- GBP/USD has been attempting to recover in response to reports on Brexit progress.

- Rising UK coronavirus cases and US political uncertainty may also weigh on the pair.

- Tuesday’s four-hour chart is painting a mixed technical picture.

“We only go into the tunnel if there is going to be light at the end of it” – the words of EU officials pour cold water on hopes for an imminent breakthrough in Brexit talks and may limit any pound gains. The Guardian’s Jennifer Rankin’s sources serve as a reality check to more hopeful talk earlier in the day. A “tunnel” is EU terminology for intense talks aimed to produce a final agreement.

Talks on future relations between Brussels and London have been dragging on for months and many expect a deal only around the EU Summit in October – or perhaps only around Christmas. The UK left the bloc in January but remains in a transition period through year-end. Without an accord, Britain will revert to unfavorable World Trade Organization rules.

While the endless saga provides both hope and despair, there is a dearth of positive coronavirus developments of late. Prime Minister Boris Johnson is considering slapping additional restrictions to curb COVID-19, especially in northern England. The rising number of cases and economic hardship are now joined by political issues.

A group of Conservative Party “rebels” led by Steve Baker – who made his name in the Brexit votes – is trying to limit the government’s powers. PM Johnson’s struggles with the virus also weigh on sterling. That is the second pound downer.

Source: FT

The US still “leads” the UK in the number of confirmed cases per population in the last week, but the focus is elsewhere. Republicans and Democrats have yet to agree on a fresh relief package with both parties also busy with the nomination of new Supreme Court Justice ahead of the elections.

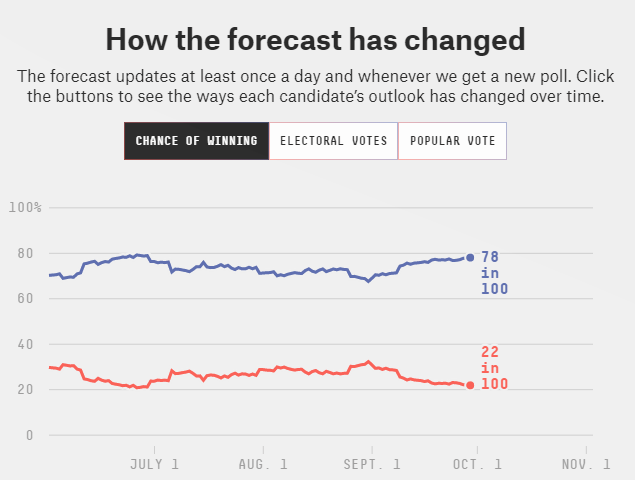

President Donald Trump and rival Joe Biden are set to clash in the first presidential debate late on Tuesday. The occupant of the White House is considered a better debater, and he would need all his skills to help him narrow the gap in the polls.

Source: FiveThirtyEight

Uncertainty about the elections – and Trump’s hint he may not guarantee a smooth transition – are weighing on markets and supporting the safe-haven dollar. And that is the third GBP/USD downer.

See 2020 Elections: How stocks, gold, dollar could move in four scenarios, nightmare one included

Ahead of the debate, several Federal Reserve officials are set to speak and they will likely repeat their message that rates will remain lower for longer while refraining from promising any imminent action.

The Conference Board’s Consumer Confidence report for September is also scheduled for release ahead of the presidential debate, and are projected to show ongoing recovery.

See US Conference Board Consumer Confidence September Preview: Neither happy nor sad

Overall, the pound has more reasons to fall than rising, and the dollar enjoys a much more favorable environment.

GBP/USD Technical Analysis

Momentum on the four-hour chart is positive and sterling trades above the 50 Simple Moving Average. However, it has failed to recapture the 100 SMA and is well below the 200 SMA. All in all, the picture is mixed.

Support awaits at the daily low of 1.2835, followed by 1.2760 and 1.2680.

Resistance is at 1.2930, a level recorded on Monday, followed by 1.30 – a psychologically significant level, which also held cable down in mid-September. The next levels to watch are 1.3040 and 1.3145.