- GBP/USD has come out on top amid long US elections process and BOE stimulus.

- Further ricochets from American politics and the UK GDP stand out.

- Early November’s daily chart is painting a bullish picture.

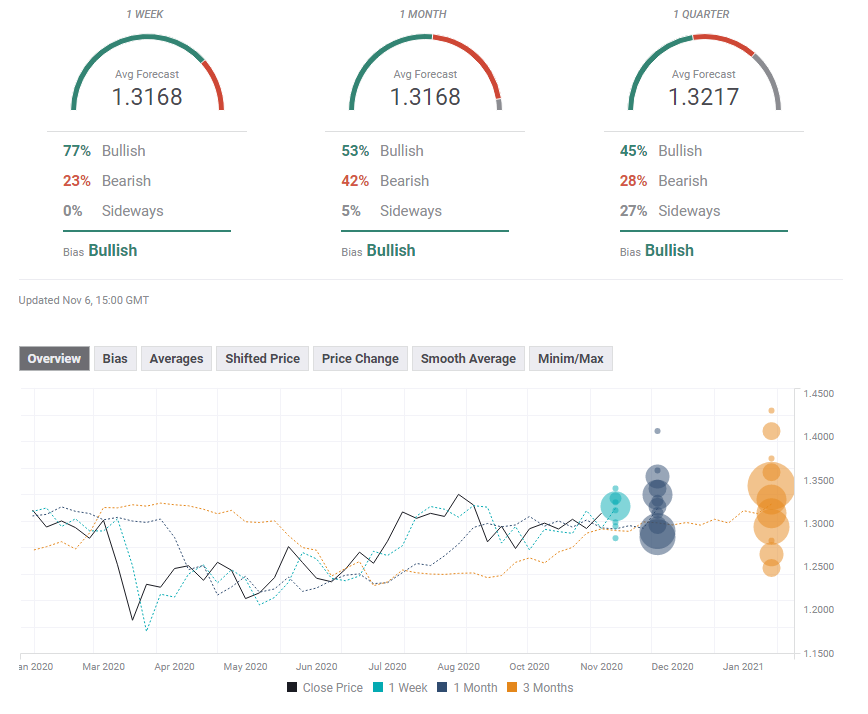

- The FX Poll is pointing to further gains for cable.

A week for the history books – GBP/USD bulls are emerging on top amid the US elections that have yet to be called and central banks that tried to compete. Additional political developments are top-tier UK data eyed, while covid concerns could creep back.

This week in GBP/USD: Election optimism and central bank support

Who will be the next president? The question remains open after long days of vote counting. However, Democratic nominee Joe Biden is leading against incumbent President Donald Trump in critical swing states – Nevada, Arizona, Pennsylvania and Georgia.

Markets cheered the growing chances of a decisive – even if delayed – result and lower chances of a contested election. Trump has been making claims of fraud without evidence, splitting the Republican Party between those who support him, others that denounce his words, and the silent majority.

Republicans are likely to hold onto the Senate after fending off challenges in Maine, Iowa, and probably North Carolina. The races for two Georgia Senate seats may go to a run-off, creating a narrow opening for Democrats.

Investors seemed to applaud a GOP-controlled upper chamber, especially after Senate Majority Leader Mitch McConnell seemed more open to state aid. The perfect mix for markets is fiscal stimulus but no new taxes nor any other major changes.

See 2020 Elections: Where the race stands in four critical states, traders on the edge of their seats

The market rally was accompanied by a sell-off of the safe-haven dollar, responsible for most of the gains in GBP/USD, yet central banks also contributed to the rally.

In the UK, the Bank of England surprised markets by boosting its bond-buying program by £150 billion instead of £100 billion expected. A few hours later, Chancellor of the Exchequer Rishi Sunak followed by announcing that the furlough scheme would be prolonged through March – and with generous conditions.

