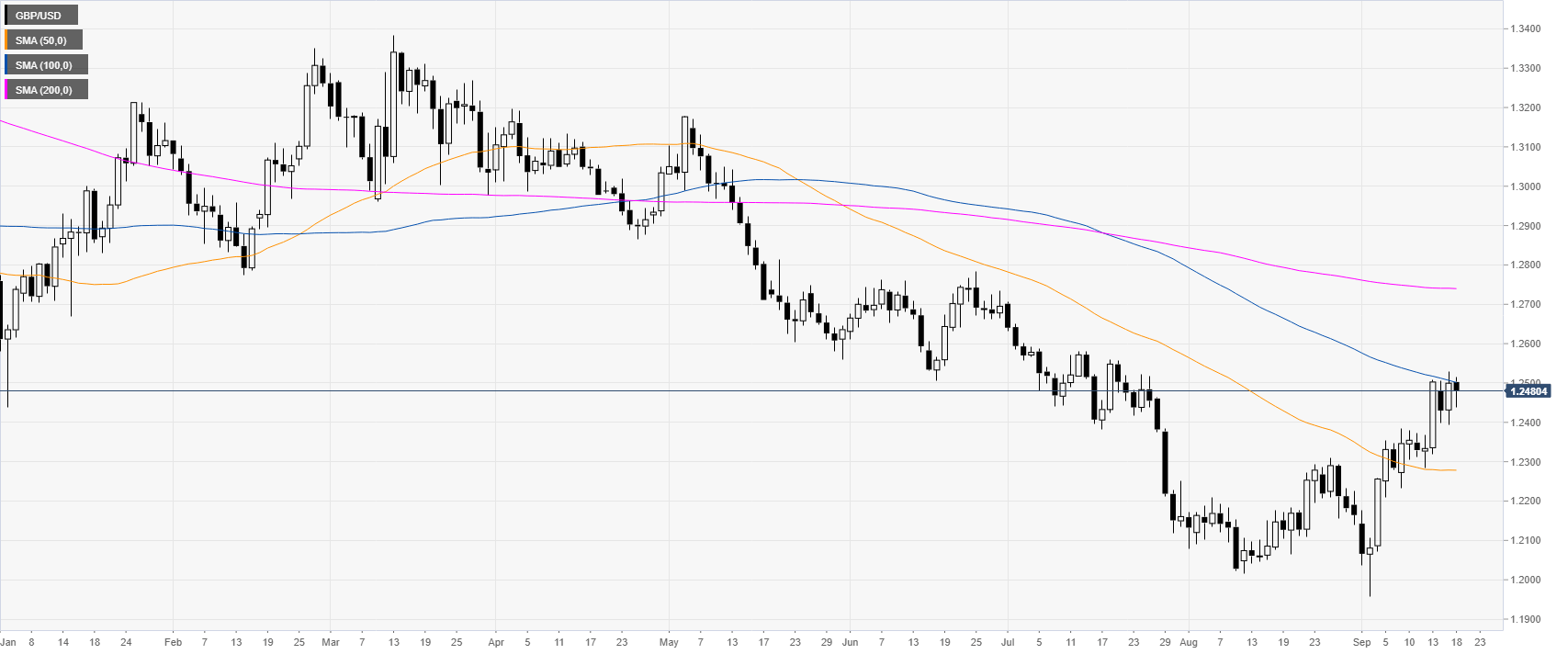

- The Sterling maintains its bullish stance ahead of the FOMC at 18:00 GMT.

- The level to beat for bulls is the 1.2515 price level near multi-week highs.

