- GBP/USD has fallen sharply as the UK’s coronavirus situation echoes the worst of the pandemic.

- The Brexit impasse and US elections uncertainty is also weighing on the pound.

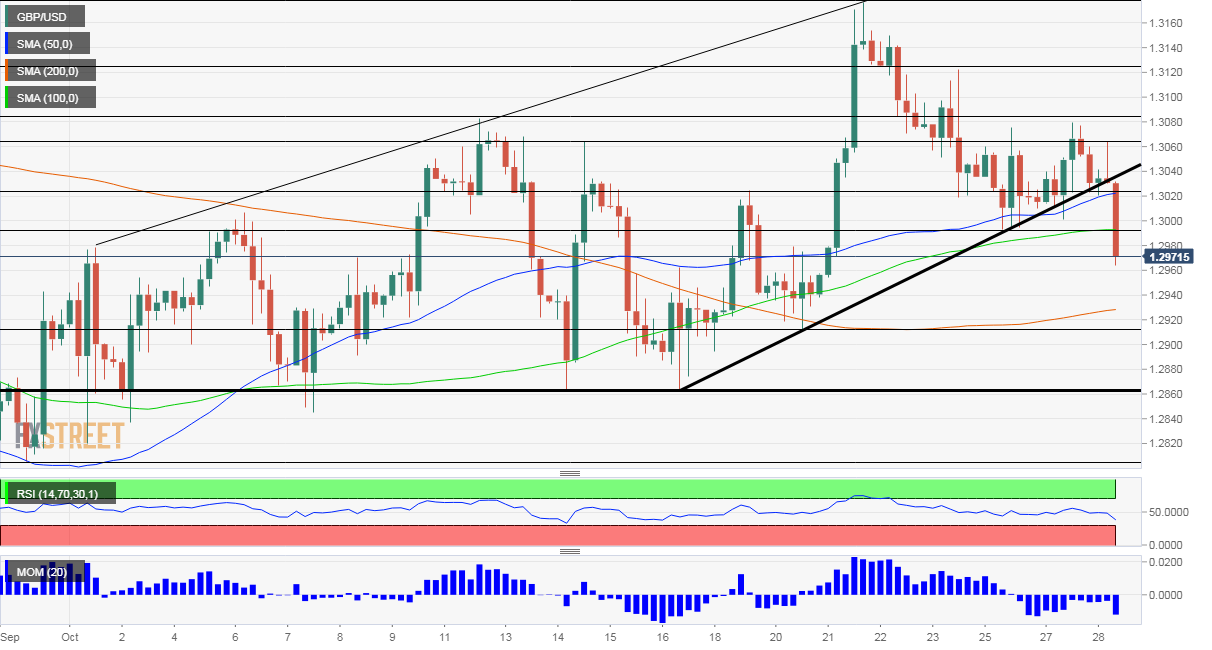

- Wednesday’s four-hour chart is pointing to further falls.