See BOE Analysis: Bailey give pound bulls three gifts, what to watch for next

The flow of more money into the economy outweighed concerns about money printing and hosted sterling.

In America, the Federal Reserve expressed concern about the resurgence of coronavirus and stated that the pace of the recovery moderated. However, it is ready to counter any downturn with more bond-buying, explicitly discussed in the meeting. Contrary to the pound’s reaction, the dollar declined as the specter of newly-minted dollars helped markets and weighed on the safe-haven dollar.

See Fed Analysis: Powell adds fuel to the market fire by defending QE, rally set to extend

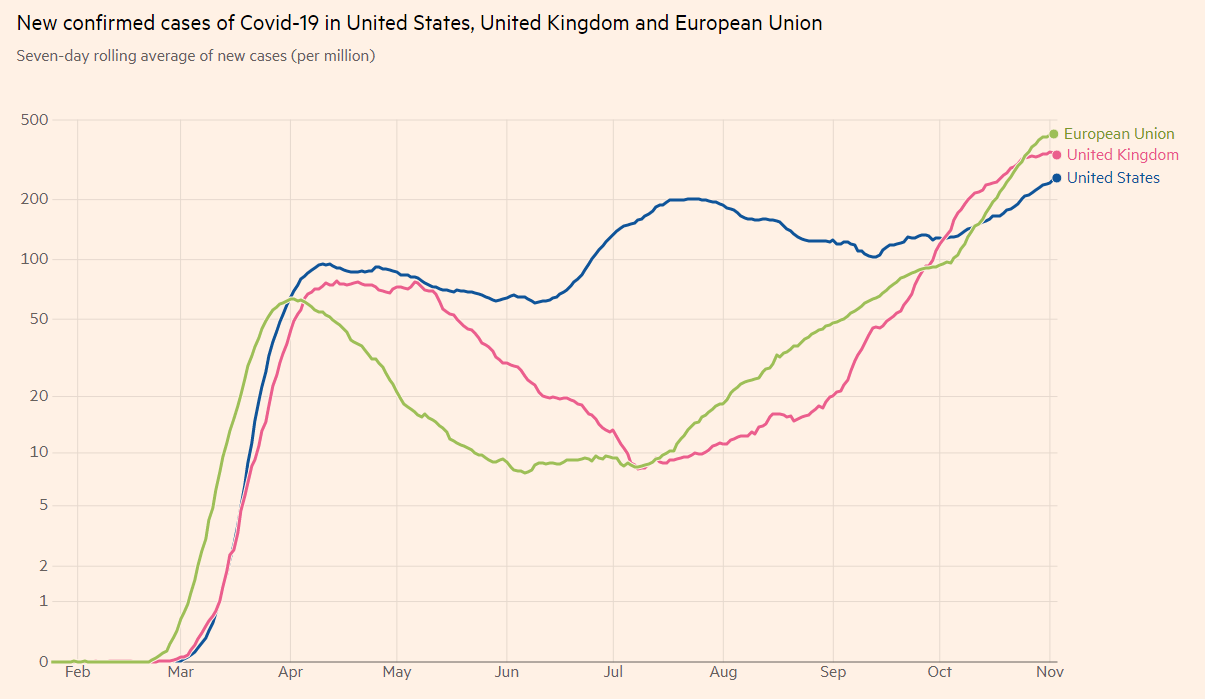

COVID-19 cases have been flattening in Britain, providing hopes that the lockdown would not last for too long. Prime Minister Boris Johnson made a complete U-turn by announcing a second nationwide shuttering, contrary to previous statements. In the US, they continue rising.

Covid mortalities in the US, the EU, and the UK

Source: FT

Brexit talks somewhat kept sterling somewhat hamstrung as both sides said there are divergences on several topics. The disappointment came after several days of optimism and an announcement of a new round of talks. The transition period expires at year-end, and optimism prevails for now.