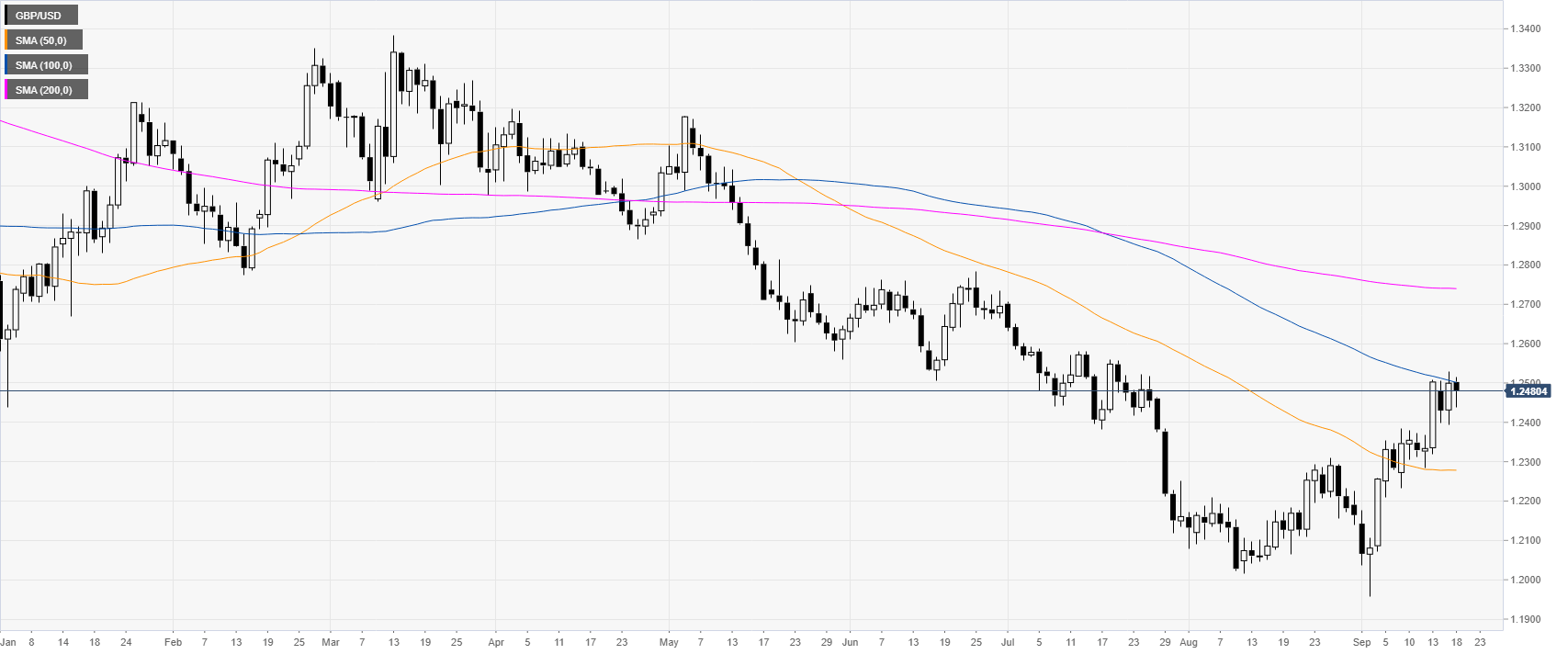

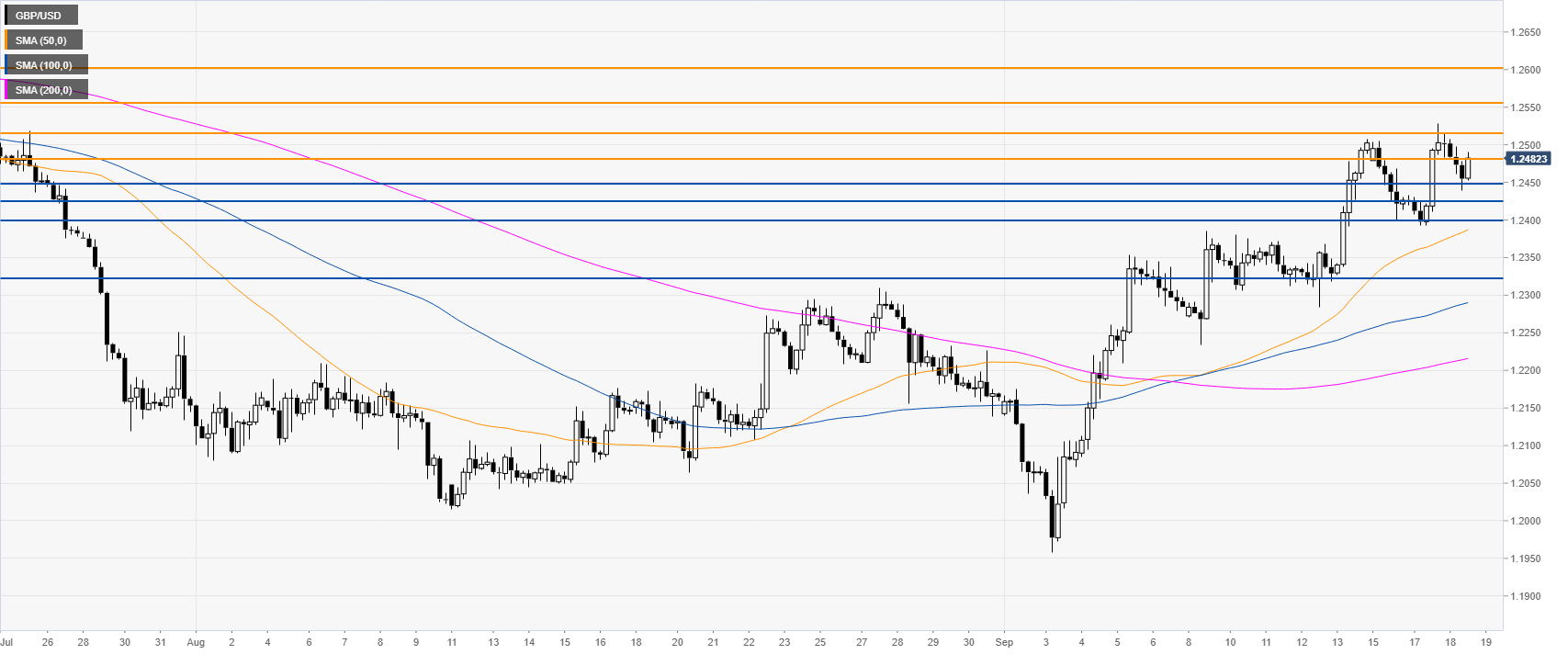

GBP/USD daily chart

The Sterling is trading in a bear trend below the 100 and 200-day simple moving averages (SMAs). However, GBP/USD is rising sharply as the market is challenging the 1.2500 handle and the 100 SMA. The FOMC decision will likely lead to high volatility. The market has already priced in a 25 bps rate cut.

