- GBP/USD has stabilized amid mixed PMI and US political uncertainty.

- Brexit headlines – that triggered this week’s rally – could bring sterling down.

- Friday’s four-hour chart is still pointing to gains.

Brexit giveth, will Brexit taketh away? Friday is the day when Chief EU Negotiator Michel Barnier provides his weekly assessment of the talks, and he could point to a lack of meaningful progress despite “intensifying” talks. David Frost, his British counterpart, could do the same.

GBP/USD is holding onto the highest levels since September, a move driven by the resumption of talks on Wednesday. However, returning to the negotiating table does not imply success. The current deadline is mid-November, ahead of the expiry of the transition period on December 31.

Cable is off the highs due to uncertainty in US politics, which has boosted the safe-haven dollar. While Democrats and Republicans report progress in fiscal stimulus talks, the chances of getting an agreement through Congress before the elections – due in 11 days – look slim.

The “lame-duck” session – between the vote and before the newly-elected officials take office – provides time for passing a relief package, the chances are lower after the critical event.

President Donald Trump continues trailing rival Joe Biden in national and state polls, at least in surveys taken ahead of their televised debate. The encounter was much more civilized, a fact that could help the incumbent narrow the gap. While the impact of the clash will be seen only in next week’s polls,

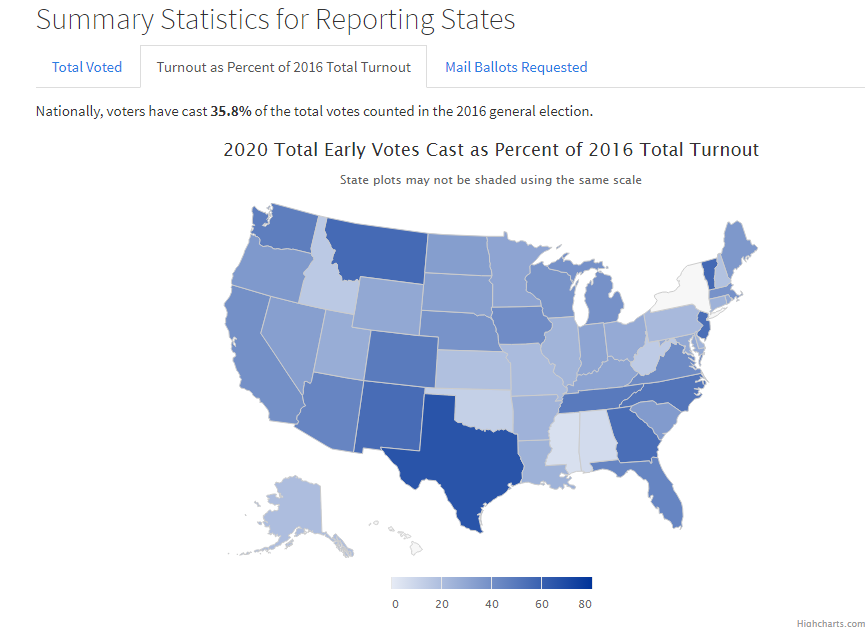

it is essential to remember that nearly 50 million Americans have already cast their ballots – over a third of total votes in 2016. Also, there are fewer undecideds in 2020 than in 2016.

Source: US Elections Project

Markit’s UK preliminary Purchasing Managers’ Indexes for October were mixed with manufacturing printing 53.3, marginally above estimates, while services slipped to 52.3, more significantly missing expectations. Both figures reflect growth, despite the increase in Britain’s covid cases.

The firm’s US figures are due out later on but are unlikely to rock the boat more than politics and stimulus.

GBP/USD Forecast

Pound/dollar is benefiting from upside momentum on the four-hour chart and is holding well above the 50, 100, and 200 Simple Moving Averages – bullish signs. The pair is capped by an uptrend resistance line that is distant at this point.

Resistance awaits at 1.3115, the daily high, followed by 1.3175, October ´s peak. The next upside target is 1.3240.

Some support awaits at 1.3080, the previous monthly high, followed by 1.3050, the daily low, and 1.3025, a high point early in the week.