The US Nonfarm Payrolls beat estimates with 638,000 jobs gained in October. Moreover, the Unemployment Rate fell under 7%, an encouraging development. The news was overshadowed by the elections.

UK events: GDP, jobs and covid statistics

The lockdown has just begun, but many Brits are asking when it will end. The official date is December 2, in time for Christmas. However, PM Johnson will base his decision on the data and will want to see the curve bending down, not only flattening.

Moreover, figures about hospitalizations and deaths would need to flatten and fall. It is always essential to remember that Monday’s figures tend to be lower than on other days due to administrative bottlenecks over the weekend.

Brexit talks continue in full force ahead of the self-imposed goal of sealing a deal by mid-November – which is roughly the end of the week. Sterling remains sensitive to comments by the Chief Negotiators – the EU’s Michel Barnier and the UK’s David Frost. The only genuine cut-off date is year-end when the transition period expires.

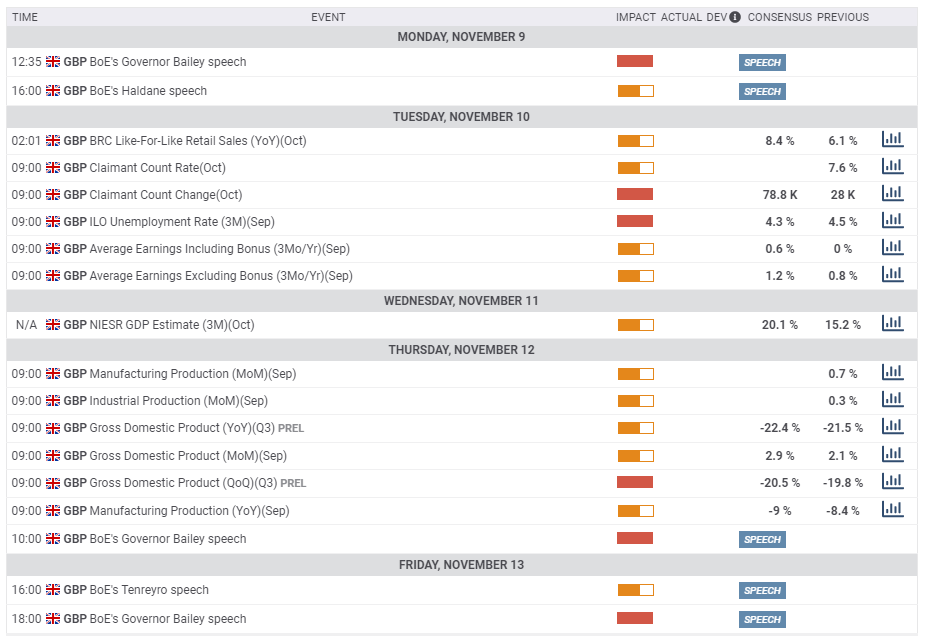

The BOE’s Bailey will have another opportunity to move markets, and so will Chief Economist Andy Haldane and other officials due to speak throughout the week. While the QE decision has been settled, any hints about negative rates will be closely watched. Sterling has room to rise if officials signal it is not imminent and fall if they convey a message of urgency.

Tuesday’s jobs report is set to show a drop in the Unemployment Rate to 4.3% in September after a disappointing increase to 4.5% in August. It is essential to remember that the furlough scheme is keeping a lid on the jobless rate. Expectations for wage growth are up, with accelerations expected.

Claimant Count Change statistics for October – a more recent figure – surprised with a moderate rise of 28,000 in September and is now projected to leap. Investors will want to see a stable market ahead of the second lockdown.

The top-tier event of the week comes on Thursday – Gross Domestic Product statistics for the third quarter. After a plunge of 19.8% in the second quarter, a substantial rebound is likely. Similar publications in Europe and the US surprised to the upside. GDP figures for September are also of interest.