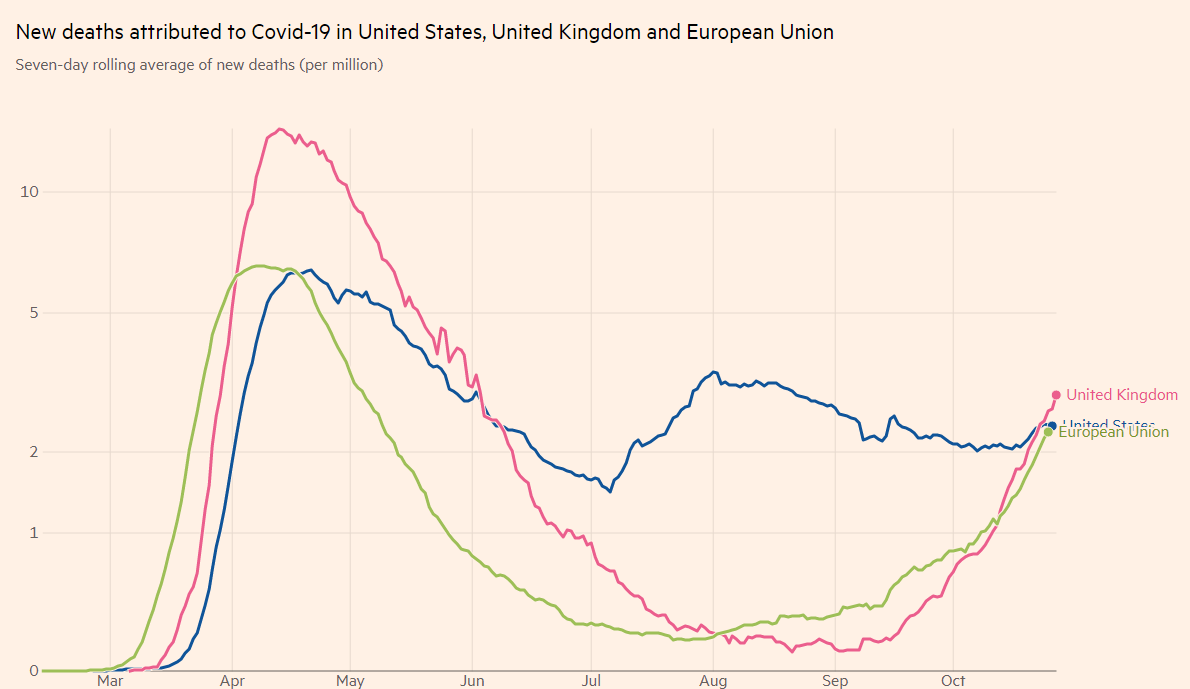

“There are now more Covid patients in Leeds hospitals than at the pandemic’s peak,” said Richard Burgon, an MP for the region. The situation is the northern English city is far from being unique. Britain is gripped by a severe second wave of coronavirus and Prime Minister Boris Johnson is under pressure to issue a second national lockdown – and that is weighing heavily on sterling.

The UK reported nearly 23,000 new confirmed cases on Tuesday, and 367 deaths – the latter being the highest level since late May. While northwest England is the hardest-hit area, infections are rising across the country. The PM, who was gravely ill with COVID-19 in March and April, seems reluctant to slap a national lockdown that would hurt the economy. However, the rapidly deteriorating situation and the fact that France and Germany are mulling similar measures may tip the scales.

Deaths per population are now higher in the UK than in the US and the EU:

Source: FT

Brexit also remains an adverse factor for the pound. While Chief EU Negotiator Michel Barnier extended his stay in London, these negotiations have yet to deliver a breakthrough. Charles Michel, the President of the European Council, said that both sides at a “most difficult spot.”

Investors know that the only genuine deadline is December 31 but the diminishing hopes seem to hit sterling when it is down.

Across the pond, tensions are rising toward the US elections. With six days to go, over 70 million Americans – more than half of last time’s total vote count – have already cast their ballots. President Donald Trump continues trailing rival Joe Biden but seems to have made some headway in Florida, the perennial swing state.

Can Trump pull off an upset victory like in 2016? According to FiveThirtyEight’s model, he has only a 12% chance of succeeding. Markets are worried about a contested election and also worry that a split Congress would fail to pass the meaningful stimulus.

More: 2020 US Election: Polling, history and the submerged Trump vote

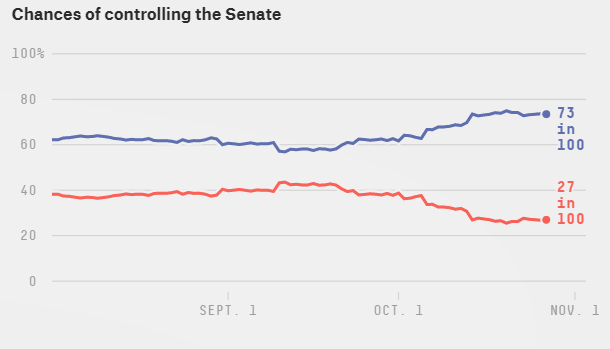

A “blue wave” – with Democrats flipping the Senate in addition to the presidency – has around 70% probability according to Nate Silver’s site. North Carolina’s Senate race could prove critical. New national, state, and Senate polls will be closely watched and could swing markets later in the day.

The state of the Senate:

Source: FiveThirtyEight

All in all, these gloomy themes will likely weigh on cable.

GBP/USD Technical Analysis

Pound/dollar has collapsed below the uptrend support line that accompanied it since mid-October and has pierced the 50 and 100 Simple Moving Averages on its way down. Momentum is to the downside while the Relative Strength Index is still above 30, thus outside oversold conditions.

Support awaits at 1.2910, which was a low point last week. It is followed by 1.2865, a double-bottom from seen earlier in the month.

Resistance is at 1.2985, which worked as support last week. It is followed by 1.3020, which capped cable earlier. The next levels to watch are 1.3065 and 1.3085.