- GBP/USD is struggling just to the south of the 1.3600 level despite the announcement of more support for UK businesses.

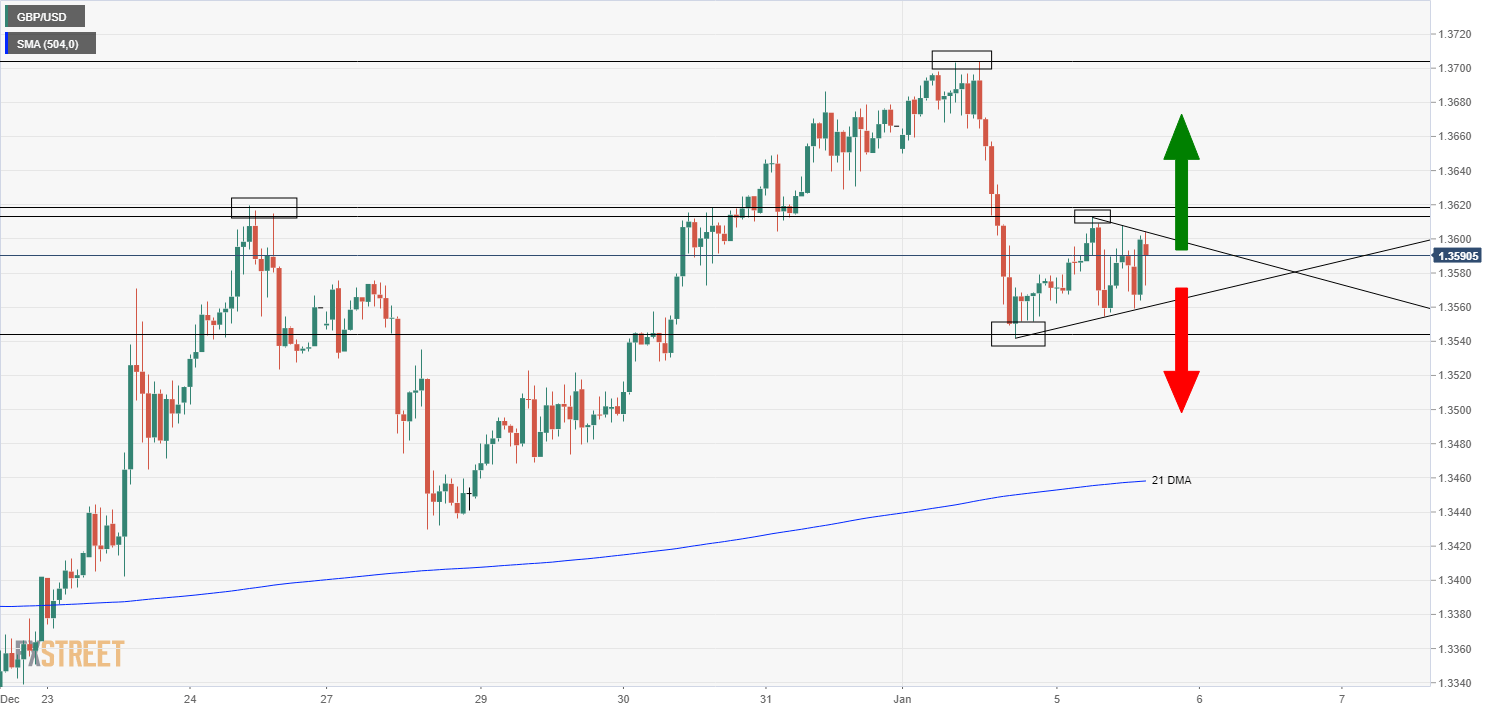

- Prices have formed a short-term pennant structure that is subject to a breakout.

GBP/USD has struggled to regain a grip on the 1.3600 level on Thursday after England and other parts of the UK entered into a stricter lockdown in an attempt to bring the spread of Covid-19 back under control. At present, the pair trades in the 1.3570s, only meagrely higher on the day and only around 20 pips above lows.

UK government announces further support for businesses

The UK Chancellor of the Exchequer announced one-off top-up grants for retail, hospitality and leisure businesses worth up to £9,000 per property on Tuesday with the aim of helping businesses through to the Spring. The additional support comes in wake of UK PM Boris Johnson’s announcement last night that England will enter a tougher lockdown until at least midway through February in order to help control the virus.

Dollar unmoved by ISM manufacturing PMI data

USD was unmoved in the immediate aftermath of ISM manufacturing PMI numbers released on Tuesday. The numbers came out much stronger than expected; the headline index rose to 60.7, well above expectations for a print of 56.6 and last month’s 57.5. Meanwhile, the subindices were also strong across the board; prices paid rose to 77.6 versus expectations for a rise to 65.7 from last month’s 65.4, its highest number in nearly three years, while new orders and employment were also strong.

Tuesday’s data is likely to add further wind behind the sails of upwards moving US inflation expectations; since the start of December, 10-year break evens have rise from below 1.8% to around 2.0% (its highest level since 2018) and many think that further upside is in store.

In terms of how this is likely to translate into price action in GBP/USD; with the Fed having already indicated that it will be behind the curve when it comes to tackling inflation, further USD weakness is likely in store (amid expectations that the Fed will not act early to avert a fall in the purchasing power of the US dollar), which is likely to be a tailwind for GBP/USD in 2021.

Looking Ahead

The dollar side of the equation will be dominated by US politics (the outcome of Tuesday’s Georgia Senate elections and Thursday’s Congressional certification of the November Presidential election) and US data (December ISM services figures are coming up on Thursday, followed by December NFP numbers).

Meanwhile, on the sterling side of the equation; the UK PM will be addressing the nation for a second day running, likely to talk about the recently announced new support measures for businesses, ahead of a testimony by Bank of England Governor Andrew Bailey in front of the Treasury Select Committee on Wednesday at 14:30 on the bank’s latest financial stability report. Any comments on policy will of course be on note.

GBP/USD forming a near-term pennant

GBP/USD has formed a pennant structure over the last 24 hours or so (see the chart below). An upside break of the 1.3600 level would open the door, technically speaking, for a move back towards resistance at 1.3620 (the 17 and 24 December highs). A break above this level would signal a potential move higher towards recent multi-year highs around 1.3700. Conversely, a downside break opens the door to a move lower towards the 1.3500 level and even a test of the pair’s 21-day moving average at 1.3458.

GBP/USD hourly chart