Here is the list of UK events from the FXStreet calendar:

US events: Election fallout, the return of covid

At the time of writing, the election has yet to be called. As mentioned, Biden is in pole position to win. Markets are betting on a quick and decisive resolution. After the rally in equities and the downfall of the safe-haven dollar, there could be a “buy the rumor, sell the fact” response. However, it is unclear if a win for the Democratic candidate is fully priced in.

Results from the critical four states of Pennsylvania, Georgia, Arizona and Nevada are due out through the weekend.

Trump is unlikely to concede, and the words of McConnell are critical. If the Senate Majority Leader acknowledges such an outcome, it could provide calm. However, if Republicans close ranks behind Trump’s unsubstantiated claims, the greenback could surge in a flight to safety move.

Once the dust from the elections settles – and it is unclear when that happens – coronavirus could return to the forefront. Cases have hit record levels above 100,000 daily, and mortalities are also on the rise. So far, the Fed’s virus concerns have been seen as an indication of more stimulus, but the economic damage has yet to be factored in. Updated statistics and potential restrictions could boost the dollar.

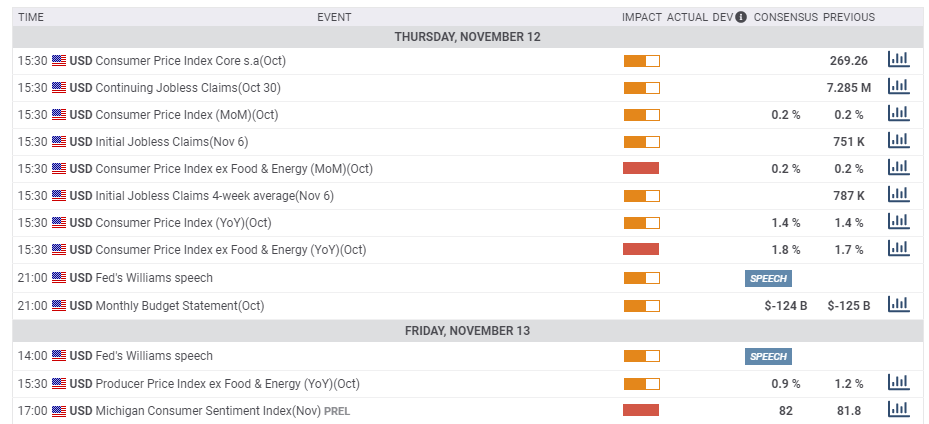

Inflation figures are of interest on Thursday. The Core Consumer Price Index is set to edge higher to 1.8%, nearing the Fed’s 2% target. However, the central bank is willing to let prices rise, and hiking rates is far beyond the horizon.

Weekly jobless claims are likely to remain below 800,000, extending their gradual decline. After quick drops, the pace of return to pre-pandemic levels has moderated.

The University of Michigan’s preliminary Consumer Sentiment Index figures for November are forecast to remain stable above 80. Any fall could indicate Americans’ anxiety around the elections.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

The technical picture has improved for pound/dollar. The currency pair has broken above the 50-day Simple Moving Average and continues benefiting from upside momentum. It is also trading above the 100-day and 200-day SMAs.

Critical resistance awaits at 1.3180, which was October’s high. It is followed by 1.3270, a high point in August, and then by 1.3360 and 1.3405.

Support awaits at 1.308, which a peak in early October, followed by the psychologically significant 1.30 level. Strong support awaits at 1.2850, a double-bottom, and then by 1.28 and 1.2705 – the latter is where the 200-day SMA hits the price.

GBP/USD Sentiment

The flattering of the UK covid curve, fresh Brexit hopes, and a settled US election could keep cable’s rally running – even with the occasional profit-taking. Trump remains the wildcard and so do US coronavirus figures.

The FXStreet Forecast Poll is showing that experts are bullish on all timeframes. Targets on all timeframes have been upgraded. It seems that the recovery has legs, according to the poll.