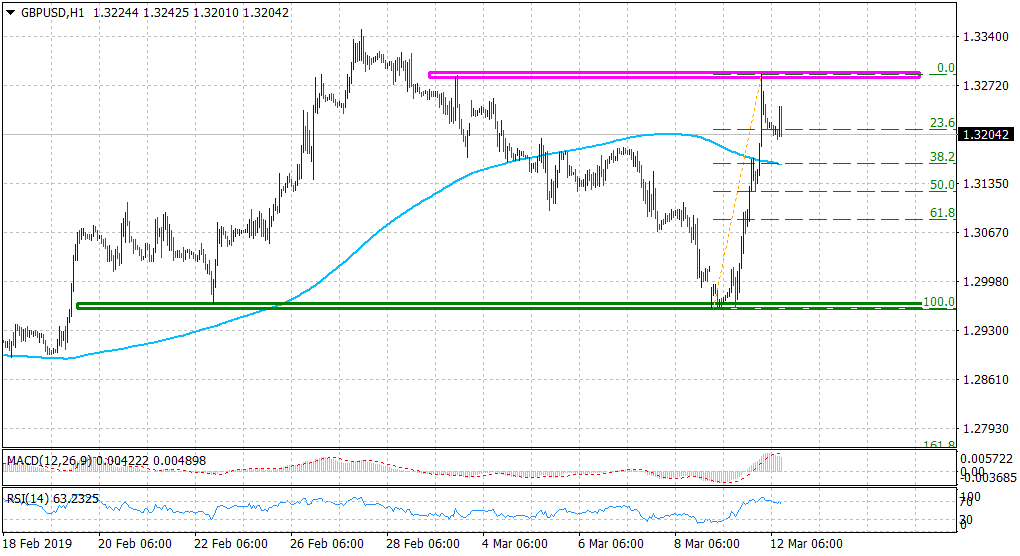

“¢ The pair witnessed a modest intraday pull-back from 1-1/2 week tops, with bears now eyeing a follow-through weakness below 1.3200 handle or 23.6% Fibo. level of the upsurge over the past 24-hours.

“¢ Highly oversold conditions on the 1-hourly chart turned out to be one of the key factors prompting some profit-taking ahead of the highly anticipated UK parliament vote on the PM May’s Brexit deal.

“¢ Today’s UK macro releases – monthly GDP growth figures and manufacturing/industrial production data, seems unlikely to be a game changer but might still produce some short-term trading opportunities.

“¢ Meanwhile, any subsequent decline is likely to find decent support near the 1.3160 confluence region – comprising of 200-hour SMA and 38.2% Fibo. level, and should help limit deeper losses.

“¢ On the flip side, the 1.3245-50 region, followed by the 1.3285-90 zone now seems to act as an immediate hurdle, which if cleared might extend the momentum towards multi-month tops, around mid-1.3300s.

GBP/USD 1-hourly chart

GBP/USD

Overview:

Today Last Price: 1.3204

Today Daily change: 52 pips

Today Daily change %: 0.40%

Today Daily Open: 1.3152

Trends:

Daily SMA20: 1.3073

Daily SMA50: 1.298

Daily SMA100: 1.2884

Daily SMA200: 1.2986

Levels:

Previous Daily High: 1.3171

Previous Daily Low: 1.296

Previous Weekly High: 1.3269

Previous Weekly Low: 1.299

Previous Monthly High: 1.3351

Previous Monthly Low: 1.2773

Daily Fibonacci 38.2%: 1.309

Daily Fibonacci 61.8%: 1.3041

Daily Pivot Point S1: 1.3018

Daily Pivot Point S2: 1.2884

Daily Pivot Point S3: 1.2807

Daily Pivot Point R1: 1.3229

Daily Pivot Point R2: 1.3305

Daily Pivot Point R3: 1.344