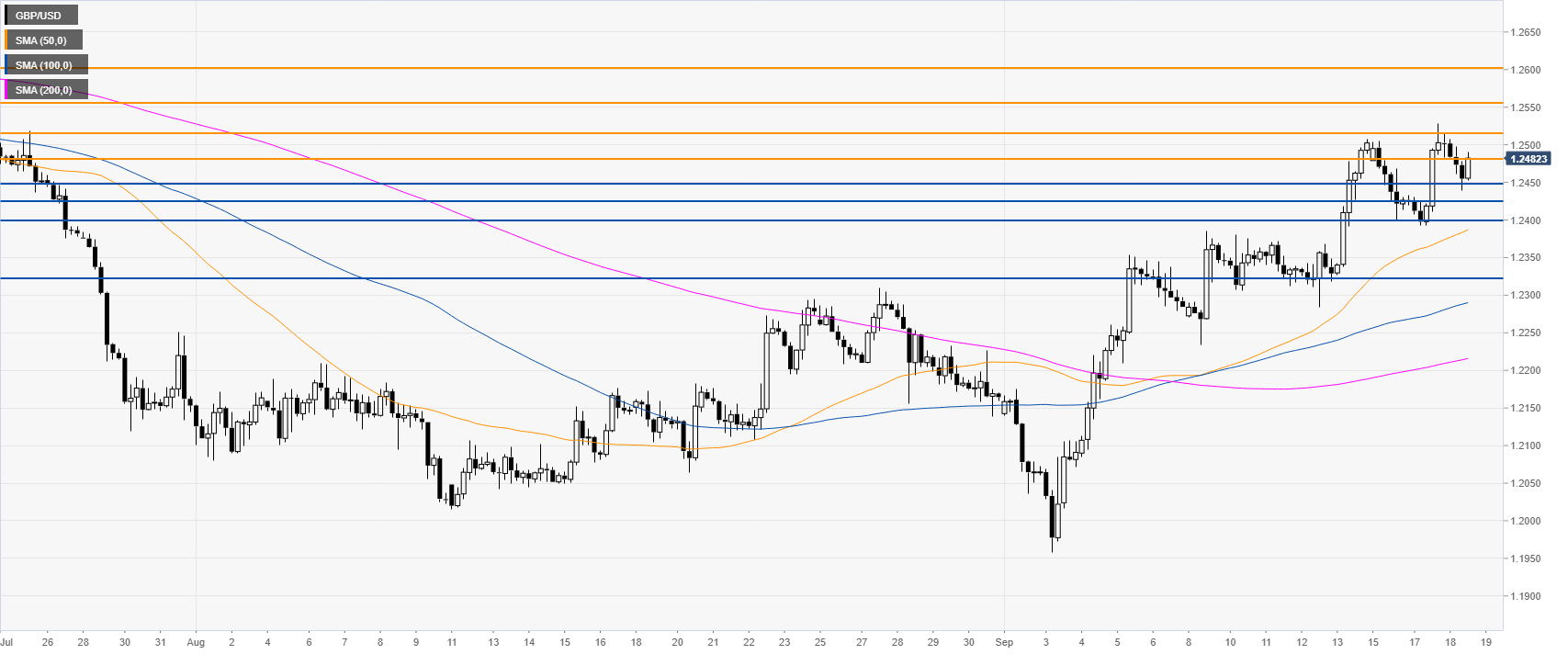

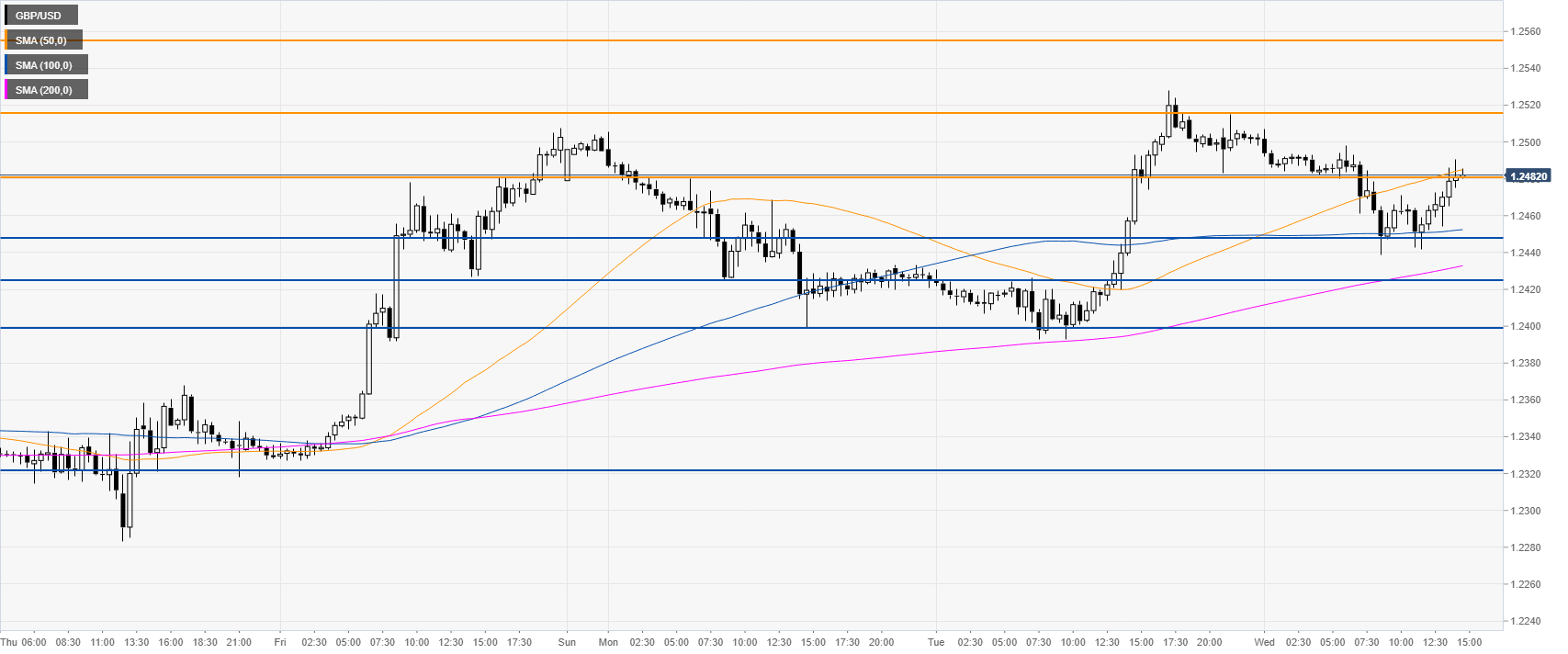

GBP/USD four-hour chart

The Pound is trading above the main SMAs, suggesting bullish momentum in the medium term. The market is testing the 1.2480 resistance as bulls will likely attempt to break beyond it en route towards 1.2515, 1.2554 and potentially the 1.2600 figure if the markets gather enough momentum.

