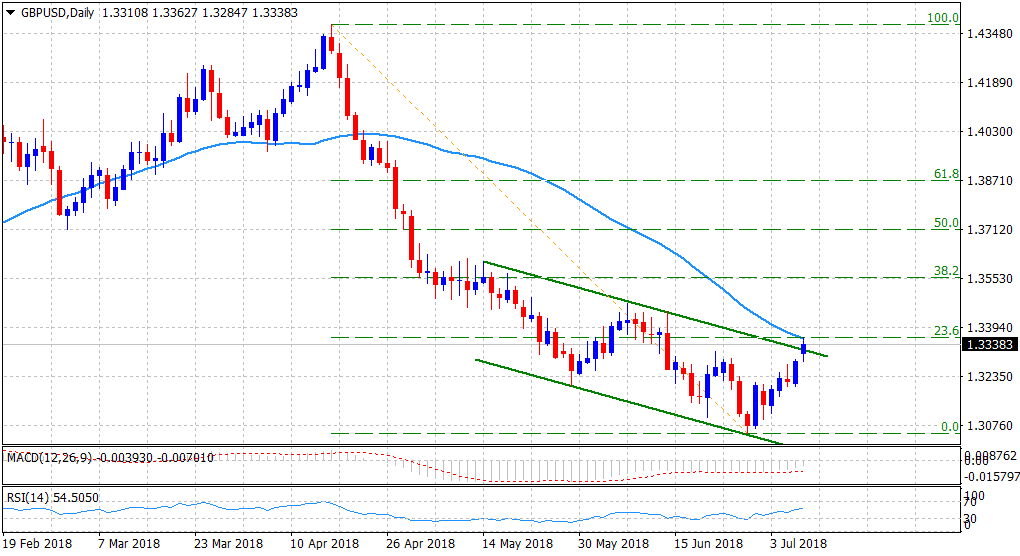

“¢ Reverses an Asian session dip to sub-1.3300 level and finally breaks through a short-term descending trend-channel formation on the daily chart.

“¢ The positive momentum stalled, at least for the time being, near an important confluence region, comprising of 50-day SMA and 23.6% Fibonacci retracement level of the 1.4377-1.3050 downfall.

“¢ With short-term technical indicators gradually picking up positive momentum, a follow-through buying beyond the mentioned barrier would reaffirm the bullish break and pave the way for an extension of the pair’s near-term upward trajectory.

Spot Rate: 1.3338

Daily High: 1.3363

Daily Low: 1.3285

Trend: Bullish

Resistance

R1: 1.3358 (confluence region)

R2: 1.3405 (R3 daily pivot-point)

R3: 1.3447 (June 14 swing high)

Support

S1: 1.3285 (current day swing low)

S2: 1.3232 (100-period SMA H1)

S3: 1.3200 (round figure mark)