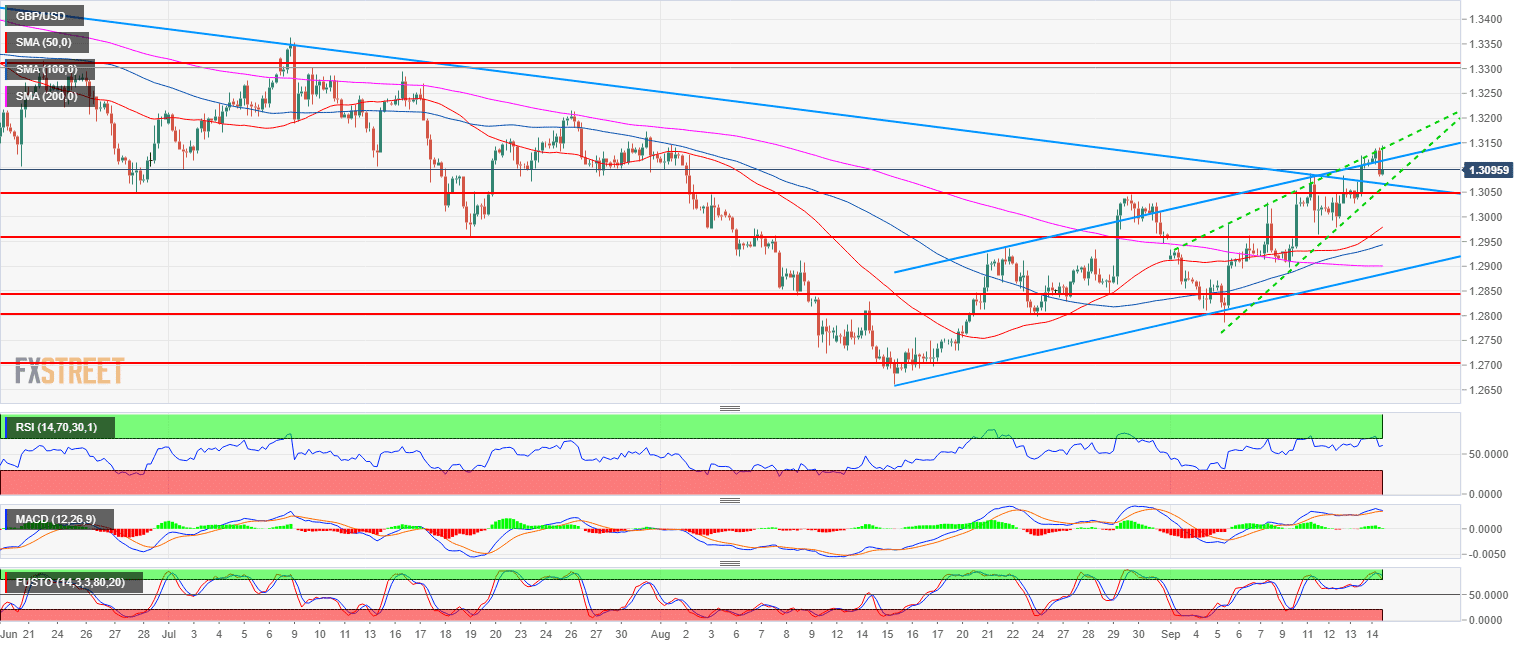

- GBP/USD main bear trend has been on hold since mid-August.

- GBP/USD is currently pulling back after grinding higher all week. GBP/USD is evolving in a rising wedge (green lines) suggesting that any further advances might be limited for the time being. The RSI, MACD and Stochastics are showing some signs of exhaustion as well.

- Targets for a pullback down can be located near 1.3050 (August 30 swing high, key level) and 1.2957 (July 19 swing low).

Spot rate: 1.3095

Relative change: -0.09%

High: 1.3144

Low: 1.3082

Main trend: Bearish

Short-term trend: Bullish above 1.2800

Resistance 1: 1.3082-1.3100 supply/demand level and figure

Resistance 2: 1.3200 figure (key support/resistance)

Resistance 3: 1.3300 figure

Support 1: 1.3050 August 30 swing high, key level

Support 2: 1.3000 figure

Support 3: 1.2957 July 19 swing low

Support 4: 1.2937 August 22 swing high

Support 5: 1.2900 figure

Support 6: 1.2868 August 22 low

Support 7: 1.2845, August 29 low

Support 8: 1.2800 August 24 swing low