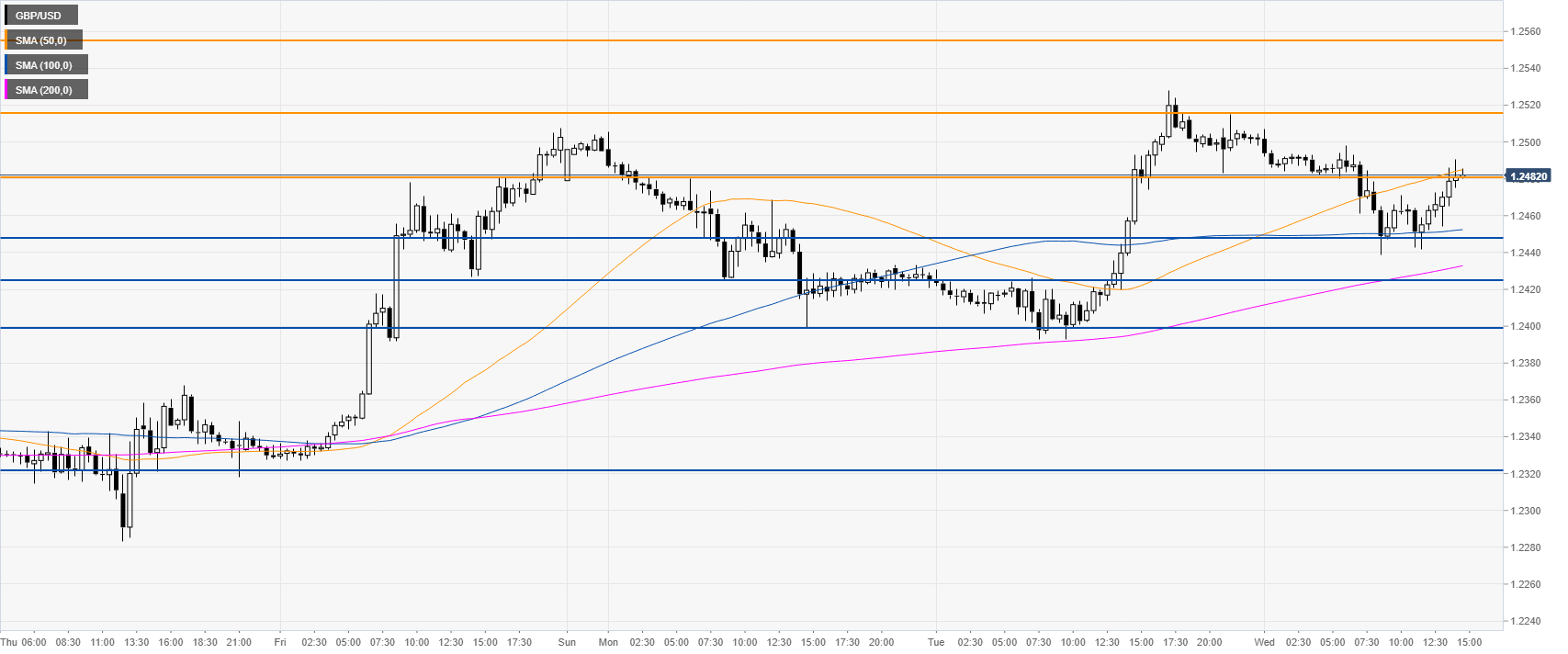

GBP/USD 30-minute chart

The Sterling is trading above the 100 and 200 SMA suggesting bullish momentum in the near term. Immediate support is seen at 1.2450 and 1.2425. Furter down lie 1.2400 and 1.2321, according to the Technical Confluences Indicator.

Additional key levels