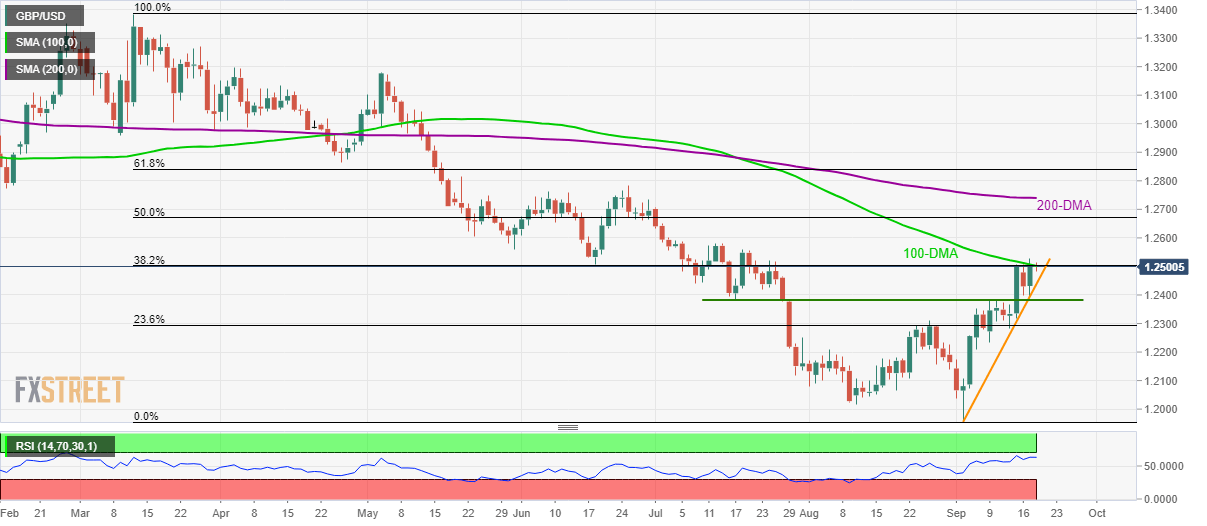

- GBP/USD again confronts the key resistance-confluence amid strong RSI support.

- A two-week-old rising trend-line offers immediate support.

GBP/USD nears crucial technical indicators while taking rounds to 1.2500 during Wednesday’s Asian session.

With the 14-day relative strength index (RSI) indicating the strength of upside momentum, the quote is likely to cross the 1.2500/05 confluence including 100-day simple moving average (DMA) and 38.2% Fibonacci retracement of March-September declines.

However, a sustained break of weekly top surrounding 1.2530 become necessary to convince buyers targeting mid-July highs close to 1.2570/80.

Further to note, 50% Fibonacci retracement level of 1.2670 and 200-DMA level of 1.2740 are likely following numbers that can lure bulls past-1.2580.

In a case price fail to clear the upside barrier, a three-week-old rising trend-line, at 1.2440 now, should be watched closely as a break of which could recall sellers aiming for 1.2385/80 horizontal-line and 23.6% Fibonacci retracement level of 1.2293.

GBP/USD daily chart

Trend: bullish