are going nowhere fast, with the only good news being the commitment of both London and Brussels to continue talks. Britain’s tensions with Beijing also remain high amid China’s tighter grip on Hong Kong and the UK’s phasing out of Huawei gear.

Moreover, the US and the UK recently lowered expectations for reaching a trade deal this year – and that may wait for the next administration in Washington. And while America is struggling with COVID-19 and infections in the continent are rising – they are increasing also in the UK.

Source: FT

Overall, GBP/USD is advancing due to dollar weakness but has room to fall. It could spike above 1.30, but it is hard to see a sustained move from there.

GBP/USD Technical Analysis

The Relative Strength Index on the four-hour chart is around 70 – flirting with overbought conditions and implying a downside correction. Momentum remains upbeat and the currency pair is trading above the 50, 100, and 200 Simple Moving Averages, hinting of more gains if the correction is moderate.

The daily high of 1.2975 is the first hurdle, and it is closely followed by the round 1.30 level. Further above, 1.3070 and 1.3150 come into play.

Support awaits at 1.29, followed by 1.2845 and 1.2775. All served as stepping stones on the way up.