- GBP/USD is down about 70 pips from Asia as GBP/USD dropped after the Bank of England dovish rate hike.

- GBP/USD found support near the 1.3000 level and is now having a pullback to the upside. Late bears will try to short at the 1.3075 level while bulls will try to push the market higher towards 1.3100. A breakout above 1.3100 would be negative for bears.

- Bears are currently losing stream and the reaction at 1.3076 and 1.3100 will be capital for determining the short-term directionality of the currency pair. Bears need to regain the 1.3000 level in order to drive the market down towards 1.2957, the current 2018 low.

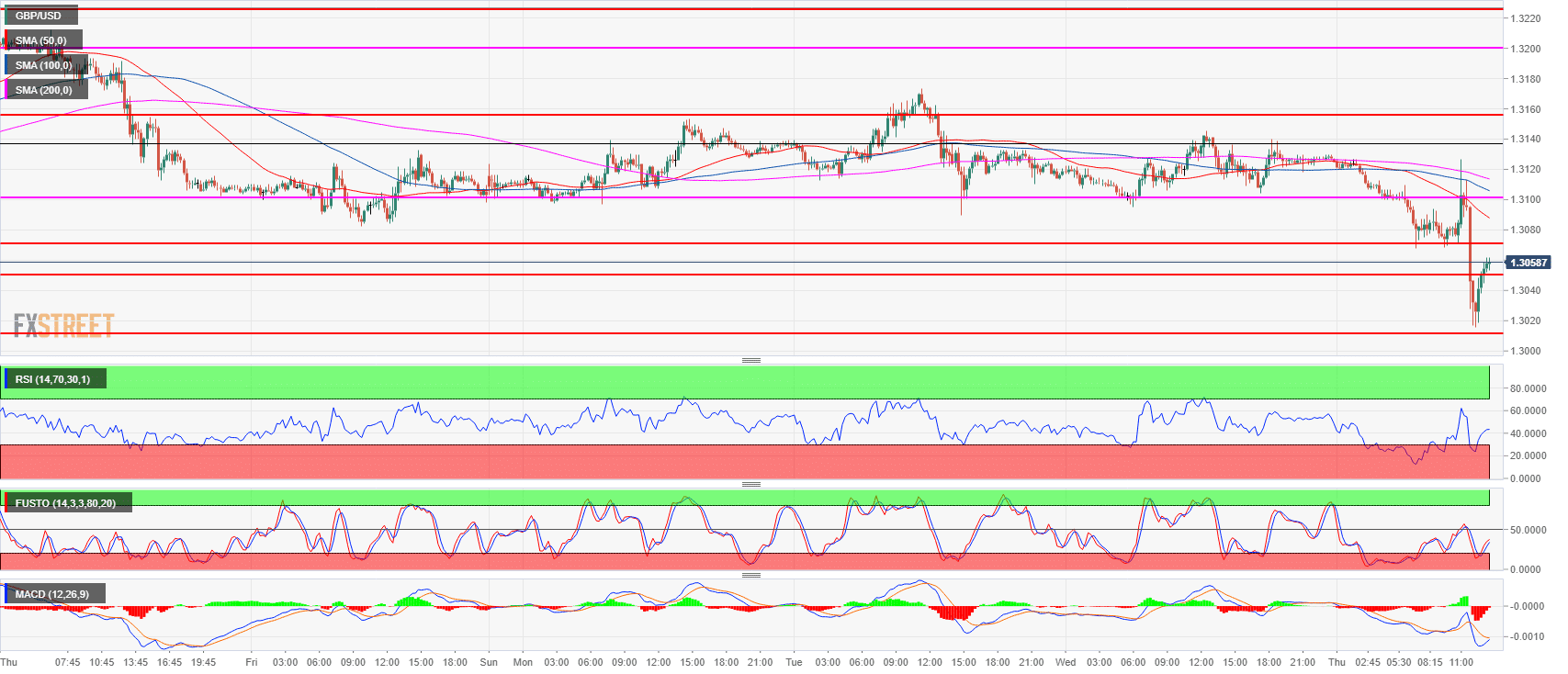

GBP/USD 15-minute chart

Spot rate: 1.3054

Relative change: -0.55%

High: 1.3129

Low: 1.3015

Trend: Bearish / Bullish pullback

Resistance 1: 1.3100-1.3076 area, figure and July 24 low

Resistance 2: 1.3155 former breakout point

Resistance 3: 1.3200 figure

Resistance 4: 1.3230 supply level

Resistance 5: 1.3250 June 4 high

Support 1: 1.3049 June 28 low

Support 2: 1.3010 July 18 low

Support 3: 1.2957 current 2018 low

Support 4: 1.2908 September 5, 2017 low